It canceled plans to build an all-electric full-size pickup, opting instead for a range-extended version of the Ram 1500 powered by a battery pack but backed up with a gasoline generator. The shift, which has been confirmed by the parent company, Stellantis, indicates a cooling in demand for vehicles that run solely on batteries and a recalibration in favor of technology that assures long range, quick refueling and towing behavior that’s familiar to pickup buyers.

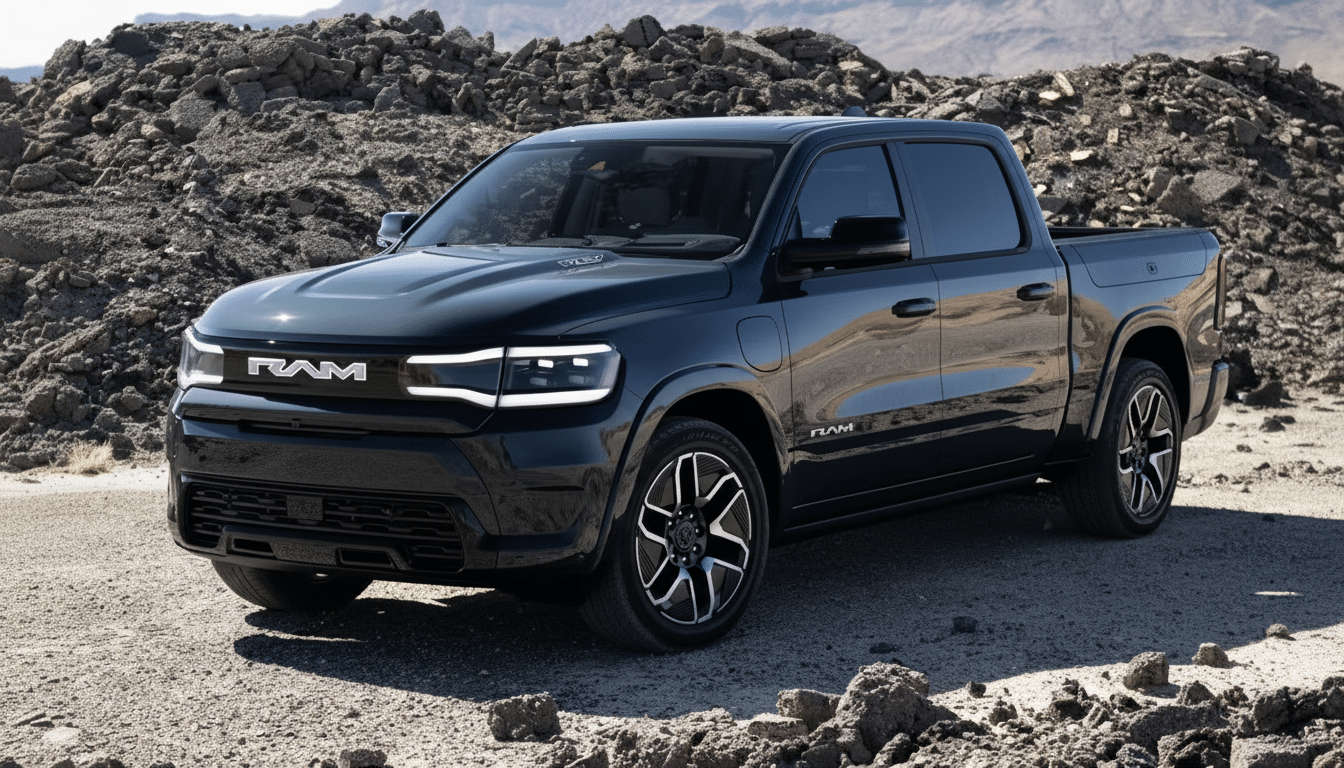

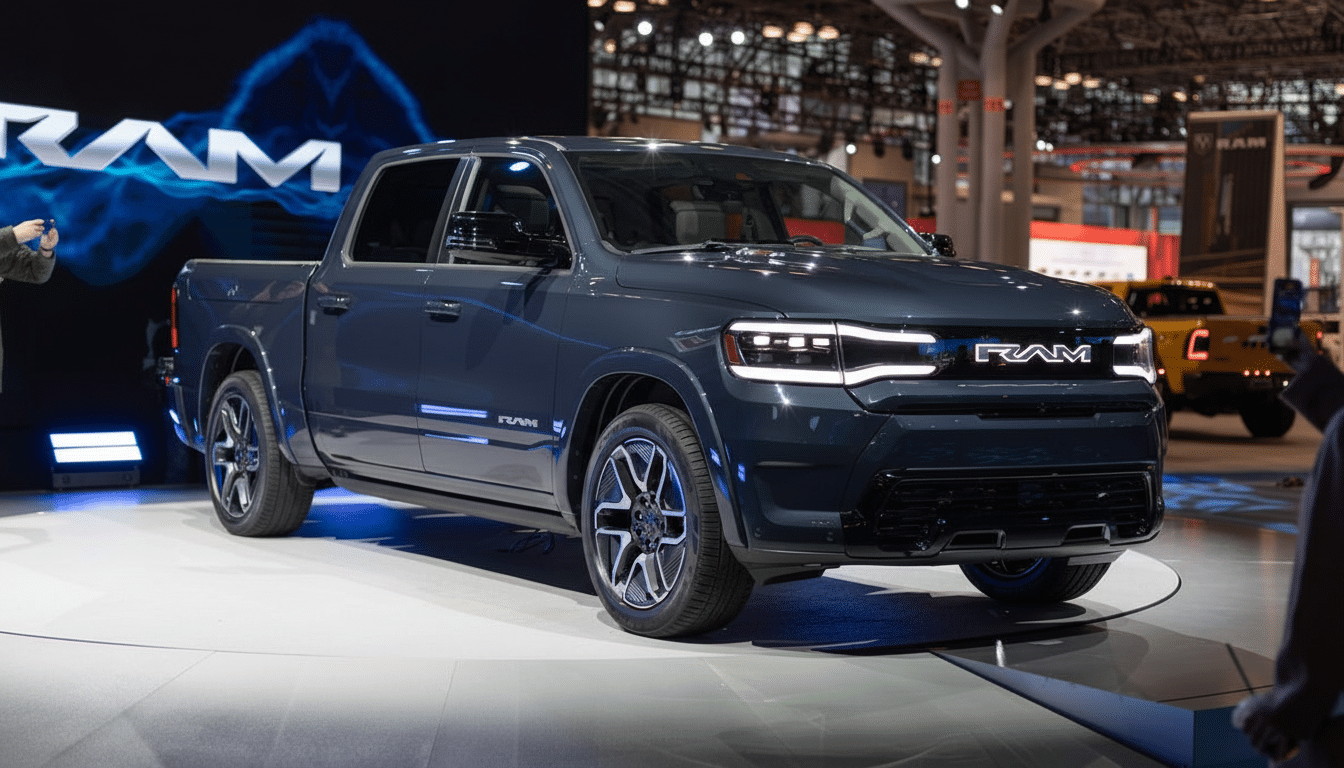

The move is part of a rebranding around the Ram 1500 REV, which will also soon limit the nameplate to an all-new extended-range EV that was previously teased with as a concept under the name Ramcharger. In practice, it’s the trade of a huge battery for a smaller pack and an onboard engine to make electricity as drive for the motors — to deliver headline range numbers without stranding drivers at power outlets when loaded up or towing.

Why Ram Is Backing Away From a Pure-Electric Pickup

Stellantis cites a slowdown in demand in those areas for full-size battery-electric trucks. That’s in line with broader market signals: industry trackers at Cox Automotive have observed above-average days’ supply for some EV nameplates as well as a consumer shift toward hybrids and plug-ins as a transitional solution. EV studies from J.D. Power also place charging availability and purchase price as the two most lingering obstacles to widespread adoption.

Pickup buyers add a certain wrinkle. Extended highway commutes, jobsite use and towing a trailer are examples of how they can expose the weakest results in terms of range too. Indeed, independent tests and analyses have found that towing heavy loads can cut range in half or more, particularly at interstate speeds. Studies conducted by the National Renewable Energy Laboratory show how load, speed, temperature, and elevation contribute to the energy consumption of light-duty trucks.

Ram’s battery-only 1500, in its original form, would have required a very big and expensive pack to achieve acceptable range with a trailer in tow. That adds curb weight, drives up cost and can cut payload capacity — trade-offs that count in a segment where capability is table stakes. A range extender, like the one in an all-electric BMW i3, works around those trade-offs by reducing overall battery size and enabling a gas engine to climb to peaks of energy demand.

How the Range-Extended Ram 1500 REV Works

The battery-powered REV uses two electric motors to drive the car normally. As the state of charge falls, or demand rises (think steep grades with a trailer), an onboard gasoline engine spins a generator to provide power for the motors and sustain the battery. Those wheels are always driven by electricity; the engine never drives them mechanically. That’s an important difference from traditional hybrids and contributes to preserving the seamless, instant-torque EV feel.

While it’s promising competitive towing and payload, Ram has once again flirted with an overall range target that would make today’s battery-only pickups look paltry. For work crews and long-haul users, the practical logic is clear: daily short trips can be handled mostly on grid power, while cross-country runs revert back to a fast gas refill instead of an extended charging break — particularly at trailheads or construction sites or through some of these rural corridors where high-speed charging is still scant.

More out the package and weight benefits are leveraging packaging. By taking the smaller battery of a pure BEV truck out of their equations, engineers can gain room and mass for payload or accessories and probably improve ride and handling. The flip side of that are tailpipe emissions in engine mode, which puts the REV between a plug-in hybrid and full battery electric vehicles on the regulatory spectrum.

Competition Pressure And The Regulatory Math

That Ram’s pivot does not occur in a vacuum. Ford has softened production of its electric truck and doubled down on hybrid F-150 models; General Motors has resequenced its electric truck rollout and recommitted to plug-in tech in segment sweet spots; Toyota leans heavily into hybrid systems for full-size trucks; Rivian and Tesla still hammer at pure-electric strategies but encounter cost, capacity, and use-case headwinds from traditional pickup owners.

When it comes to compliance, range-extended trucks wouldn’t get the same zero-emission credits as BEVs — but they could significantly reduce fleet-average emissions and petroleum use versus conventional pickups. Stellantis has been relying on electrified Jeeps — the Wrangler 4xe and Grand Cherokee 4xe — to raise its mix, and a high-volume plug-in pickup would continue to insulate the lineup during continued growth in charging networks and shifts in battery costs.

Policy dynamics continue to be a watch item. Some states with aggressive zero-emission sales targets for light-duty vehicles may influence automakers to move back toward BEVs over the long haul. Yet, regulators and analysts at research organizations like the International Council on Clean Transportation say that plug-in hybrids and range-extended architectures can speed real-world emissions reductions if they provide significant electric miles.

What It Means For Buyers And Truck Fleets

The REV approach shaves off the two biggest anxieties for retail buyers—range and charging downtime—without jettisoning the torque-rich, quiet driving experience of an EV. Perhaps more compelling for fleets is the operational math: The predictable, local routes will allow maximum electrification, while the generator makes the vehicle route-agnostic and prevents queueing at high-demand chargers on peak days. Total cost of ownership will depend, however, on pricing, fuel and electricity costs and duty cycle.

There are risks. Purists will perceive the retraction as backpeddling on real zero-emission trucks. The dual-powertrain hardware adds complexity. And given the proliferation of high-speed workplace or depot charging, especially in markets like America and China, a sensibly-priced BEV pickup could still win on simplicity and running costs. But for a segment that values capability above all else, Ram is banking on a practical mash-up of electrons and gasoline to hit the sweet spot — for now.

Stellantis says it is proceeding with production plans for the range-extended Ram 1500, essentially replacing the canceled BEV program. And if the truck can hit its range, towing and price targets, it might be able to reset the definition of “electrified” in the pickup world — and buy some time for charging networks and battery economics to catch up with American truck habits.