Oura has escalated the smart ring arms race, recently launching a complaint against Samsung’s Galaxy Ring and other new entrants via the US International Trade Commission.

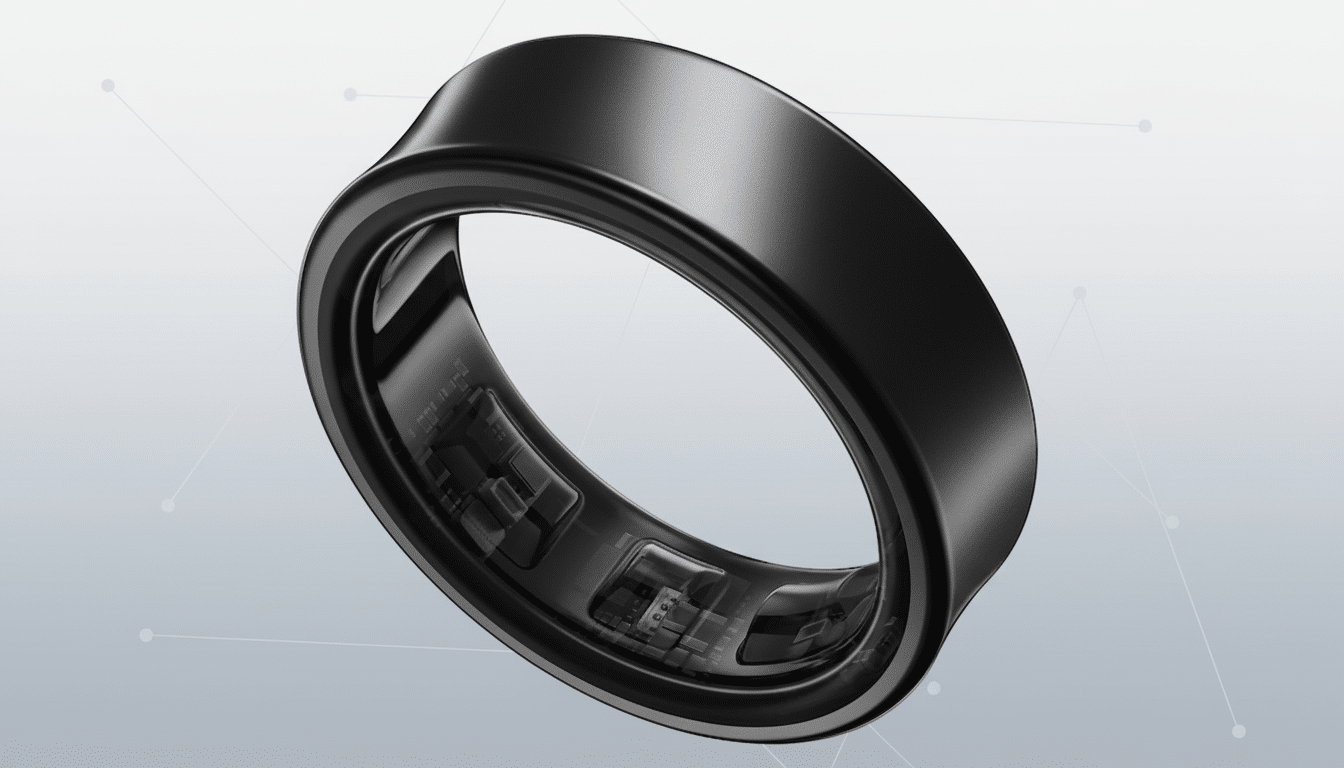

The sleep and recovery pioneer is accusing numerous competitors of violating key patents issued for the ring form factor, sensor layout, internal and external components, as well as production processes — teeing up a potential battle that could shape how the category develops in the US.

What Oura Is Alleging in Its ITC Patent Complaint

Among other targets in its filing, Oura takes aim at Samsung and Reebok for the brand’s smart ring, Zepp Health for its Amazfit device, and Nexxbase for the Luna ring. The products depend on protected designs and techniques that Oura has honed through years of iteration — think the micro-ring chassis with skin-facing sensors, purpose-built temperature and optical arrays, assembly processes that juggle durability with comfort. Oura has built a large patent portfolio with the US Patent and Trademark Office, and the ITC complaint says that it will be aggressive in enforcing those assets as big tech companies enter its turf.

It’s not Oura’s first tussle over IP. The company maintains that in the past it resolved disputes with firms including Circular, Omate, and RingConn via licensing agreements — an outcome it indicates is an option this time too. Consider that a shot across the bow and an invitation: App makers are free to redesign, or pay to license Oura’s innovations.

What the ITC Filing Means for Import Remedies

An ITC Section 337 action is not like any other civil lawsuit. If the Commission accepts for investigation, and ultimately finds an importation violation, it can issue exclusion orders that halt infringing products at the border (enforced by US Customs). That remedy — effectively an import ban — frequently produces more leverage than damages in federal court.

Target dates for ITC probes are usually about 16 months out, with an administrative law judge holding an evidentiary hearing and making an initial determination before the full Commission’s review. Many disputes are resolved before a final decision, often through licensing, redesigns, or consent orders. The immediate risk for consumers is small, but a late-stage exclusion order could temporarily block US sales of infringing rings.

Samsung’s legal posture as Galaxy Ring enters spotlight

Samsung anticipated friction. Long before the Galaxy Ring was released to the public, a number of months prior thereto, either in September 2016 or January 2017, NevoUS filed its first complaint for declaratory judgment against Oura in the United States District Court for the Northern District of California, seeking a declaration that it did not infringe Oura’s patents. That action was dismissed without a merits ruling, paving the way for Oura’s ITC strategy. Now that the complaint is in play, Samsung has a classic calculus to consider — challenge on technical grounds, settle for a license, or redesign around the patents.

The Galaxy Ring is a move that puts Samsung right in Oura’s lane with offerings like sleep tracking, heart-rate measurement, temperature checks, and recovery-style insights baked into its larger health setup. Crucially, Samsung stood up its ring without a self-contained subscription from day one of sales, unlike Oura’s membership model — a competitive angle that raises the stakes if an exclusion order appears poised to squelch Samsung’s US launch.

A category on the cusp as smart rings go mainstream

As the world of smart rings moves out from the niche and into the mainstream, big-name brands are taking note too, with Zepp Health previewing its Amazfit Helio Ring for athletes, Reebok-branded hardware also surfacing in select areas, and India’s Nexxbase launching its Luna ring, signaling interest in a region of the world that could give activity tracking on fingers a proper push. Industry watchers at Counterpoint Research and IDC have noted a growing sweet spot in wearables that are not wristwatches for people wanting 24/7 biometric readings without wrist-encumbering bulk. Entrants with large platforms can add velocity to adoption — but they also run into the IP groundwork laid down by first movers.

For Oura, the math is straightforward: Insist upon differentiation based on miniature sensors, battery electronics, and algorithms proven to work well in contact with skin, or find itself commoditized as deep-pocketed competition copies its playbook. For rivals, a license could be a quicker and cheaper route than battling the whole thing out in court, particularly if the ITC starts an investigation and a possible ban on imports appears to be happening.

What comes next as the ITC weighs an investigation

The next step is the procedural one: the ITC’s decision on whether to launch an investigation. If so, be prepared for a rigorous discovery schedule, expert dust-ups on claim construction and sensor architecture, and back-channel negotiations occurring in parallel to the litigation. A settlement could come at any time; a final exclusion order, if issued, would likely be after the Commission reviews the judge’s initial determination.

The two are likely to end up with a licensing pact, similar to Oura’s previous settlements with other companies. But now that Samsung is anchoring the category’s identity, both sides have reason to push back the boundaries of their patents before they will blink. Either way, this case will be instrumental in determining just how rapidly smart rings are able to scale — and who gets paid as they do.