A deepening shortage of high-performance memory is spilling into the console world, with Nintendo weighing a higher sticker price for its next Switch and industry chatter suggesting Sony could slow-roll early PS6 milestones. The pressure, first reported by Bloomberg, stems from chipmakers diverting capacity to lucrative AI parts, tightening supply for game hardware. Neither company has publicly commented.

Memory Squeeze Hits Console Roadmaps and Costs

Consoles are uniquely exposed to memory cycles because they ship in massive volumes with fixed designs that must hold for years. If DRAM and graphics memory get pricier or hard to secure, platform holders face uncomfortable choices: absorb costs and erode margins, push retail prices up, or slide launch windows until supply stabilizes. Multiple supply chain analysts say the current crunch is broad-based, touching LPDDR5/LPDDR5X used in portable systems and GDDR6/GDDR7 favored in high-end consoles.

Why AI Is Straining Game Hardware Supply Chains

The generative AI boom has lit a fire under high-bandwidth memory (HBM) and top-bin DRAM. Firms like SK hynix, Samsung, and Micron have reallocated factory lines and capital spending to feed AI accelerators, where HBM commands premium pricing and record demand. Market trackers including TrendForce and Omdia report DRAM contract prices rising sharply in recent cycles, with HBM capacity effectively sold out and knock-on tightness spreading to GDDR and LPDDR.

That pivot helps explain why inventory for gaming components is tighter than usual. Even when manufacturers expand wafer starts, advanced memory takes time to ramp, and early GDDR7 yields are still improving. In the interim, console buyers compete with data centers, GPUs, and flagship phones for the same pool of leading-edge memory dies.

What A Switch 2 Price Shift Could Look Like

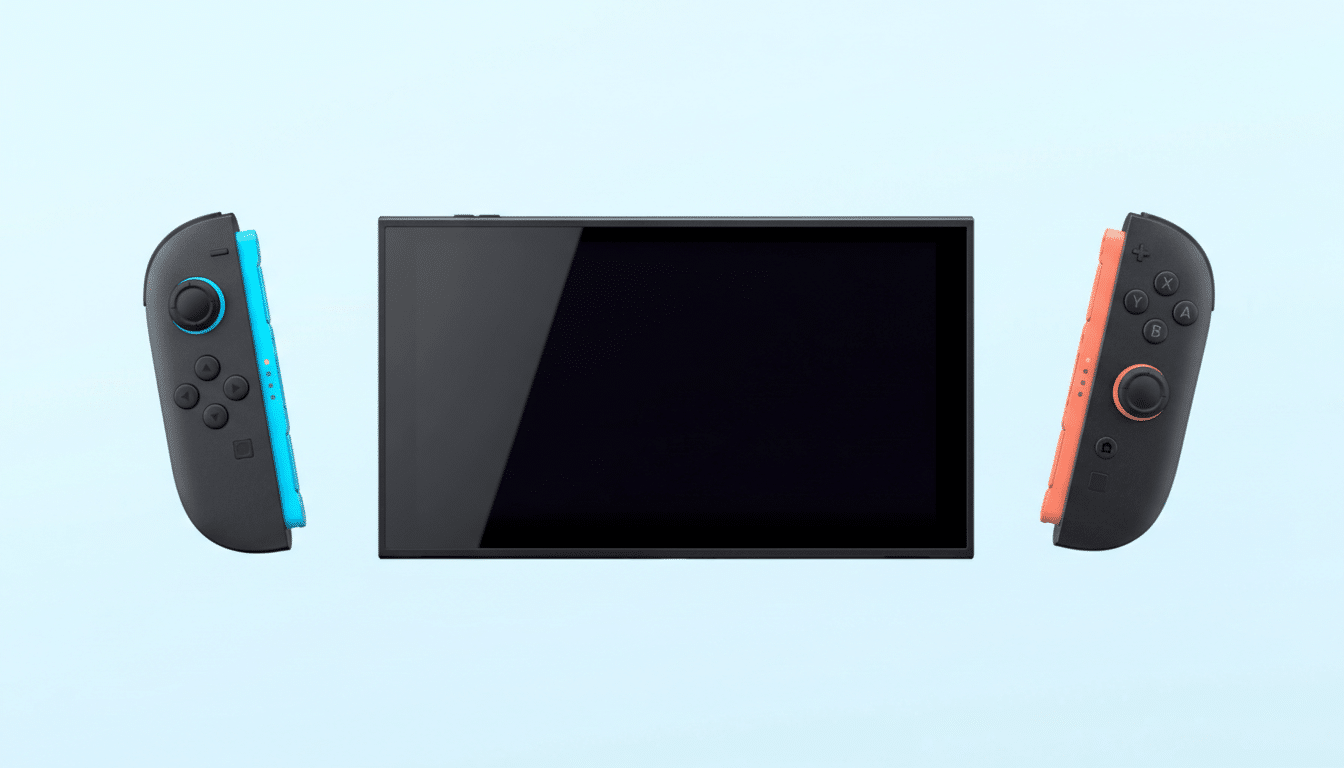

Bloomberg’s reporting indicates Nintendo is considering a higher price for its next Switch amid the memory squeeze. While the company has not disclosed specs, developers expect a bump to modern LPDDR5 or LPDDR5X and a larger capacity—commonly rumored in the 8–12 GB range—to support more ambitious games and fidelity.

Here’s the cost reality: analysts estimate recent LPDDR5X contract prices have climbed in the low double digits, with top-speed bins seeing even steeper premiums. For a portable console buying millions of units, that can add $10–$25 to the bill of materials depending on capacity and bus configuration. Layer in pricier storage and a more capable SoC, and it becomes harder to hit the familiar mass-market target without sacrificing margins.

Earlier chatter suggested tariffs might drive up prices, but that ultimately didn’t move the needle. Memory is the clearer culprit now, and it’s a variable Nintendo can’t fully control. A modest retail increase would track with broader consumer electronics trends during tight memory cycles.

PS6 Planning Runs Into GDDR Trade-offs and Supply Constraints

On the high-end side, Sony’s next PlayStation will almost certainly rely on a large pool of graphics memory—today’s PS5 uses 16 GB of GDDR6, and developers increasingly target 4K assets, ray tracing, and heavier AI inference on-device. The natural step is more capacity and bandwidth, likely via faster GDDR6 or an early GDDR7 adoption.

That’s where the shortage bites. GDDR6 has tightened as GPU vendors soak up supply, and GDDR7’s ramp is constrained by new process steps and maturing yields. Industry teardowns and cost models from firms like TechInsights suggest memory can represent 10–20% of a console’s silicon bill. A multi-digit % price swing on that line item is enough to force schedule or design adjustments, especially if the platform holder wants to avoid a steep launch price.

Bloomberg’s sourcing points to exactly that calculation: better to secure stable memory allocations and predictable costs than to rush a flagship launch into a volatile market. Even incremental delays in component readiness can cascade through developer roadmaps and marketing beats.

Key Signals To Watch In The Gaming Supply Chain

- Memory vendor guidance: SK hynix, Samsung, and Micron have been explicit about prioritizing HBM. Any commentary about expanding GDDR or LPDDR output would be an early sign of relief.

- Contract price trends: Research firms like TrendForce track DRAM and NAND pricing. A flattening or decline in LPDDR5X and GDDR6 quotes would ease console cost pressure.

- Developer documentation: Changes in recommended memory targets or SDK notes can hint at final hardware decisions for next-gen systems.

- Retail positioning: If Nintendo signals a premium tier or accessory bundling at launch, that could be a tactic to offset elevated component costs without shocking the base model’s tag.

The Bottom Line for Console Pricing and Timelines

The AI-driven memory land grab is bleeding into consumer gaming. With HBM eating fab capacity and GDDR/LPDDR prices elevated, Nintendo is weighing a higher Switch 2 price and Sony may adjust PS6 timing to avoid launching into a parts crunch. Until memory supply loosens, expect conservative planning, tighter allocations, and fewer aggressive price plays from console makers.