Meta is preparing to unleash a new wave of AI models and products, with Mark Zuckerberg signaling that agentic shopping tools will be a centerpiece and that a larger rollout is planned for 2026. The company’s pitch is simple and aggressive: build AI that understands a user’s personal context across its apps, then turn that intelligence into effortless, conversion-friendly commerce.

Agentic Commerce on Meta Platforms and Apps

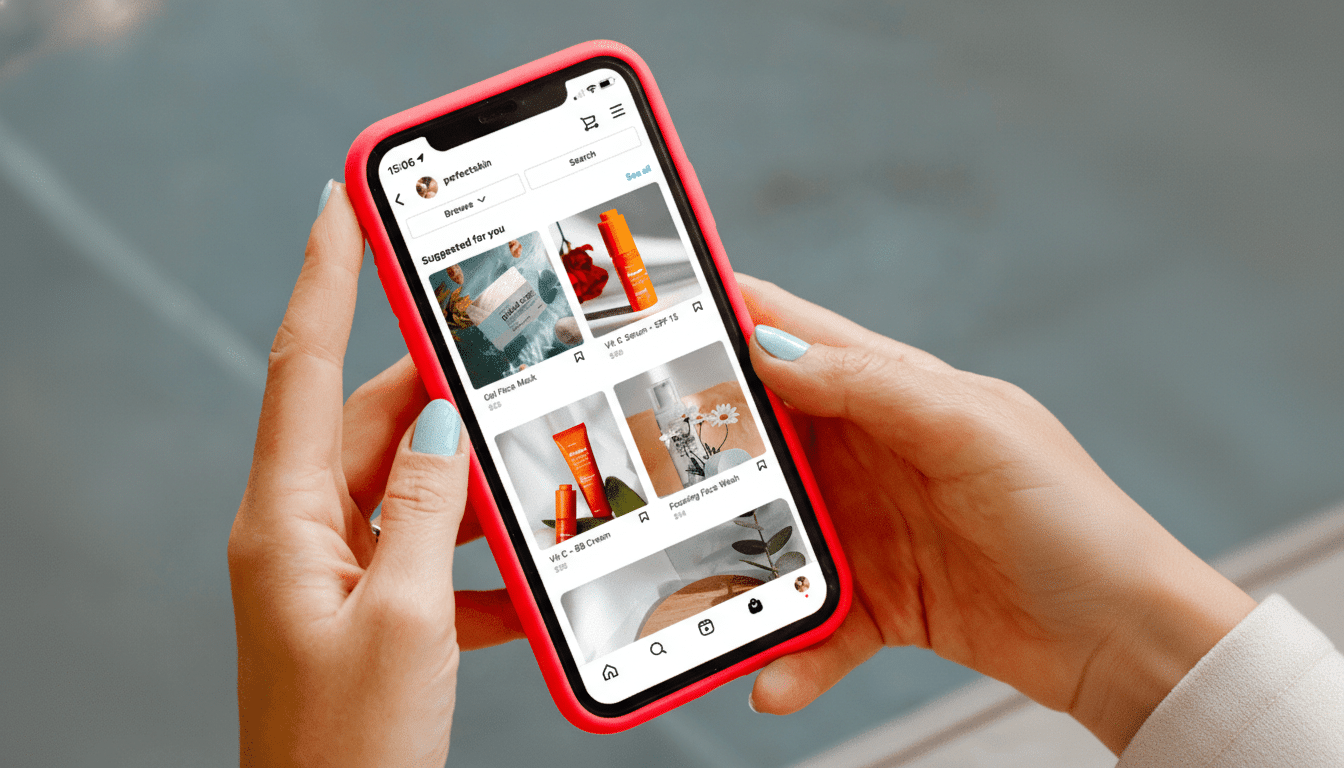

Zuckerberg told investors that Meta’s revamped AI stack will start surfacing in products soon, and he singled out commerce as a priority. He described “agentic” shopping assistants that do more than search—they interpret intent, reconcile preferences, compare options across catalogs, and close the loop inside Instagram, Facebook, and WhatsApp.

The strategic angle is Meta’s unparalleled social graph and engagement data. An agent that “knows” a user’s style cues from Reels, past purchases in Shops, creator follows, and family group chats could recommend the right product at the right moment, then streamline checkout with saved credentials. In practice, that could look like a WhatsApp thread where an agent assembles a back-to-school kit from trusted merchants, or an Instagram DM that negotiates sizes and inventory before one-tap payment.

Meta has already laid groundwork for this kind of flow. Instagram Shops and native checkout are widely deployed, and WhatsApp Business—by Meta’s own counts—serves hundreds of millions of active business accounts. Adding context-aware agents atop that surface area turns discovery channels into transactional funnels without forcing users to jump apps or re-enter details.

Infrastructure Signals Behind The Rollout

The commerce promise sits on top of a massive infrastructure build. In its latest filing, Meta said it expects capital expenditures of $115 billion to $135 billion in 2026, up from $72 billion the prior year, citing investments tied to its Meta Superintelligence Labs and core services. Separate reporting has suggested internal projections of as much as $600 billion in infrastructure spending through 2028.

That ramp is consistent with the cost profile of frontier models, inference at social scale, and the storage required to safely leverage user context. It also aligns with a recent run of acquisitions and talent moves: Meta recently acquired general-purpose agent developer Manus, with plans to keep the service available while weaving the technology into Meta’s own products.

The operational thesis is clear: if Meta can compress intent understanding, retrieval, generation, and payments into a sub-second experience, the company converts more browsing into buying. In an environment where small improvements in time-to-value translate into sizeable lifts in conversion, infrastructure spend is a direct lever on revenue.

A Crowded Field of Transactional Agents Emerges

Meta is hardly alone in chasing agentic commerce. Google and OpenAI have both demoed transaction-enabled agents, with early partnerships spanning companies like Stripe and Uber. Amazon has been threading conversational search deeper into its marketplace experience. The competition is coalescing around the same insight: when agents can take action, not just answer, the funnel gets shorter and the margin opportunity expands.

Meta’s differentiator is reach and behavioral context. Its platforms host the discovery surface, the social proof, the merchant storefront, the messaging channel, and the ad rails. If agents can move fluidly across those layers, Meta can reduce friction in ways that are hard for rivals to replicate without similar cross-app density.

Monetization, Measurement, And Guardrails

Agentic shopping creates new monetization paths: paid placements within agent recommendations, higher-value conversions credited to ad campaigns, and incremental fees on in-thread transactions. Expect Meta to emphasize closed-loop measurement—tying ad exposure to agent-driven purchases—as a way to improve return on ad spend and justify premium inventory.

The flip side is trust and compliance. Agents that leverage “personal context” will face intense scrutiny from regulators and users. Privacy-by-design, clear opt-in controls, and enterprise-grade brand safety are not optional. In markets governed by rules like the EU’s Digital Services Act and emerging AI regulation, consent and transparency around automated recommendations will be decisive. Handling misfires—out-of-stock items, returns, biased suggestions—will require visible user controls and human handoff.

There’s also the macro payoff. McKinsey has estimated that generative AI could add trillions in annual economic value, and commerce is one of the most immediately monetizable domains. For Meta, even small gains in conversion rate across Instagram Shops or WhatsApp Business could compound materially at platform scale, especially if agents unlock new categories like service bookings, travel, and local retail.

What to Watch Next as Meta Rolls Out Agentic Commerce

Early pilots are likely to appear inside messaging and shopping surfaces, where the path from intent to action is shortest. Key signals to watch include agent completion rates without human handoff, conversion lift versus baseline experiences, average order value, merchant opt-in, and the breadth of third-party integrations enabled by the Manus technology and Meta’s developer ecosystem.

Zuckerberg’s message is that Meta’s AI work is ready to leave the lab and meet the feed. If the company can blend personal context with rigorous privacy controls and a snappy transaction layer, agentic commerce could be the most consequential product shift on its platforms in years.