Introduction

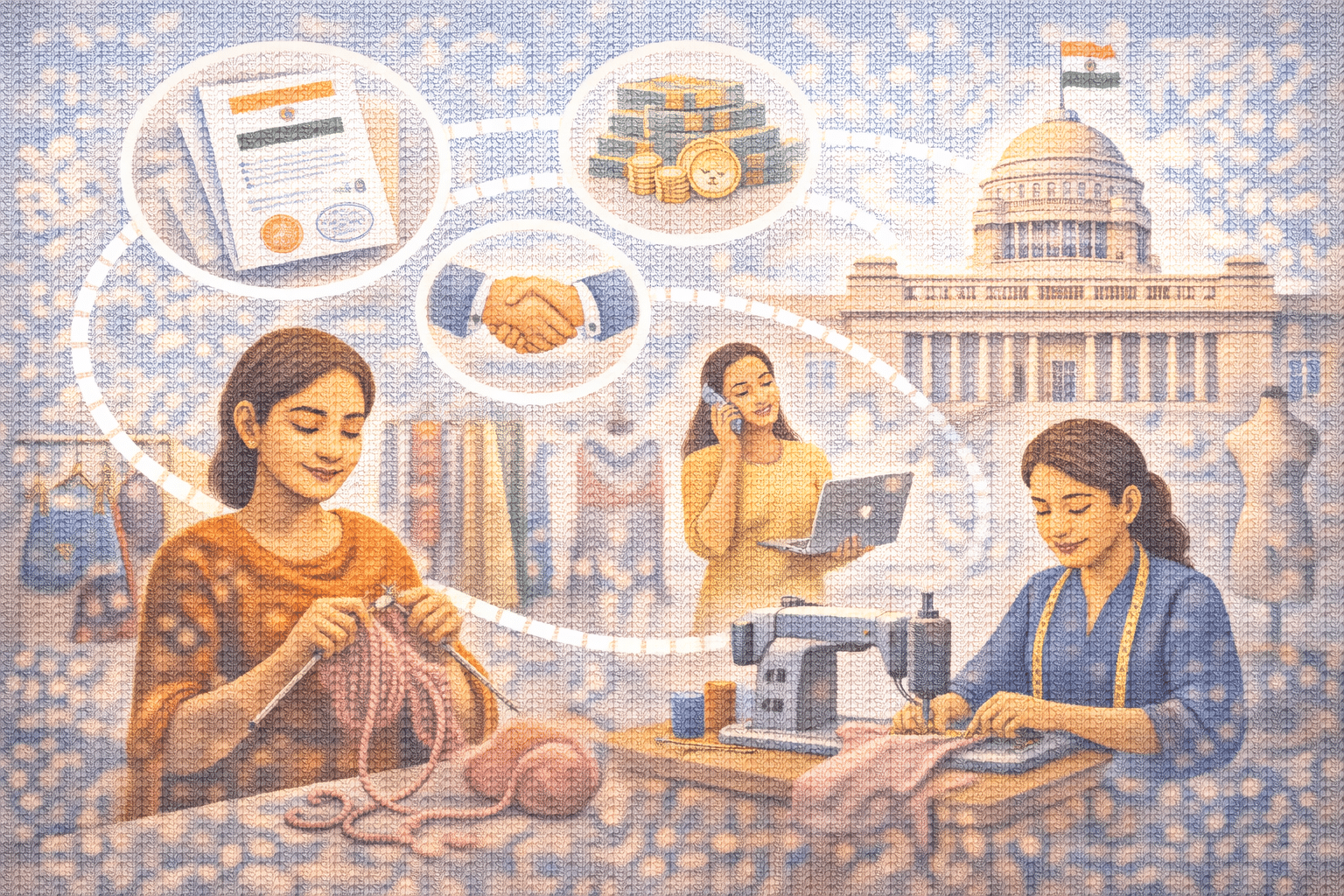

The business and startup economy is growing at par in India. This is not just dominated by men but women too are driving the startup eco-system. In spite of growing zeal among women, they still face a lot of challenges on a daily basis. Gender bias, inadequate funding, and lack of support is something women have to deal with on a regular basis.

But you need to worry, as there are a lot of schemes introduced by the government to support women entrepreneurship. In this blog, we will explore various Government loans for Women Entrepreneurs in India.

Government Loans for Women Entrepreneurs in India

In current times, women entrepreneurs are emerging in India. In order to support women entrepreneurship several loan schemes are introduced by the Indian Government. Let’s have a look at the Government Schemes for women entrepreneurs: –

Annapurna Scheme

The Annapurna scheme is specially designed for women entrepreneurs in the food and catering business. The scheme offers a loan up to ₹50,000 for buying kitchen equipment and utensils. There is no collateral required for this loan up to a certain limit. You can repay the loan in 36 instalments.

Mudra Yojana

The Government of India launched the Mudra Loan program under the Pradhan Mantri Mudra Yojana. This initiative has the main objective to promote entrepreneurship and provide financial support to micro and small enterprises. The scheme has a major focus on women entrepreneurship.

Mudra loans for women are available on easy terms and conditions. The scheme provides collateral free loans up to ₹10 lakhs. The eligibility criteria for this loan is very simple.

Standup India Scheme

The Stand-Up India Scheme was started by the Ministry of Finance to promote entrepreneurship in women and marginalized communities. This scheme provides bank loans to at least one SC or ST tribe borrower and at least one woman per bank branch to start a greenfield business. If the business is a non-individual enterprise, then a woman or a SC/ST entrepreneur must own at least 51% of the shares.

Stree Shakti Yojana

Stree Shakti Yojana scheme promotes entrepreneurship among women and provides financial aid to start a business. The scheme was launched by the Government in the year 2000. This scheme helps women to achieve economic independence and bring job creation.

The scheme is run in partnership with public sector banks. Under this scheme, women get a discount of 0.05% on the interest rate of applicable loans. Loan is available up to ₹50 lakhs. No collateral is needed for loans up to ₹10 lakhs.

Udyogini Scheme

The Udyogini Scheme encourages women entrepreneurship with financial support for various ventures. It majorly targets underprivileged and economically disadvantaged women with priority to widowed, destitute, and disabled women in India.

This scheme offers loans up to ₹1 lakh to women entrepreneurs. Those with annual income of less than ₹40,000 are eligible. The loan is available at lower interest rates.

Mahila Coir Yojana

Mahila Coir Yojana has the major objective to provide self-employment opportunities to the rural women artisans in coir producing regions. Under this scheme, women get a subsidy of up to 75% of the cost of equipment and machinery for coir processing.

In addition to this, a margin money subsidy is also provided up to 25% of the project cost. Women artisans who have completed the training programme in the spinning of coir yarn at any of the Coir Board’s training institutes are eligible for this scheme.

Mahila Udyam Nidhi Scheme

Mahila Udyam Nidhi Scheme is an initiative by the Small Industrial Development Bank of India (SIDBI). This scheme provides financial assistance to women entrepreneurs in production, manufacturing, and service-related industries.

Eligible women entrepreneurs can avail loan up to ₹10 lakh under this scheme which is repayable over up to 10 years. The loan can be used for production, manufacturing, and service-related activities.

Tips to get Government Loans for Women Entrepreneurs

Here are some tips that can help women entrepreneurs get Government loans: –

- Firstly, one needs to understand the eligibility criteria before applying for a loan. You can apply for a loan only if you are eligible.

- Women shall prepare a comprehensive business plan. It outlines their business idea, market potential and financial objections. This is necessary for loan approval.

- One should take advantage of the mentorship and guidance provided by many programs.

- Women can also connect with government resources and centres for any kind of support.

Conclusion

Women entrepreneurs are increasing in India. They play a big role in changing the nation. The government too is encouraging women to start their own business through various government loan schemes. These schemes provide financial support to women in initiating their business. By taking advantage of these loan schemes, women can easily overcome barriers and enter the business world.