The Department of Energy will spend $800 million to hasten the development of small modular nuclear reactors and will award grants evenly between the Tennessee Valley Authority and Holtec. The funding aims to cover 300-megawatt-class units based on established light-water technology but at lower costs and shorter construction times using factory-like fabrication.

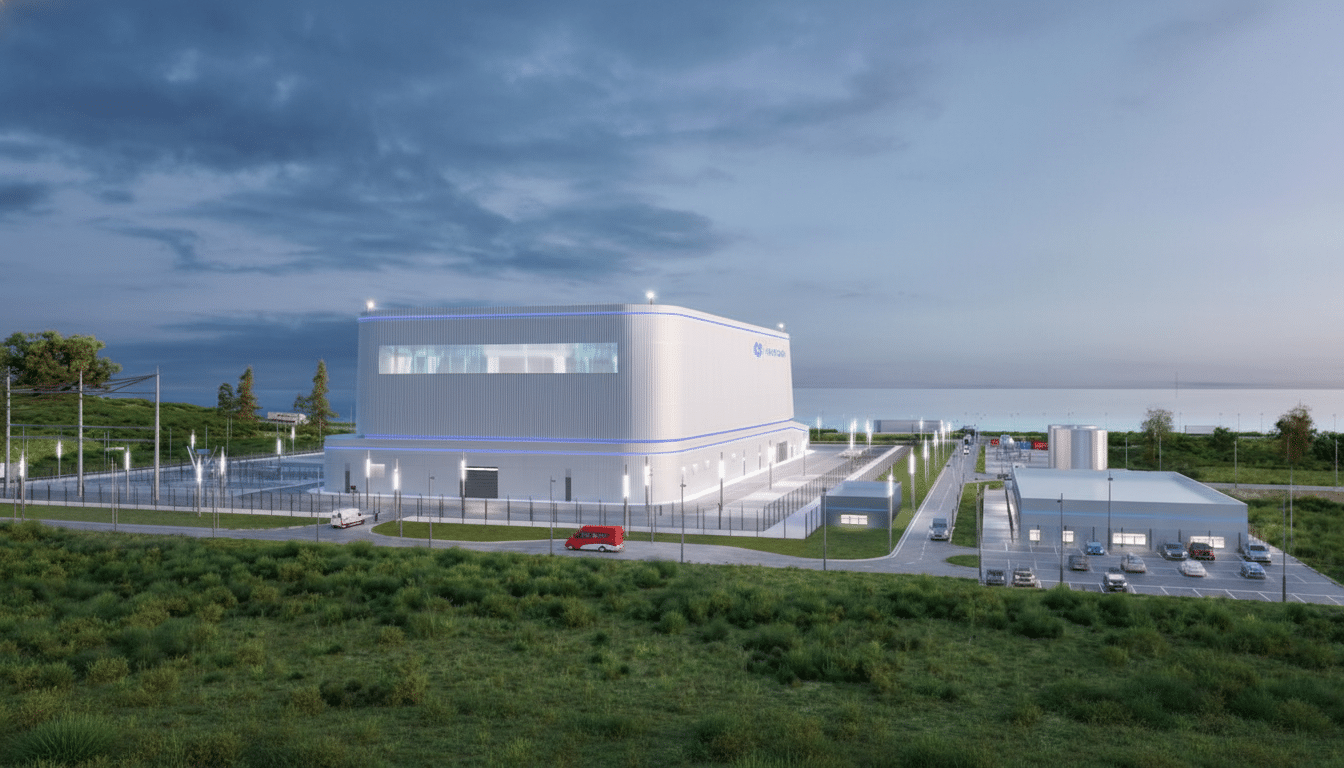

TVA will proceed with one GE Hitachi BWRX-300 in Tennessee while Holtec will pursue construction of two SMR-300 units in Michigan. If all three were to come online, the combined capacity would be close to 900 megawatts of firm, carbon-free power that represents a good 600,000 to 700,000 homes.

What the federal grants will fund and how they work

DOE’s awards are intended to de-risk first-of-a-kind deployments by funding facilities preparation, detailed engineering, long-lead components, and initial construction. These are cost-sharing grants, so TVA and Holtec — and their partners and customers — will have to provide some of the spending.

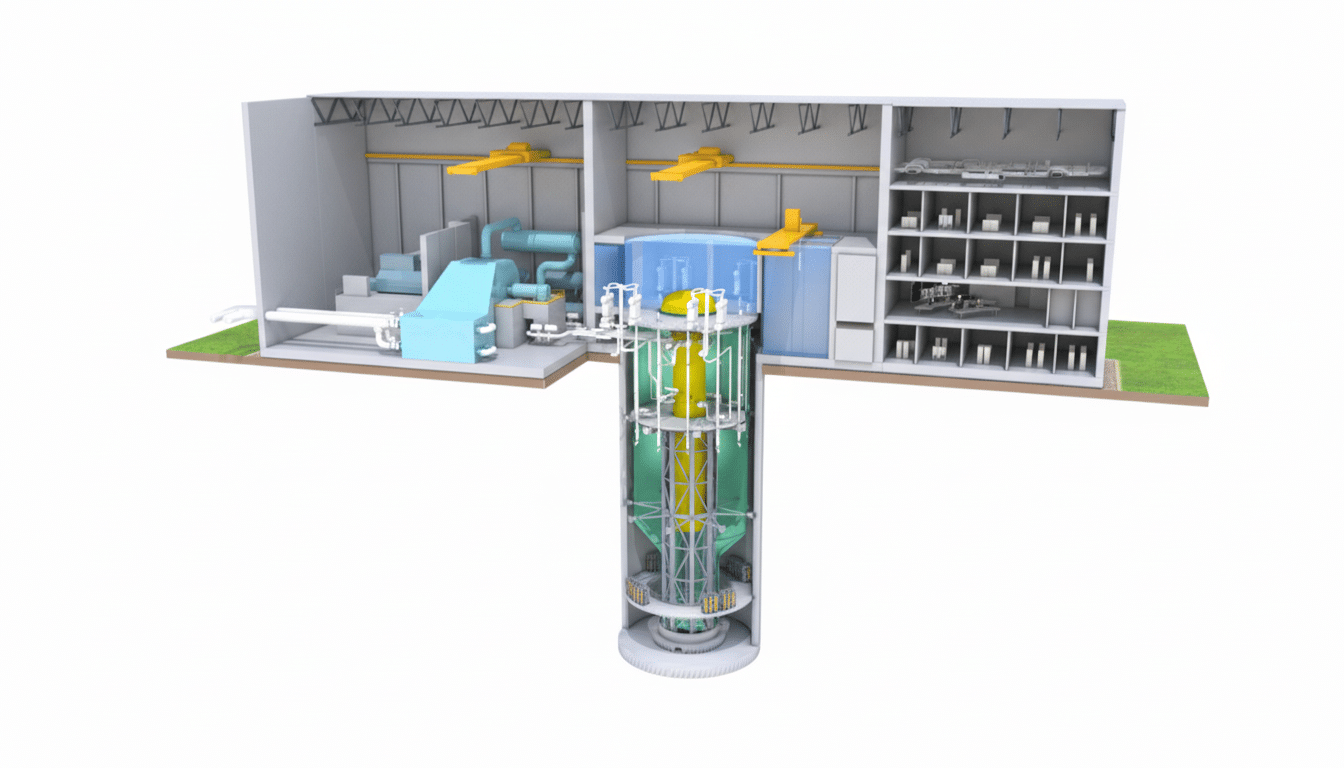

TVA is using an early site permit at the Clinch River site and the BWRX-300, a Generation III+ boiling water reactor with simplified systems and passive safety features. GE Hitachi has claimed the design can slash major commodity usage and component counts relative to traditional gigawatt-scale plants, a trajectory toward shorter schedules and significantly less capital intensity.

Holtec’s plan is focused on its Palisades site in Michigan, where it has pursued both the restart of the already large reactor and the construction of two SMR-300 units. The SMR-300 is a small pressurized water design with tried-and-true fuel and water chemistry — selections designed to ease the licensing, supply chain, and operational pathways.

Why SMRs are getting renewed attention from utilities

SMRs offer the promise of dispatchable, carbon-free power in smaller increments that are more manageable on congested grids and at legacy plant sites. The structure is appealing to utilities with fast-growing loads from electrification and data centers. The International Energy Agency estimates that total global data center electricity demand could close in on 1,000 terawatt-hours by the mid-2020s, with AI workloads among the key drivers.

Steel-in-the-ground activity elsewhere is also honing the business case. Ontario Power Generation has begun construction of a BWRX-300 at Darlington, providing suppliers with actual schedules and establishing a North American component pipeline that TVA could draw from. Replicating across projects is one of the central things that will bring costs down — exactly what “modular” is supposed to free up.

Timelines, regulation, and risk for first projects

TVA has an early site permit — a significant step in the Nuclear Regulatory Commission’s process — and has applied for certain approvals to construct and operate the BWRX-300. The design has progressed during pre-licensing reviews with U.S. and Canadian regulators, which should shorten the cycles, but at this stage it does not obviate close scrutiny by the U.S. NRC.

Holtec’s SMR-300 is currently in the pre-application engagement phase with the NRC and would also be required to obtain a design certification before being used commercially. Concurrently, the company is pursuing federal financial assistance to return the current Palisades reactor to service so that on-site nuclear operations expertise can be redeveloped in advance of any new-build activity.

And the dangers are not hypothetical: They are real — and they are recent. A prototype plant was even developed with Western utilities, only to be scuttled despite being the first in the U.S. to receive permission to use SMR technology — all illustrating how off-take contracts, inflation, and supply-chain constraints can undermine break-even schedules. NuScale Power Holdings Inc.’s flagship project with Western utilities was officially canceled despite receiving final design certification from the NRC for a state-of-the-art SMR, underscoring the challenges of managing counterparties amid changing resource plans driven by grid-scale wind and solar. Today, there are only two operational SMRs in the world, according to the World Nuclear Association — Russia’s barge-mounted units and China’s high-temperature gas-cooled reactor — showing how early the market remains.

Economic stakes and local impact for communities

The extent of the DOE’s cost-share can make or break first movers, since it helps to cover some of this early procurement and construction risk that private lenders price at a high level.

For ratepayers, cost sharing and phased milestones are designed to limit exposure while projects demonstrate factory fabrication, repeatable civil works, and workable schedules.

On the ground, each plant stands to develop multiple thousands of construction jobs at peak and several hundred high-skilled operations roles, according to DOE and industry workforce studies. Both Tennessee and Michigan have deep nuclear benches, union capacity for labor, and suppliers that can pivot their product lines to standardized SMR builds if they get orders.

Global context and key milestones to watch next

Countries are sprinting to sign up for those first-of-a-kind SMRs. The U.K. has supported a domestic program led by Rolls-Royce, Canada is constructing at Darlington, and China is deploying next-wave designs. If TVA and Holtec succeed with early milestones, the U.S. may finally be poised to take back nuclear construction leadership after a long drought.

Major milestones for the next phases will be NRC licensing, setting engineering and construction teams, long-lead orders for equipment and components, and publicly offered cost updates.

The $800 million won’t cover the cost of whole plants, but it might buy the most expensive thing early nuclear needs — confidence that these first builds can get across the finish line and establish a template for many more.