ElevenLabs has crossed $330 million in annual recurring revenue, according to CEO Mati Staniszewski in an interview with Bloomberg, a marker that underscores how quickly voice AI is moving from eye-catching demos to enterprise-grade deployments. The company says adoption now spans both Fortune 500 organizations and startups, with enterprises using its voice agents to handle more than 50,000 calls each month.

ARR Growth and Enterprise Adoption at ElevenLabs

Staniszewski outlined a striking growth curve: ElevenLabs needed 20 months to reach $100 million in ARR, 10 more months to hit $200 million, and only five months to reach the current figure. That compression points to a playbook that is landing initial use cases and expanding quickly across teams and workflows.

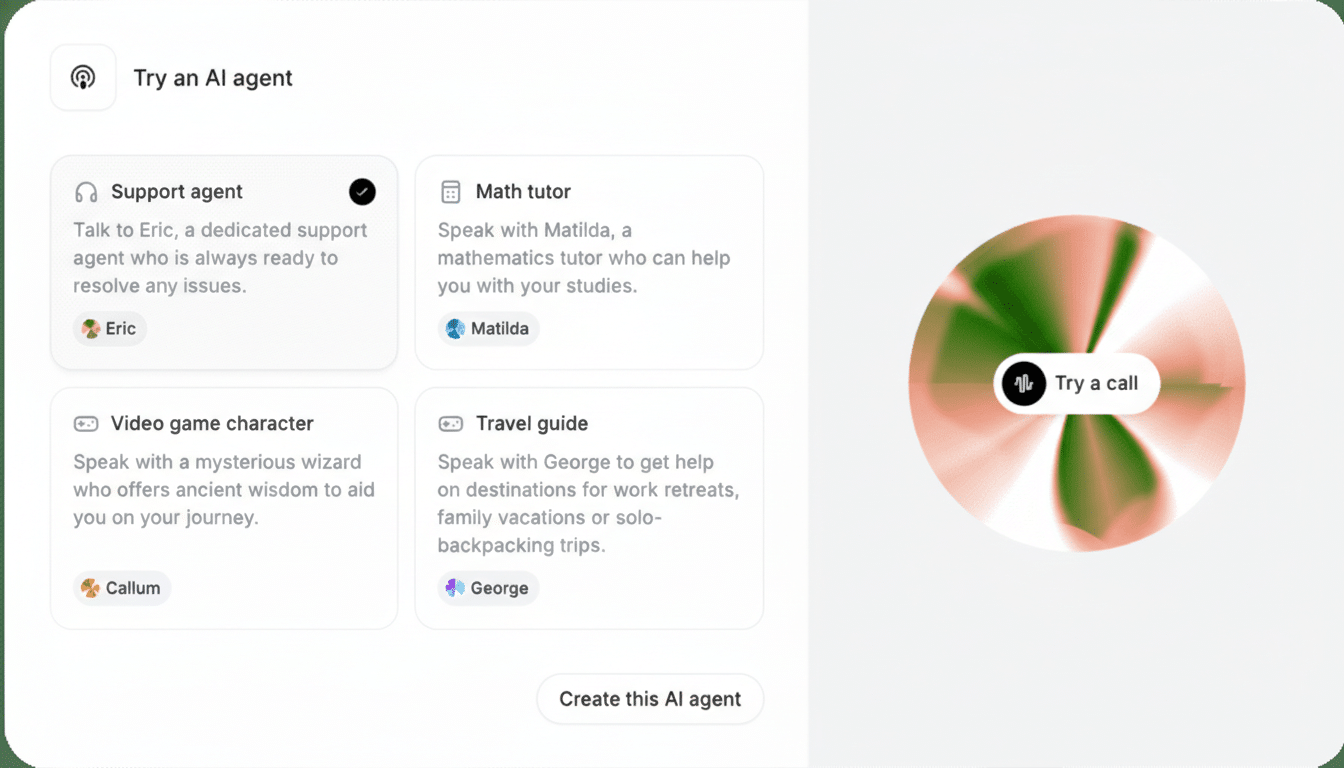

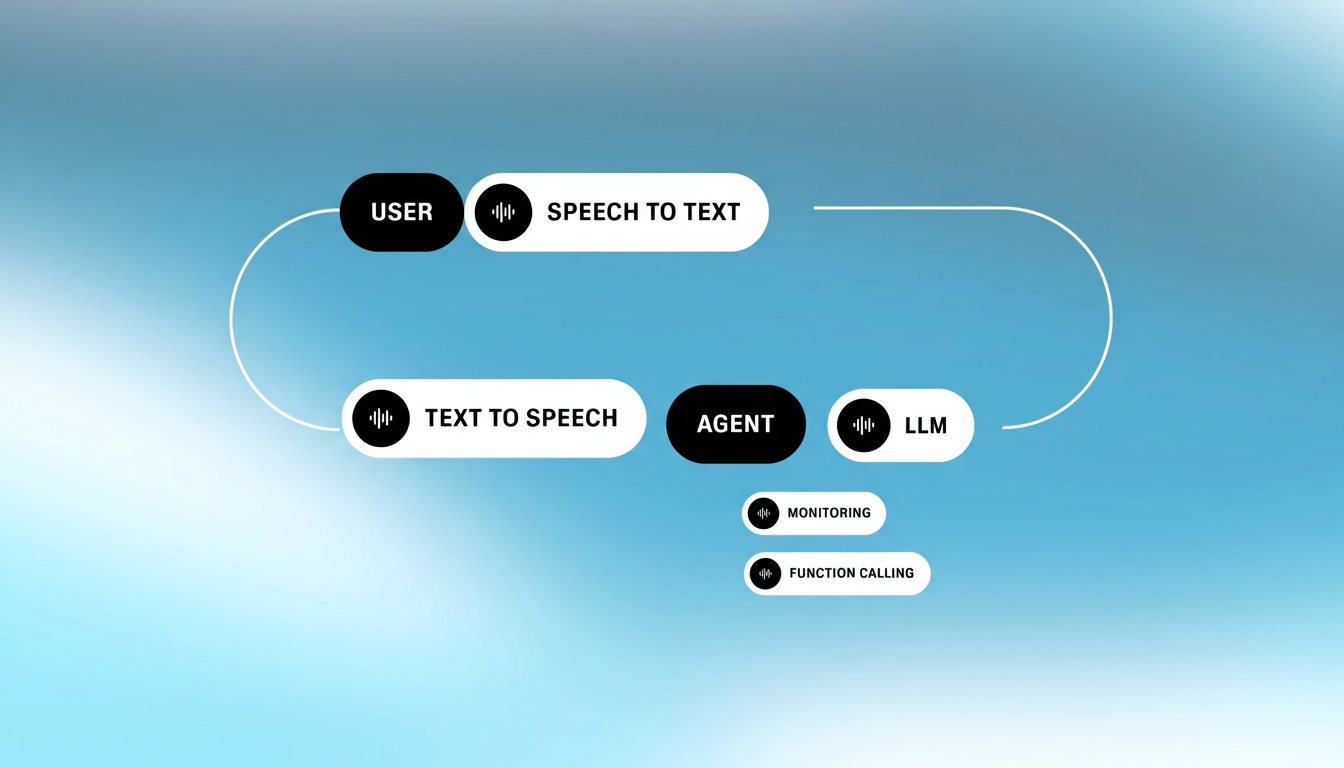

At the center of that expansion are AI voice agents trained on a company’s data and knowledge bases to handle customer support and experience interactions. ElevenLabs’ pitch is that natural-sounding, low-latency voices can resolve routine queries, escalate complex issues to humans, and integrate with CRM and ticketing systems without retraining call centers from scratch.

The company has also diversified beyond core text-to-speech. Alongside its voice agent stack, it offers studio tools, model APIs, and creative features, positioning the platform for multiple entry points: support, sales enablement, media production, and accessibility.

Why Voice AI Is Scaling Now Across Industries

Three shifts are driving adoption:

- Quality has improved: modern models deliver near-human prosody, multilingual fluency, and responsive turn-taking that make fully automated calls feel natural rather than scripted.

- Integrations have matured, with connectors to knowledge bases and workflow tools enabling agents to retrieve records, update tickets, and follow business rules.

- Unit economics are improving as inference costs decline and model efficiency rises, making large-scale deployments feasible beyond pilots.

Analyst houses such as Gartner and Forrester have noted that conversational AI is moving from proof-of-concept to production in customer service, and boardroom interest has shifted from experimentation to ROI. In practice, enterprises are targeting faster response times, consistent service quality, and freeing human agents to handle higher-value interactions rather than routine password resets or policy questions.

Competitive Landscape and Model Strategy

The $330 million ARR milestone places ElevenLabs among the most commercially advanced application-layer AI startups. The company competes and partners across a crowded field: hyperscalers offer voice and conversational stacks through Microsoft Azure AI, Google Cloud, and AWS, while specialized vendors like PlayHT and WellSaid Labs focus on high-fidelity text-to-speech. The differentiator ElevenLabs is betting on is end-to-end voice agents tuned for production call flows, not just voice synthesis.

Its go-to-market appears usage-centric—charging for characters, minutes, or calls—augmented by enterprise contracts that bundle security, compliance, and dedicated support. That model tends to favor “land-and-expand” motions: start with one queue or region, prove value, then scale across lines of business and languages.

Funding Firepower and High-Profile Licenses

ElevenLabs has backed its growth with significant capital. It raised a $180 million Series C co-led by a16z and ICONIQ at a $3.3 billion valuation, followed by a $100 million secondary transaction led by ICONIQ with participation from Sequoia that doubled the company’s valuation as investors purchased employee shares. The war chest supports enterprise scale-up, model R&D, and new modalities, including music creation tools.

On the content side, the startup has secured voice partnerships with well-known figures such as Michael Caine and Matthew McConaughey, signaling a push to normalize consent-based voice licensing for media, advertising, and entertainment while addressing rights management and provenance.

Safety, Consent, and Policy Signals Shaping Voice AI

Runaway growth in voice synthesis inevitably raises safety questions: spoofed calls, executive fraud, and political deepfakes. Industry responses now center on layered defenses—voice watermarking and detection, identity verification for cloning, auditable consent flows, and content provenance standards like C2PA. Regulators and standards bodies, including NIST with its AI Risk Management Framework, are pushing providers to formalize controls without stifling innovation.

For large customers, procurement increasingly treats safety as a product feature. ElevenLabs’ ability to ship robust guardrails and enterprise controls will be as important as accuracy and latency in winning regulated sectors and public-sector contracts.

What to Watch Next for ElevenLabs and Voice AI

Key signals to monitor include:

- Growth in monthly call volumes

- Renewals and expansions inside large accounts

- Ecosystem partnerships with contact center platforms such as Genesys, Five9, and NICE

- Advancements in multilingual agents

- On-device or edge inference for privacy-sensitive workflows

- Tighter CRM/ERP integrations

For now, the headline is clear: a voice AI specialist has translated product buzz into meaningful, recurring revenue at enterprise scale. If ElevenLabs can sustain its growth curve while strengthening safety and compliance, it will remain a defining company to watch in the next chapter of conversational AI.