Tesla has quietly removed the Long Range Rear-Wheel Drive Cybertruck from its online configurator, effectively nixing the model that had served as a price floor for the company’s soon-to-be-released pickup.

The shift was first spotted after a change made to the company’s website, and it effectively raises the base price of a new Cybertruck into five figures.

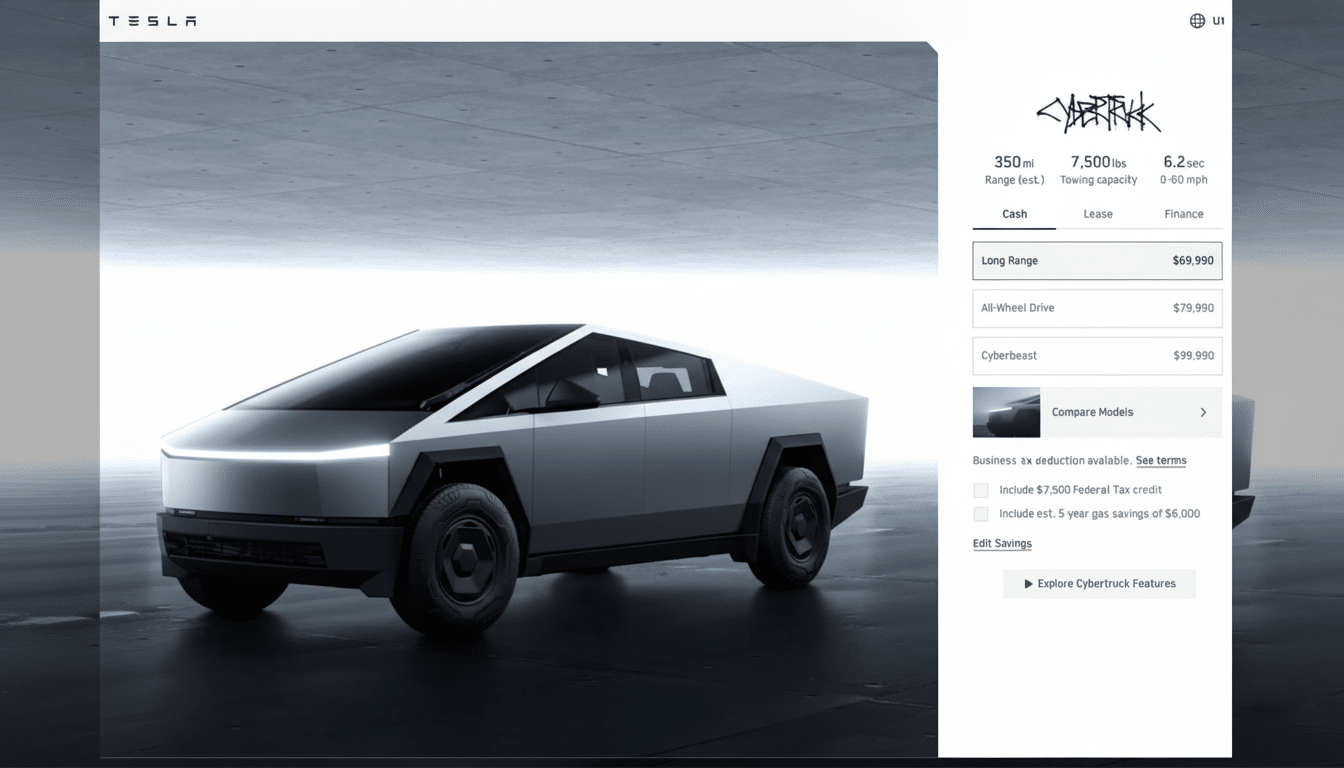

The scrapped LR RWD had been priced at around $69,990 on the online store, the website lists that price being about $10,000 less than the mid-tier All-Wheel Drive and just over $40,000 under its top-of-the-line Cyberbeast. Tesla has not publicly explained the decline, so owners and analysts have been left to read the tea leaves.

What Tesla Cut — and Why It Matters

“The LR RWD was positioned as the ‘value’ Cybertruck, but if you didn’t love it, many of our reservation holders told us that we would lose some of them to either buying a dual motor AWD or not buying at all,” Musk wrote in the email (emphasis his). “… Among other things, there are no air suspension or [HEPA] filtration options for it.”

The same variant doesn’t include rear light bar and comes with a regular bed instead of an included tonneua cover.

Those trade-offs likely limited its appeal among truck shoppers who value capability and features as well as range.

Eliminating a lowest-priced configuration also has the effect of resetting customer expectations. Without the LR RWD, the Cybertruck’s base is now closer to where most new electric pickups change hands and further from better-equipped trims that Tesla can construct without compromises.

Pricing, Margins and the Reality of Production

Automakers often streamline early production by focusing on the higher-margin variants, particularly for complex launches. The Cybertruck is made of the same stainless-steel exoskeleton as a home appliance, features steer-by-wire, uses a 48-volt electrical architecture (compared to the more common 12 or 24 volts), and employs Tesla’s in-house 4680 battery cells — an atypical combination that rewards build simplification and trifling options.

Analyst have long noted that cutting low-margin configurations can improve profitability during a ramp. Without the LR RWD, Tesla can concentrate on configurations that share more parts and sport better per-unit economics, one of the favorite chestnuts cited by every automaker in earnings calls.

There is also the demand mix. Because early adopters typically gravitate toward better-equipped cars… and Tesla’s order book likely reflects that. Eliminating a trim level that underperformed in take rate — or complex manufacturing — can raise throughput without increasing factory complexity.

What It Means for Shoppers

The practical upshot is simple: the cheapest new Cybertruck now costs around $10k more than it used to with that LR RWD option on offer. That delta counts when you pile on the destination and accessory for such cars as a powered tonneau, not to mention average insurance premiums on high-performance EVs.

Incentives are another moving target. The availability of the $7,500 federal clean vehicle credit requires certain final assembly and battery-sourcing already outlined and reaches MSRP thresholds while following guidance from the Treasury Department. Shoppers considering a Cybertruck will want to verify if they are eligible at the point of sale and also account for state or utility rebates, some of which come with regional caveats.

If you are still in the market for the discontinued configuration, there may be some LR RWD inventory available on lots. In the past, Tesla has been known to let customers scoop up end-of-line trims before they’re removed from its online Design Studio pages.

Competition in Electric Pickups

The electric pickup field is now a race.

While General Motors teased an all-electric Chevrolet pickup that could go into production as soon as late-2020, Ford was preparing for Detroit’s 2021 auto show (2019) debut of an F-Series truck with some form of plug. According to recent registration data recently from S&P Global Mobility, the Ford F-150 Lightning is topping the sales charts this segment year with the Chevrolet Silverado EV faring well in its wake. By killing off its cheapest trim, the risk for Tesla is that it forfeits some of those price-sensitive buyers to rivals — or sends them rippling down into lightly used EV trucks where prices are more fungible.

Conversely, a more streamlined lineup could help shore up the cost-performance equation that still makes the Cybertruck interesting with its design.

The AWD and Cyberbeast trims provide the truck’s headline stats, while Tesla’s charging infrastructure and over-the-air updates continue to be compelling for many potential buyers.

Safety Optics and Brand Momentum

The Cybertruck has elicited a level of attention that’s outsize — and not just from customers eager to take delivery or critics intent on picking it apart. News-making recalls, like the one covering problems with accelerator pedal covers tallied by the National Highway Traffic Safety Administration, have helped keep the truck in reader’s consciousness. There’s no hint of a safety-related motive for canceling the LR RWD, but simplifying certainly streamlines Tesla toward consistent builds and software calibrations.

A Familiar Tesla Playbook

Tesla often changes its trims and pricing around. The company has spent the year cycling its way into and out of various entry variants for both the Model 3 and Model Y lineups, plugging in option bundles and discounting inventory to balance demand. It’s quite possible a cheaper Cybertruck resurfaces after production costs come down or battery supply eases.

For now, the point being: the cheapest new Cybertruck is no longer the LR RWD. Shoppers who want in at what may be rock bottom prices will do well to check local inventories, confirm what incentives are being offered and study the feature sets carefully — since in Tesla land, the fleet can change just about as fast as the news.