They are short, melodramatic, and often painfully corny — but TikTok-like microdramas are on pace to mint billions anyway. The one-minute soaplets flooding mobile feeds pair cliffhangers with casino-grade monetization, and the combination is turning shameless pulp into one of the year’s most lucrative entertainment stories.

The surge is measurable. Appfigures estimates that ReelShort drove roughly $1.2 billion in gross consumer spending in 2025, up 119% year over year, while DramaBox added about $276 million, more than doubling its 2024 take. Analysts tracking the category expect total spend across leading apps to climb well into the multi-billion range as new players pile in and conversion funnels mature.

- Why Low-Budget Microdramas Convert and Keep Viewers

- From China to Every Feed: Microdramas Go Global Fast

- Quibi’s Lesson Inverted: Cheap, Vertical, Free-to-Start

- AI Turbocharges Production of Formulaic Microdramas

- Risks and Regulation for Microdrama Monetization

- What to Watch Next as Microdrama Apps Scale Up

Why Low-Budget Microdramas Convert and Keep Viewers

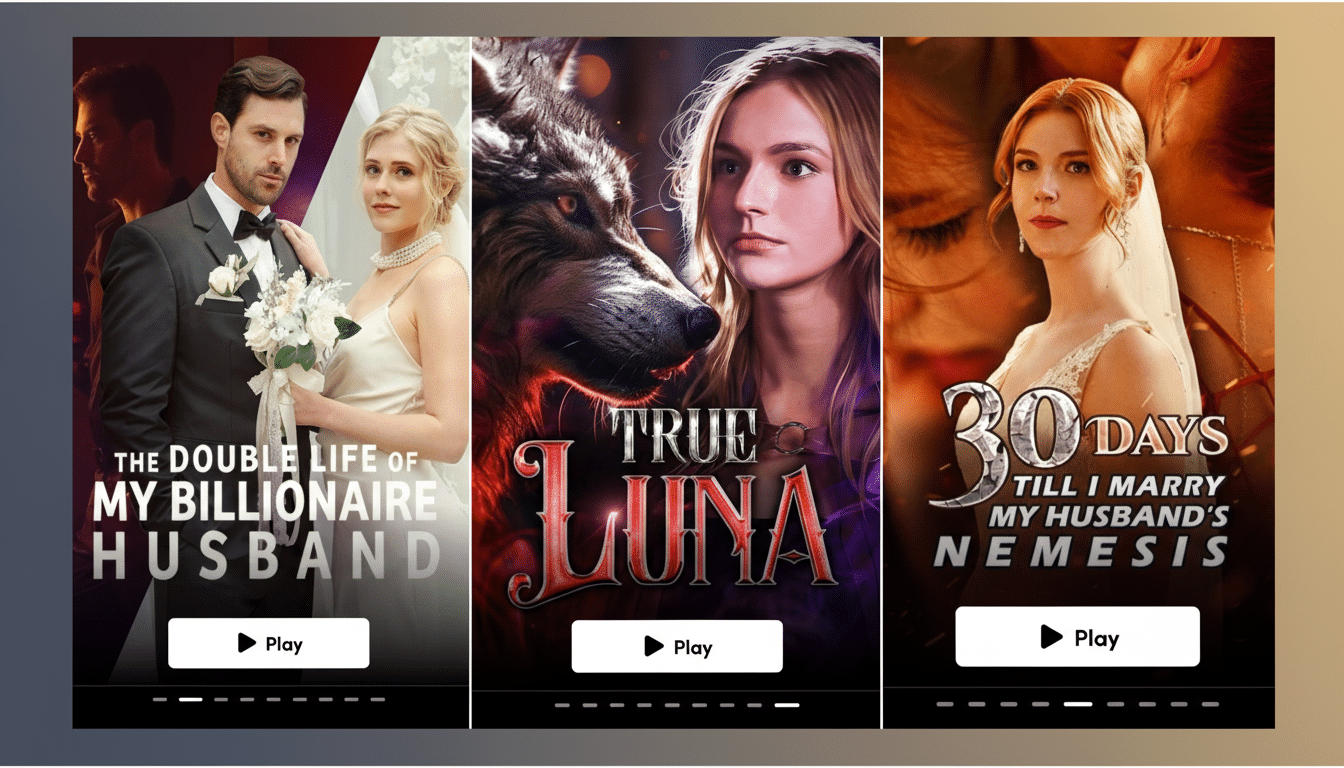

Microdramas thrive by borrowing tools from mobile gaming. Episodes drip-feed dopamine and stop at the precise moment you want resolution, nudging viewers to watch ads, buy coins, or spring for a weekly VIP pass that can run around $20. The free path never quite keeps pace, so users slide from curiosity to commitment with barely a tap, and the “so-bad-it’s-good” vibe becomes a feature, not a bug.

Creators lean into familiar plot scaffolding — secret babies, fake marriages, billionaire rescues — because predictability converts. The shows are inexpensive to make, easy to localize, and ruthlessly A/B tested. Think of it as an algorithmic telenovela: short beats, fast reversals, and a monetization prompt exactly when emotions spike.

From China to Every Feed: Microdramas Go Global Fast

After catching fire in China, the format is scaling globally. ReelShort and DramaBox helped prove the model in Western markets, and now platform owners and Hollywood veterans want in. TikTok has rolled out PineDrama as a standalone microdrama app to capture spend it previously pushed to third parties. Meanwhile, a new studio-backed entrant, GammaTime, raised $14 million with participation from high-profile angel investors including Alexis Ohanian, Kris Jenner, and Kim Kardashian, signaling that capital is ready to underwrite aggressive production slates.

Quibi’s Lesson Inverted: Cheap, Vertical, Free-to-Start

It’s impossible not to remember Quibi’s implosion, but microdramas flipped the playbook. Quibi tried premium talent and 10-minute “quick bites” with subscription walls. Microdrama apps pursue volume over prestige, vertical video over cinematic sheen, and free-to-start funnels over pure subscription. Instead of spending on stars, they spend on user acquisition, ad arbitrage, and live ops — the levers that actually move mobile revenue.

AI Turbocharges Production of Formulaic Microdramas

Generative tools are accelerating the content factory. Audio-series platform Pocket FM introduced a writer assist called CoPilot trained on thousands of hours to map story “beats” and inject cliffhangers that boost retention. Ukrainian startup Holywater, which raised $22 million to build its My Drama app, calls itself an “AI-first entertainment network.” In a format where archetypes and twists are formulaic by design, large language models can draft variations quickly, while teams A/B test thumbnails, summaries, and endings to maximize token purchases.

Interactivity adds another revenue seam. Some series let viewers choose the next plot turn, but the empowering option often costs tokens while the drearier path is free. That subtle pay-to-feel-good loop is straight from the game economy playbook.

Risks and Regulation for Microdrama Monetization

The same mechanics that print money also invite scrutiny. Consumer protection regulators have warned about “dark patterns” in subscriptions and in-app purchases, and app store policies continue to tighten around deceptive onboarding and cancellation flows. There’s also the risk of ad fatigue driving churn as CPMs fluctuate, plus looming questions about IP if AI-generated scripts echo existing works.

Labor dynamics could get interesting, too. If AI squeezes writers, expect pushback from creator communities and unions. Still, industry executives such as Dhar Mann Studios CEO Sean Atkins argue there’s room for human storytellers who can build franchises on top of the format’s reach — especially if revenue sharing improves.

What to Watch Next as Microdrama Apps Scale Up

Key signals over the next two quarters:

- Rising ad-to-VIP conversion rates

- Stable weekly average revenue per user despite scaling

- The number of shows crossing meaningful completion thresholds

Also watch for:

- Telecom bundles

- Crossovers with e-commerce

- M&A as platforms try to own both distribution and the studio pipeline

Microdramas may be schlocky, but the unit economics aren’t. If the current trajectory holds, these minute-long cliffhangers will be one of the year’s most profitable — and polarizing — entertainment bets.