Autonomous driving startup Waabi has secured $1 billion and signed an exclusive deal to bring its self-driving system to Uber’s ride-hailing network, marking the company’s first major move beyond autonomous trucking into robotaxis. The pact includes milestone-based support from Uber tied to the deployment of 25,000 or more Waabi-powered vehicles on its platform, signaling one of the most ambitious robotaxi scale-up plans announced to date.

Waabi’s $1B funding round and exclusive Uber partnership

The funding is anchored by a $750 million Series C co-led by Khosla Ventures and G2 Venture Partners, plus approximately $250 million in milestone-linked capital from Uber to underwrite deployment. Additional investors include Uber, NVentures (the venture arm of Nvidia), Volvo Group Venture Capital, Porsche Automobil Holding SE, BlackRock, and BDC Capital’s Thrive Venture Fund, among others. With this round, Waabi’s total funding rises to roughly $1.28 billion.

For Uber, the tie-up complements a multi-partner autonomy strategy that already features integrations with companies such as Waymo, Nuro, Wayve, WeRide, and Momenta. The company is also launching Uber AV Labs to collect and provision high-quality fleet data to autonomy partners, an asset that can accelerate software validation and geographic expansion.

While neither side has disclosed a start date or initial service markets for the 25,000-vehicle target, the exclusive arrangement for ride-hailing gives Waabi guaranteed demand and a distribution channel that handles tens of millions of trips globally each day. In practical terms, that could shorten the path from limited pilots to meaningful city-by-city availability if safety and regulatory milestones are met.

A bet on generalizable AI and Waabi’s simulation platform

Waabi’s pitch centers on a “generalizable” AI stack trained in Waabi World, a closed-loop simulator that constructs digital twins of road networks, generates adversarial scenarios, and performs high-fidelity sensor simulation. Founder and CEO Raquel Urtasun says this framework allows the Waabi Driver to learn from fewer real-world miles and with far less manual labeling than traditional approaches, cutting both time and cost to scale.

Urtasun previously served as chief scientist at Uber’s self-driving unit before Uber sold those assets to Aurora Innovation in 2020. Her return to Uber’s mobility marketplace via Waabi underscores a strategic through-line: leverage advanced simulation and a leaner, software-first development model to span multiple vehicle types without rebuilding core autonomy from scratch.

Waabi argues this method reduces dependency on vast safety driver fleets and megawatt-hungry data centers. If borne out in commercial operations, it could offer a cost curve advantage at precisely the stage when robotaxi operators must demonstrate durable unit economics and reliability.

From trucks to taxis: Waabi’s expansion beyond freight

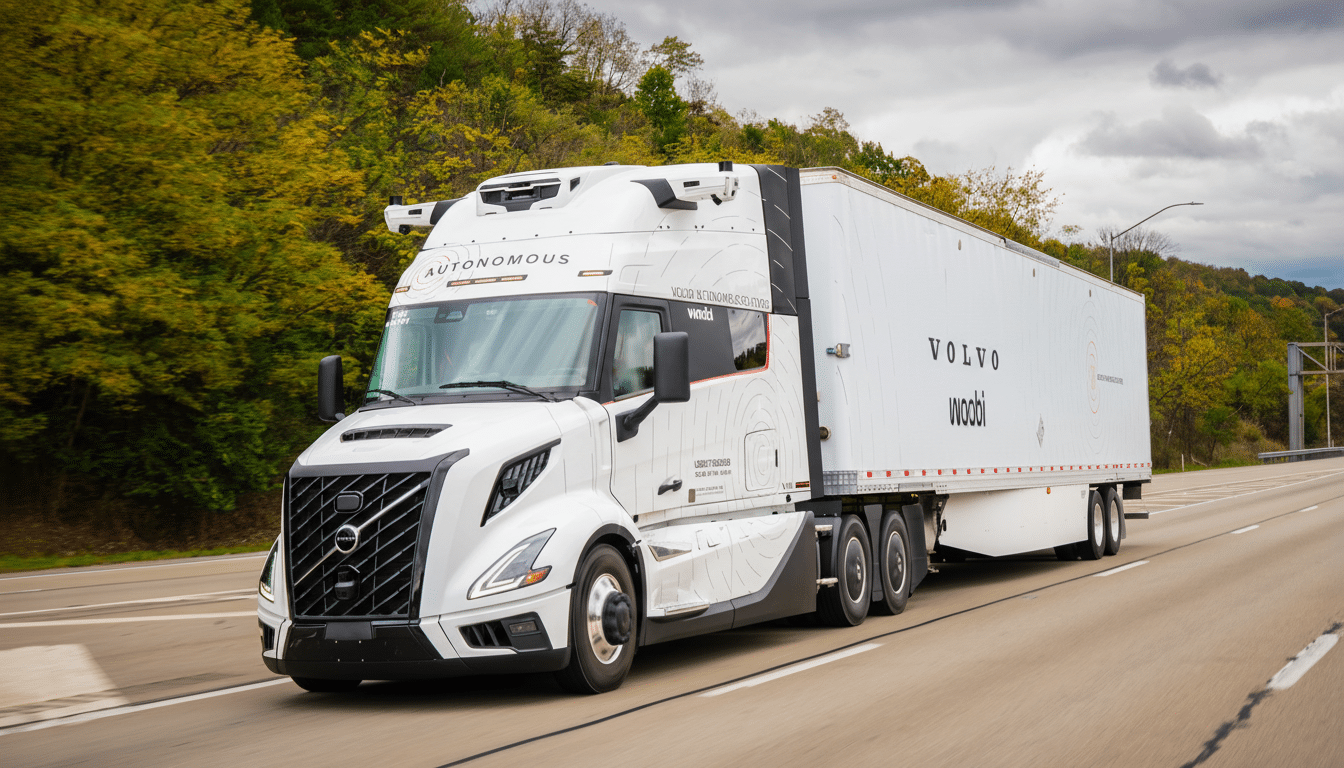

Since launching five years ago, Waabi has concentrated on long-haul trucking, running supervised pilots in Texas and preparing for driverless operations on highways. A fully driverless truck launch was targeted earlier but has been pushed into the coming quarters. The company’s trucking go-to-market is notable: it sells autonomy-enabled trucks directly to shippers, aiming to capture value without operating a carrier network.

The Uber deal brings passenger vehicles into the fold. Waabi says its “Waabi Brain” is vehicle-agnostic, and the company intends to work with an OEM to integrate sensors and redundancy at the factory level, rather than retrofit. That approach mirrors its trucking blueprint and aligns with safety expectations that favor built-in fail-operational systems over piecemeal add-ons.

The stack’s portability is a key strategic bet. Competitors have attempted to straddle freight and robotaxis, with mixed outcomes—Waymo exited freight to focus on robotaxis, while Aurora stayed the course in trucking. By contrast, Waabi contends its simulation-led development can scale across domains without exploding headcount or fleet costs.

Competitive stakes and risks in autonomous mobility

Waabi’s raise lands in a market that is both capital-intensive and scrutinized. Aurora Innovation has raised roughly $3.46 billion to date, while Kodiak Robotics has brought in about $448 million, highlighting the wide financing spectrum in autonomy. Meanwhile, regulators at the federal and state levels continue to probe AV incidents and establish operating guardrails, a reminder that approvals can hinge on transparent safety cases and measurable performance improvements.

The 25,000-vehicle ambition is significant. Realistically, deployment will likely proceed in stages: supervised pilots, limited rider-only service zones, and incremental expansion of operational design domains. Success will depend on repeatable safety performance, robust remote operations protocols, and supply chain readiness at the OEM level to build sensorized, redundant vehicles in volume.

If Waabi’s simulator-driven approach can compress validation cycles and reduce edge-case exposure, it could meaningfully lower cost per mile. Industry analyses from firms like McKinsey have long projected that autonomy could unlock hundreds of billions of dollars in mobility value this decade, but only for players that combine technical maturity with scalable, capital-efficient deployment.

What it means for Uber’s autonomy and marketplace strategy

For Uber, partnering with Waabi deepens a portfolio strategy that spreads technical and regulatory risk across multiple AV suppliers while keeping the Uber app as the demand funnel. In time, autonomous supply can bolster reliability during peak hours and improve coverage in low-demand windows, with potential to lift margins as autonomy scales.

The milestone-linked structure also aligns incentives: Uber funds as vehicles hit the road, while Waabi secures a ready-made customer base and operational data. If Waabi’s trucking program ramps alongside robotaxis, the company could benefit from cross-domain learnings, with Uber’s Freight unit offering another proving ground for the technology.

The bottom line: Waabi’s $1 billion raise and exclusive Uber partnership elevate it from a promising trucking player to a contender in robotaxis. Watch for the first launch markets, the OEM manufacturing partner, and the timing of fully driverless operations. If the company’s generalizable AI thesis holds, the next phase of ride-hailing could arrive sooner—and more efficiently—than many expected.