Oura is not backing away from its membership fees. Despite a growing wave of smart rings that tout one-time hardware costs and no monthly charges, the maker of the Oura Ring says its subscription is here to stay and central to how the company delivers health insights.

Why Oura Says Membership Fees Matter for Accuracy and R&D

In a recent interview cited by Bloomberg, CEO Tom Hale said the subscription underwrites the heavy lifting behind Oura’s accuracy and long-term analytics. In other words, the ring is only part of the product; the rest lives in the cloud, in models that are retrained, validated, and expanded over time.

Hale characterized the membership as fuel for ongoing R&D, from new algorithms to clinical collaborations. Oura’s biometrics have been used in peer-reviewed studies and public-health projects, including work with researchers during the pandemic to explore temperature trends and illness detection. That kind of pipeline demands continuous investment, the company argues, not just a one-off hardware sale.

The company also points to engagement as proof the formula resonates: Oura counts millions of active subscribers, and 75% of them open the app at least five times a week, according to Hale. He added that the subscriber base eclipses many streaming services—a notable benchmark for a niche wearable.

What an Oura Membership Costs and the Features It Unlocks

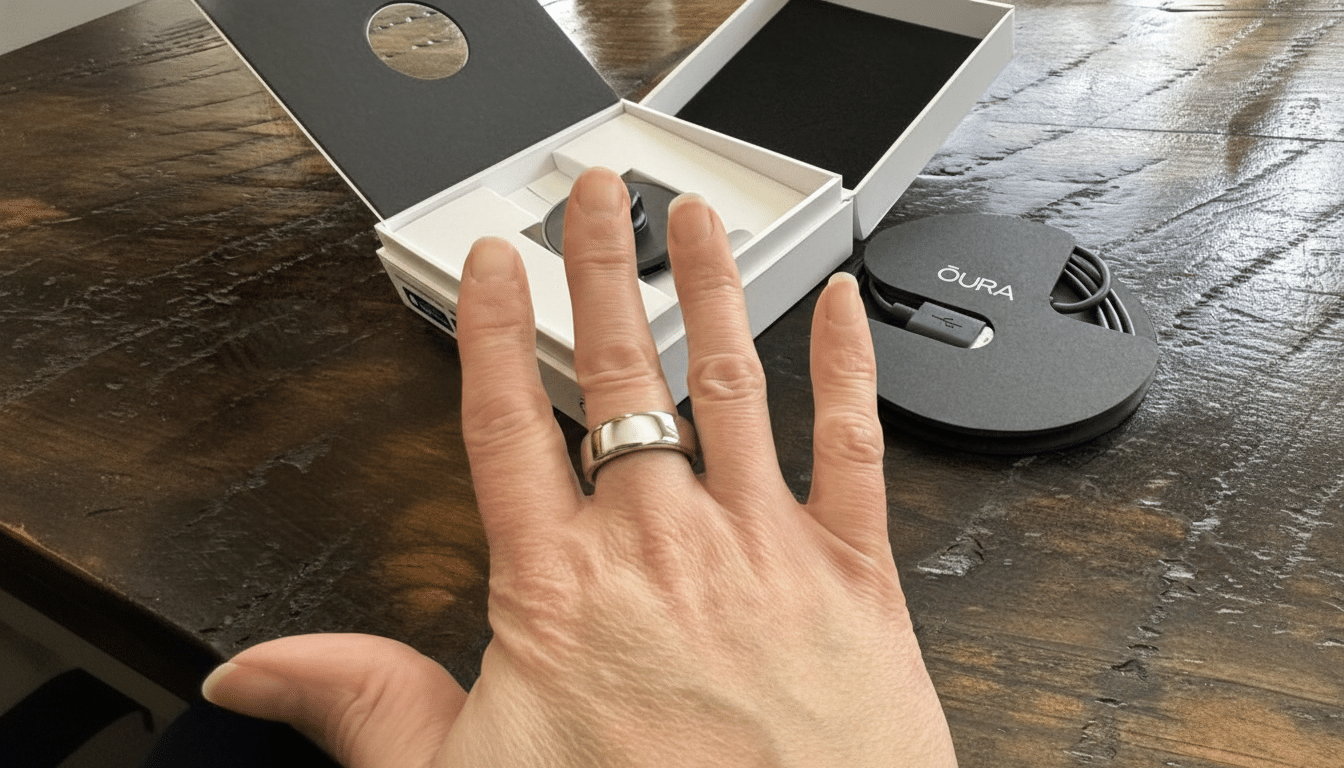

The subscription runs $5.99 monthly, or $69.99 annually, and it sits on top of the ring’s purchase price, which starts at $349 and climbs to $499 depending on finish. Access to Oura’s full feature set—including readiness and sleep scores, detailed sleep staging, temperature trends, activity insights, and longitudinal reports—requires an active membership.

Oura has leaned into features that benefit from long-term data. Recent updates have focused on stress and recovery insights, women’s health and cycle awareness, and daily guidance that adapts as baselines shift. Integrations with third-party services, such as fertility and contraception tools that analyze temperature variation, also rely on the continuous data pipeline the subscription supports.

Rivals Test No-Fee Playbooks as Alternatives to Subscriptions

The decision comes as competitors promote a simpler proposition: pay once, use forever. Samsung’s Galaxy Ring is launching with no subscription requirement and ties into Samsung Health. Newcomers like RingConn and Ultrahuman highlight lifetime access to core metrics. Even lifestyle-branded entries such as the Reebok Smart Ring are pitching hardware-only pricing to lower the barrier to entry.

Not everyone is anti-subscription, though. Whoop, for example, leads with membership as its business model. And on the watch side, players like Garmin and Apple lean the other way, charging no ongoing fee for health metrics while monetizing hardware and optional services. The category is effectively running a live A/B test on whether users prefer higher upfront costs with no recurring bill or a lower hardware price paired with software that evolves behind a paywall.

For Oura, the bet is that people will pay for measurable gains in quality and utility. Sleep staging accuracy, nightly readiness guidance, and nuanced stress signals don’t improve themselves; they’re tuned with larger datasets, clinician input, and computational resources. If the outputs keep getting better—and clearly communicated—members may view the $5.99 as good value.

What This Means for Wearables and the Future of Smart Rings

Oura’s stance signals a maturing wearables market where services and retention matter as much as units sold. Recurring revenue can stabilize a business that would otherwise be exposed to upgrade cycles and seasonal sales, and it gives companies a reason to ship meaningful features after purchase rather than saving them for the next model.

The approach also opens doors beyond consumers. Employers and insurers are increasingly experimenting with wellness incentives, and a service-led model makes it easier to bundle analytics, coaching, or population-level reporting—areas where consistent funding and validated metrics are essential.

For buyers, the trade-off is straightforward: pick hardware with an ongoing bill and expect a faster cadence of software improvements, or choose a no-fee ring and bank on strong baseline features with fewer cloud-heavy extras. With Oura doubling down on subscriptions, that choice is likely to define smart rings for the foreseeable future.