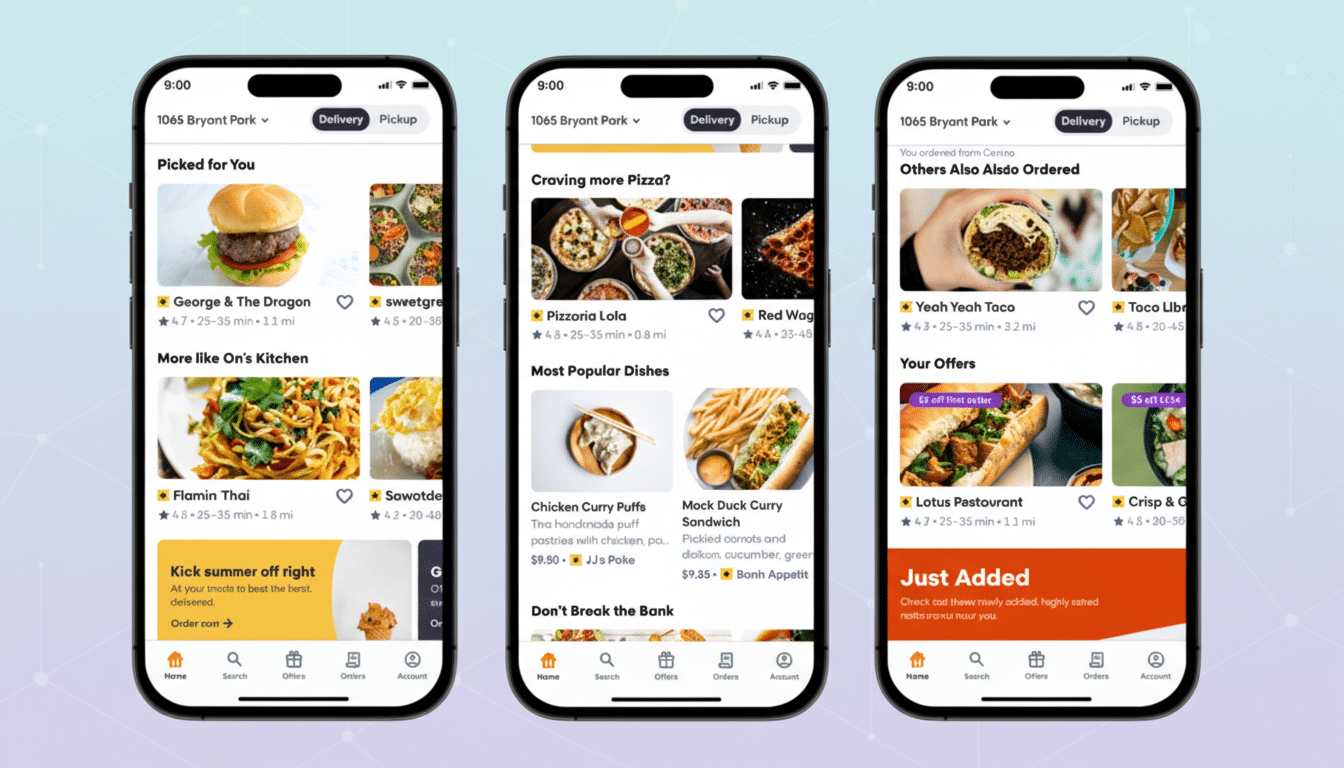

Grubhub is dropping delivery and service fees on restaurant orders over $50, positioning the offer as a permanent price cut rather than a short-term promo. The company is marketing the change with a high-profile Super Bowl spot featuring George Clooney and a simple message to consumers: “Grubhub will eat the fees.”

For customers, the savings are meaningful. Grubhub says delivery and service fees on large baskets typically add up to about $13 per order across food apps. Under the new policy, those charges fall to $0 for qualifying restaurant deliveries over $50. Taxes and tips are unchanged, and the offer applies to restaurant orders rather than grocery or convenience categories.

A Permanent Waiver on Delivery and Service Fees for Large Orders

Unlike rotating promo codes, this waiver is designed to be always-on and simple: cross the $50 threshold on a restaurant delivery and the delivery and service fees disappear. That makes the math easy for group dinners and office lunches. A $60 family meal that once carried roughly $12–$15 in platform fees can now avoid that add-on entirely, with only menu prices, taxes, and tip remaining.

The economics hinge on high-basket orders. Large tickets tend to be more profitable for platforms and restaurants because fixed costs are spread over more items, and diners are less price sensitive when ordering for multiple people. By absorbing consumer-facing fees on these orders, Grubhub is betting that bigger baskets, higher order frequency, and lower checkout abandonment will offset the lost fee revenue.

How It Stacks Up Against Rivals in Food Delivery

DoorDash and Uber Eats frequently promote reduced fees, but comparable waivers are usually tied to paid memberships—DashPass and Uber One—along with eligibility rules and restaurant-level restrictions. A blanket, permanent waiver on delivery and service fees above a set cart size is a notably simpler proposition that does not require a subscription.

The move comes as Grubhub seeks to close a usage gap with its larger competitors. Market intelligence firm Sensor Tower has reported that Grubhub’s monthly active users trail far behind DoorDash, which approaches the 50 million MAU mark in the U.S., while Grubhub sits in the single-digit millions. By carving out a distinct value hook for bigger orders, Grubhub is aiming squarely at families, offices, and group dining—cohorts where average cart sizes routinely top the new threshold.

What It Means For Diners And Restaurants

For diners, the headline benefit is less sticker shock at checkout. In an era of heightened scrutiny over so-called “junk fees,” flattening the fee line item to $0 on larger orders simplifies price expectations and can improve trust. It also narrows the gap between pickup and delivery on high-value meals, which could keep more orders on-platform instead of shifting to phone-in or in-person pickup.

For restaurants, the calculus is more nuanced. Consumer-facing delivery and service fees are separate from the commissions restaurants pay platforms to access logistics and demand. Industry disclosures and court filings have shown those commissions can run from the teens to the low 30% depending on services, promotions, and exclusivity. Grubhub’s fee waiver targets the customer side of the equation, which could increase order volume and average ticket sizes without altering existing commission contracts. Whether the higher throughput outweighs any operational strain during peak periods is something operators will watch closely.

Grubhub has not indicated changes to courier incentives or pay as part of this announcement. Tips remain optional but customary, and the company is likely to keep encouraging gratuities to support driver earnings and fulfillment reliability.

Marketing and Loyalty Push Behind the New Fee Waiver

The campaign’s creative centers on a clear promise delivered in a culturally dominant moment, a tactic that can reset brand perception quickly if the product offer holds up. To reinforce loyalty beyond a single ad, Grubhub has also acquired Claim, a startup that powers cash-back rewards at local restaurants for dine-in and pickup. That deal signals a broader strategy: pair upfront fee relief on large deliveries with ongoing, personalized rewards that drive repeat behavior across channels.

Behavioral research has long shown that drip pricing depresses conversion by making the final total feel unpredictable. Removing two of the most salient add-on fees for big orders could lift conversion rates at the last step of checkout—a metric delivery platforms scrutinize as closely as market share.

What to watch next as Grubhub rolls out the fee changes

Key signals will include the share of orders crossing the $50 threshold, changes in average order value, and repeat rates among households that place group orders. Competitor responses are also likely—expect time-bound promos or targeted membership perks from DoorDash and Uber Eats rather than immediate, permanent policy shifts.

Analysts will monitor third-party trackers such as Sensor Tower, YipitData, and Bloomberg Second Measure for early reads on adoption, as well as restaurant feedback on throughput and margins. If the waiver proves sustainable and expands to adjacent categories or different thresholds, it could reset consumer expectations around delivery fees industry-wide.