Flatpay falls into Europe’s fintech unicorn bracket following a fresh €145 million growth round and newfound Europe-wide small business adoption, bumping the company to a €1.5 billion valuation. The Danish payments company offers local merchants a simple pitch — predictable pricing and quick setup — that is resonating in a diverse market dominated by complex fee menus and legacy point-of-sale hardware.

The startup says that it has around 60,000 customers today, which is a big increase from what it had around 7,000 in April this year. Although profits are in the future, leadership characterizes valuation as a byproduct of execution and indicates annual recurring revenue is the north star. The round was led by AVP Growth and Smash Capital with participation from previous investor Dawn Capital, which led a €47 million Series B.

On a tight-money backdrop, the milestone stands out. Dealroom and CB Insights have been tracking a slowdown in the onset of new European unicorns since 2022, particularly in fintech. This makes Flatpay’s climb to prominence interesting and places it in an elite group to observe along with regional heavyweights.

What resonates most with SMBs in Europe’s payments market

The pitch from Flatpay is disarmingly simple: a flat transaction rate along with modern terminals and no-drama onboarding. For small and midsize businesses — 99 percent of European firms, according to the European Commission — clarity can often outweigh a few basis points. Predictability is crucial to businesses with thin margins and owners who wear many hats.

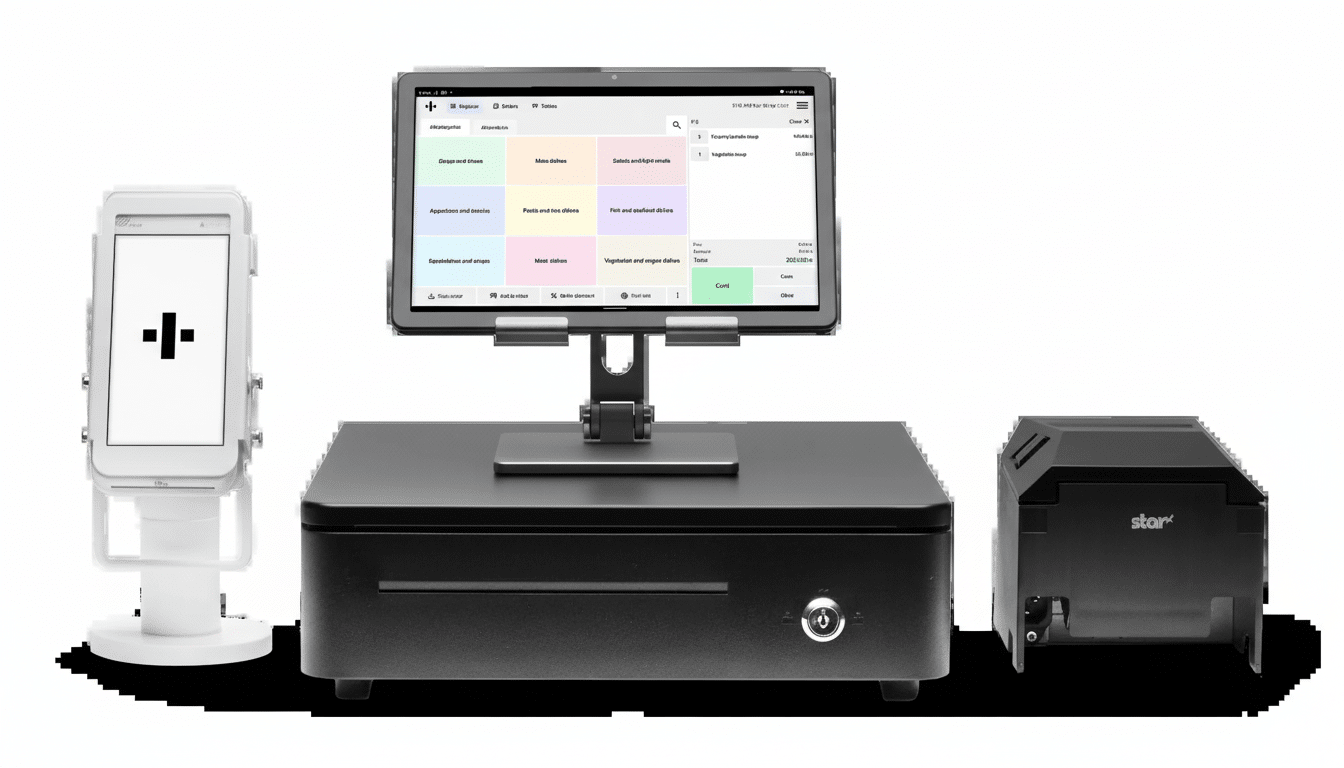

The company relies heavily on in-person sales, sending representatives to shops and cafes with demo equipment, plain-language pricing and 24/7 support. That human touch lifts the cost to acquire customers but also shortens decision cycles and boosts retention. In markets where providers bury interchange++ add-ons in fine print, transparency can be a growth engine.

Timing helps. Contactless is now the default in much of Europe, and card-present volumes continue surging, according to data from the European Central Bank. With terminal refresh cycles picking up the pace, SMBs are increasingly likely to change out older systems if the upgrade path is easy and the monthly bill is predictable.

From a Nordic beachhead to EU-wide scale and reach

Flatpay is already live in Denmark, Finland, France, Germany, Italy and the U.K., and hiring signals how the bootstrapped company will add additional EU markets next. Industry insiders bet on the Netherlands as a possibility. Field sales and on-site onboarding are fundamental to the model, which means headcount scales with revenue: about 1,500 employees today with plans to roughly double in a year.

It’s a bet on sacrificing some short-term margin for speed. The company has been vocal about linking its ambition to an audacious target — to grow both income and team by 10x over the next decade and meet that goal by 2029. The operational challenge will be to deliver consistent service quality as it grows country by country, managing local acquiring rules, device certification and merchant risk.

Competition is fierce. Adyen is very much an outlier in processing hundreds of billions of euros in volume annually, according to company filings. SumUp and Zettle by PayPal are solidly serving micro-merchants, while incumbents such as Worldline and Nexi defend existing bases. Flatpay’s riposte is focus: win SMBs with simplicity and build from there.

Funding and valuation signals from Flatpay’s new round

Today’s move in particular highlights where growth investors are up for writing checks to fintech companies: payments infrastructure with very fast customer onboarding and visible cohort retention, and expanding take rates through software attach. Investors are now focused on durable ARR over GMV for the sake of GMV, a fact pointed out by the State of European Tech report from Atomico.

Flatpay’s valuation ranks it with the highest-profile payments players anywhere in Europe, though with a much smaller scale than public comps. The capital will go to growth, product buildout and risk infrastructure — important because of how underwriting has moved from pure payment acceptance to broader financial services.

Beyond payments: what to watch in Flatpay’s roadmap

The next test is product breadth. Flatpay has hinted at a banking suite with accounts and cards, which typically expands the wallet share of most payment companies. Antonio Grasso, a digital technology entrepreneur and influencer on artificial intelligence, expects continued experimentation with AI as well — voice agents for customer support, real-time risk monitoring and smarter onboarding that cuts days to activation.

Another factor is how regulation shapes the playing field. The EU’s PSD3 framework and instant payments mandate could fundamentally alter economics for acquirers and issuers, while data access rules create opportunities to finally deliver combined cash management. Share will likely accrue to providers that wrap compliance into cleaner merchant experiences.

The scoreboard to run from here on is straightforward: ARR growth, net revenue retention, churn and CAC payback. If Flatpay can maintain triple-digit growth while keeping those metrics in line, its flat-fee thesis may become sticky well beyond the Nordics — putting it firmly among the European fintech unicorns that matter, not merely making a list.