Apple has paused development of an in‑app “AI doctor” for its Health app, scaling back a project that aimed to deliver automated guidance based on personal health data, according to reporting from Bloomberg. Rather than launching a full‑fledged coaching service, Apple is expected to fold select elements into existing experiences and explore safer ways to answer health questions through Siri.

Internally codenamed Mulberry, the initiative was envisioned as a premium Health+ subscription that blended Apple Watch and iPhone signals with lab results and educational content. Early concepts reportedly included personalized videos explaining risk factors and adaptive plans that could nudge users toward better sleep, nutrition, and activity—hallmarks of digital health coaching seen in popular wearables.

The shift follows a leadership review that concluded Apple’s offering wasn’t clearly ahead of rivals. Devices and services from Oura and Whoop already provide recovery scores, readiness metrics, and targeted lifestyle suggestions on iOS, making differentiation a higher bar. In typical Apple fashion, the company appears to be choosing a steadier path over a headline‑grabbing launch.

Why Apple Hit Pause on Its In‑App AI Doctor Ambitions

Delivering automated medical guidance is more than a product challenge—it’s a regulatory and trust gauntlet. The FDA’s guidance on Clinical Decision Support underscores that software providing specific, hard‑to‑independently‑verify recommendations may be treated as a medical device, triggering rigorous validation and ongoing compliance. That threshold rises further when AI models generate advice that clinicians—or consumers—cannot easily audit.

Generative AI brings added complications. Even state‑of‑the‑art models can hallucinate, overgeneralize, or miss nuance in sensor data. In health contexts, those edge cases become safety risks. Surveys from Pew Research have found consumers remain wary of AI diagnosing conditions, and liability questions persist whenever software begins to sound like a clinician.

Privacy is another pressure point. Apple has staked its brand on on‑device processing and strict data minimization, but coaching systems often rely on continuous ingestion of sensitive information. Balancing utility, explainability, and privacy—without slipping into regulated “medical advice”—is a needle Apple historically threads carefully.

What Survives and What Changes in Apple’s Health Plan

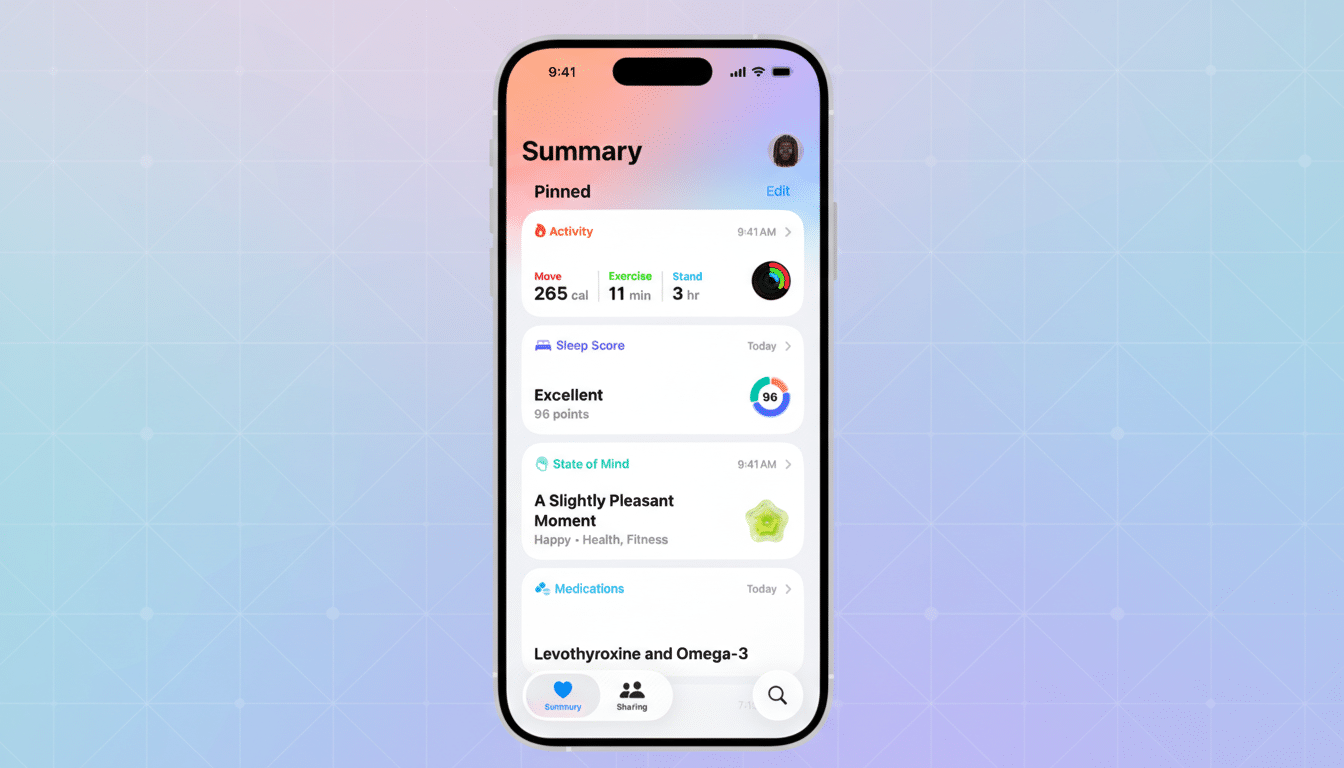

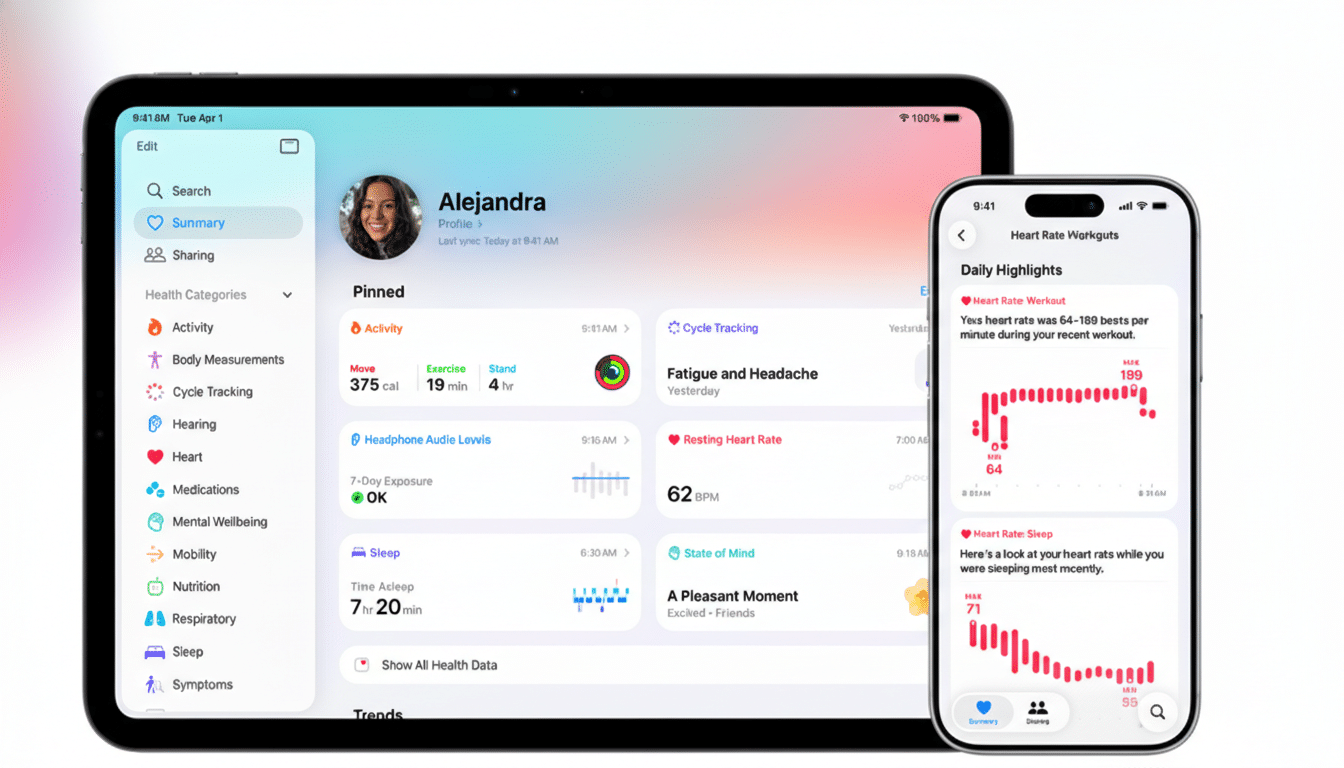

Not all of Mulberry is going to waste. Bloomberg reports some of the educational videos captured for the project will surface as context‑aware recommendations inside the Health app. That aligns with Apple’s established approach: package vetted content and gentle nudges around features such as sleep, cycle tracking, and heart health, while avoiding prescriptive diagnoses.

Expect Siri to play a bigger role. Apple is exploring ways for Siri to answer health‑related questions by referencing Health app data with explicit user permission. The likely emphasis: concise, explainable, and privacy‑forward responses, potentially powered by on‑device models for sensitive queries. Think clarity and coaching‑lite, not a chatbot practicing medicine.

This incrementalism mirrors Apple’s broader health strategy. The company has pursued regulated features—like ECG and irregular rhythm notifications on Apple Watch—only after extensive validation. It has also leaned on large‑scale collaborations, such as Stanford Medicine’s Apple Heart Study with over 400,000 participants, to ground features in real‑world evidence.

The competitive landscape and stakes for Apple’s health strategy

Apple sits atop the smartwatch market by unit share, with firms like Counterpoint Research and IDC consistently ranking it first. Estimates often place Apple’s slice of global smartwatch shipments near the 30%–40% range. That advantage gives Apple a built‑in audience for new wellness features—and a powerful reason to avoid missteps that could erode trust.

Meanwhile, competitors are moving quickly. Oura and Whoop offer recovery and readiness scores backed by subscription content, while Fitbit Premium and Samsung Health provide guided programs and stress insights. The differentiator Apple can lean on is tight hardware‑software integration, on‑device processing, and a health data platform (HealthKit) that already anchors millions of daily habits.

The stakes are high. Digital health remains one of the few categories where consumer tech can measurably impact outcomes, but it also carries outsized regulatory and reputational risk. A cautious rollout of assistive features—rather than an “AI doctor”—is consistent with Apple’s risk calculus.

What to watch next as Apple refines its AI health features

Watch for deeper Siri context awareness that can summarize trends, explain metrics like resting heart rate and HRV, and surface tailored content without crossing into medical claims. Also keep an eye on whether Apple expands research partnerships or pursues new FDA clearances for algorithmic features that demand clinical‑grade validation.

If Apple ultimately offers a premium health tier, expect it to center on high‑quality education, habit support, and integrations with clinicians or third‑party programs—while leaving diagnosis and treatment to providers. In short, the company seems intent on being an informed coach, not a doctor, and on letting the science—and regulators—set the pace.

For users, the near‑term takeaway is straightforward: richer insights and smarter explanations inside Health and Siri, delivered with Apple’s familiar guardrails. The bold promise of an AI physician can wait; a trustworthy assistant in your pocket may prove more useful—and more sustainable—right now.