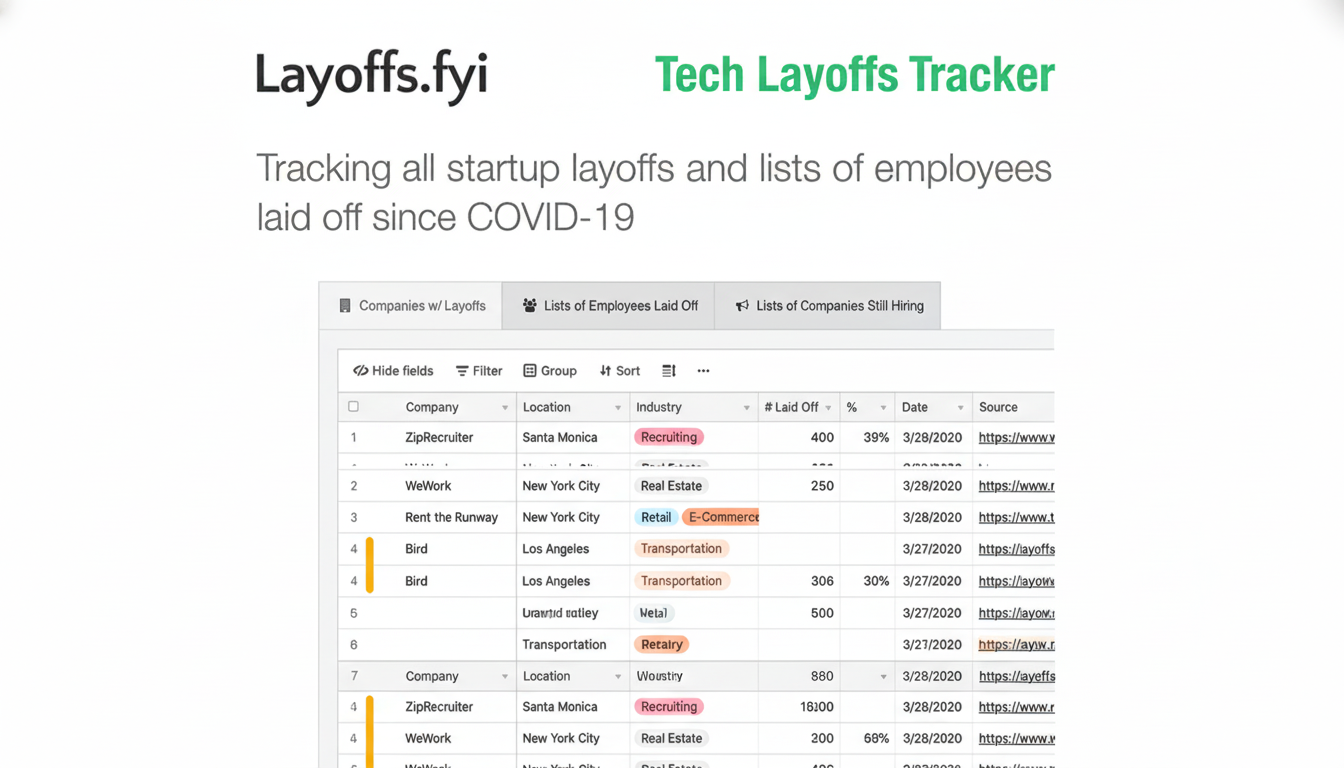

Tech layoffs are once again leading the news cycle this year, spanning big tech companies to enterprise software businesses to consumer apps; servers and EVs have also been impacted. Independent tracker Layoffs.fyi that added up to well over 150,000 jobs cut at least somewhat so far this year from more than 500 companies. Early counts last year already show tens of thousands more cuts, spiking in one winter month alone by 16,000 job losses. The throughline is clear: Companies are sprinting to remodel cost structures for an AI-first era and looking up against slower demand in key categories as well as tighter capital.

The big picture behind 2025 tech layoffs and restructurings

Three forces were responsible for the 2025 reductions: AI-induced productivity that will crush headcount in the back office and support jobs; cyclical and policy-related pressures on EV and semi companies; ongoing portfolio trimming after years of expansion. Company filings, WARN notices and reports from Reuters, Bloomberg and The Information tell a story of a steady drumbeat of cuts, reorgs and site consolidations that are commonly accompanied by pledges to invest in AI infrastructure and growth bets on core parts of the business.

The biggest tech layoffs announced across 2025 so far

Among the largest cuts was at Amazon, which said it would eliminate more than 6,500 roles around the world — about 3 percent of its workforce — while reducing head count in targeted teams such as dot-com and devices and services. Its podcast division Wondery laid off approximately 100 employees amid consolidation of its audio operations and changes at the top.

Salesforce further cut staff — more than 250 positions at its San Francisco headquarters — after previously doing so in the Pacific Northwest. Management also remains focused on further AI investments and margin discipline.

Google conducted targeted downsizing as part of moves in cloud and platform teams, hardware cuts and other “select investment areas,” including design roles, and several groups within Android—Pixel, the consumer-hardware division Chrome. At the same time, a voluntary exit program began to strike at some areas within People Operations as Google flattens layers and reallocates resources around A.I.

Meta’s Reality Labs division cut hundreds of jobs as it streamlined VR content and hardware operations, alongside some performance-oriented changes that management has characterized as a way to “move faster” with less handoffs.

Delivery Hero would cut about 450 jobs while automating customer service work, the company said. Fiverr reported about 250 cuts — or roughly one-third of headcount — as it revamps its marketplace around AI-native workflows, and reduces layers of management.

Paycom is eliminating over 500 positions as automation improves the software company’s efficiency and reduces the need for manual help. After the number of support tickets dropped due to product improvements, Atlassian eliminated 150 support and operations roles.

Chegg announced that it cut around 240 jobs, or about 30% of its staff, as a result of changing student behavior toward generative tools and it plans to redirect the savings into AI-based learning products. Other edtech companies also recorded double-digit declines for the same reason.

Chipmakers faced the sharpest resets. Intel announced thousands of reductions tied to factory and corporate restructures, including big cuts in Oregon, as export controls and foundry timelines combine to reset. ABB said it would jettison about 5,600 jobs worldwide, with a focus on automation and EV-charging business to better compete.

EV makers continued to right-size. General Motors cut about 200 jobs at a plant that manufactures electric models, given the slower-than-projected rate of purchase. Rivian has also announced additional cuts, including a roughly 1%–2% cut earlier in the year and more streamlining.

Recruitment platforms were under pressure from AI-native hiring tools: Indeed and Glassdoor, owned jointly by Recruit Holdings, announced a combined cut of about 1,300 jobs, mostly in R&D and HR as well as sustainability — the companies are consolidating systems and aiming to gravitate toward matching that is driven by artificial intelligence.

ByteDance eliminated about 65 jobs in the Seattle area, while Lenovo said it would have a low-single-digit percentage reduction of its workforce in the United States as demand for PCs approaches normalized levels. Podcast and media tech also saw retrenchment, with creator and support teams affected as companies pivot toward video and AI-driven production.

Sectors under pressure as AI, EVs and chips reshape jobs

Enterprise software is slimming customer support, sales ops and other internal platforms — the exact places where generative AI can lift throughput. Consumer internet and media are combining studios and tooling teams as ad markets reach a stabilization below peak and distribution shifts to short video plus creator platforms. Semiconductors and hardware are in a double bind: cyclically driven inventory digestion as well as geopolitical driven constraints. Ambitious roadmaps are colliding with EVs, costlier capital and cautious consumers.

Why layoffs are accelerating across tech and related sectors

Management teams are reading from the same playbook – shield free cash flow, lift operating leverage and redirect spend toward AI infrastructure, data platforms and a more focused set of flagship products. Productivity tools, copilots and automation are reaching levels of control so that one engineer, seller or agent can do the work that previously took many. That adds a further catalyst — private equity take-privates, with synergy targets which will compress overlapping roles following years of headcount growth.

What to watch next for tech employment and AI investments

Analysts for Challenger, Gray & Christmas predict tech will continue to be a large force behind job cuts while also flagging robust hiring of AI safety, infrastructure, data and applied ML positions — often at the same companies that are laying off. Watch: the speed of turns in EV inventory, chip export policies, enterprise AI adoption rates and revenue per employee as a leading indicator for whether workforce resets are nearing a bottom. For workers, the best landing zones are AI platform engineering, data governance, cybersecurity and revenue-facing roles related to AI-enabled products.

This list is based on company filings, WARN notices and reporting from reputable news organizations, as well as Layoffs.fyi data. It remains a work in progress as more cuts are verified and restructuring plans are set.