X is in private beta testing a pay-per-use API that moves users from fixed monthly tiers to metered access, which charges per request. The pilot is positioned as a self-serve option intended to jump-start third-party development on the platform after years of pricing shocks that thinned the ecosystem.

In posts from the X Developers account, the company said it is giving greater access to “new and power users” while stressing an aim of empowering builders. Early feedback from developers, however, revolves around the math: Depending on a user’s needs, the new model can end up more costly than the old flat-fee plans.

What Is the Pay-Per-Use API Pricing Model on X

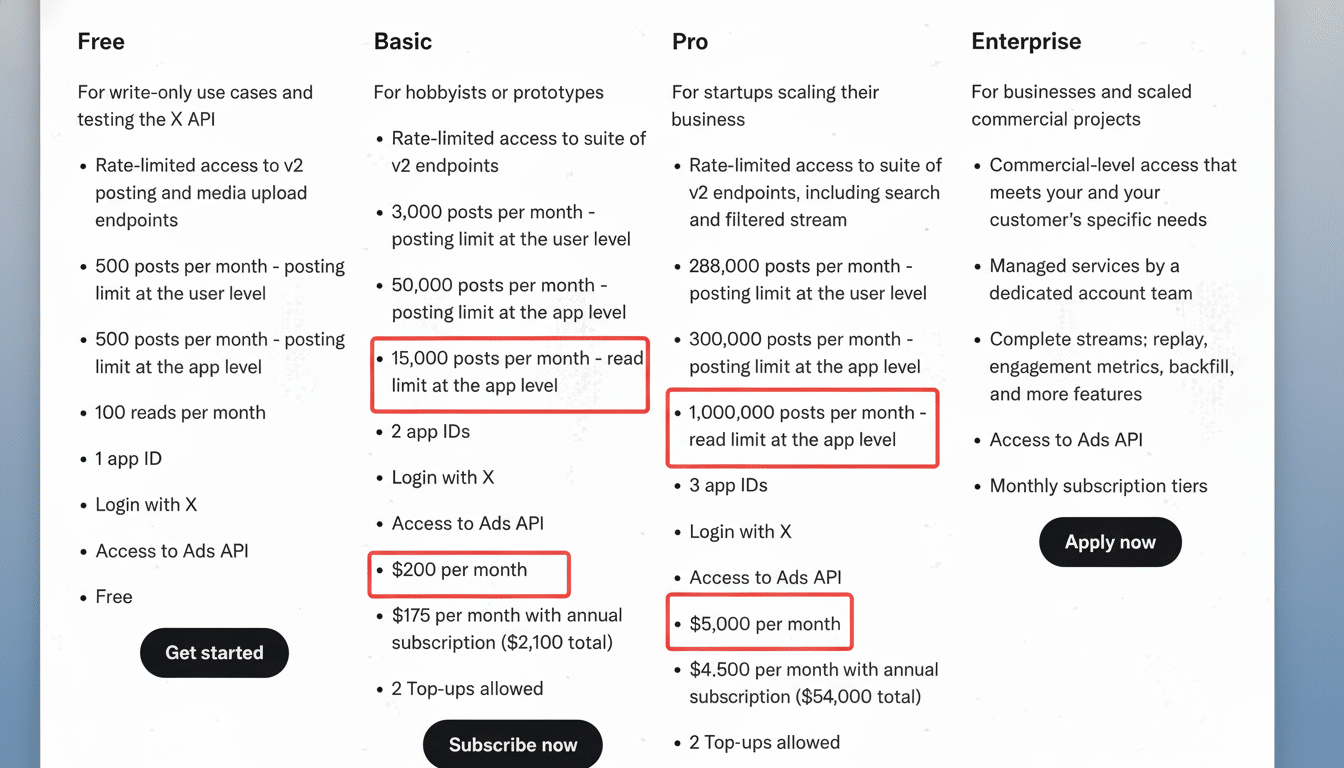

With the beta, X is pricing individual operations rather than selling bundles. According to numbers sent to testers, reading a post costs about $0.005 per request and publishing one costs roughly $0.01. The self-serve beta is capped at a limit similar to the old Pro tier; anything beyond that level redirects customers toward Enterprise deals.

X signifies that the Enterprise offerings have not changed. That matters because the company’s most contentious transition post-acquisition was switching from a free API to high-priced paid plans, including an Enterprise base said to start around $42,000 per month, with cheaper tiers rolled out after.

Pricing Math and the Real Cost Compared to Past Plans

Compared to the former Basic plan, which was $200 per month for 15,000 reads and 50,000 writes, at today’s beta rates those same reads would add up to about $75 and the writes maybe $500, for a little more than $575 altogether. That is almost triple the old Basic cost for the same usage.

Scale that up to what the former Pro tier offered: 1,000,000 reads and 300,000 writes used to cost around $5,000 a month. At today’s metered beta rates, reads alone would be $5,000; with writes, they’d reach an estimated $8,000! While it’s not a serve of deuces, the takeaway is easier to figure out: Light or spiky workloads may cost less, but sustained or heavy use trends higher than before.

Also worth mentioning: The beta ceiling is the same as the previous Pro cap, according to developers. If an app matures beyond that, X directs the customer to Enterprise and relaunches discussions of contract terms, service-level agreements and data rights — concerns that have typically been on par with price.

Why It Matters to the X Developer Ecosystem

Twitter was once home to one of the richest third-party ecosystems in social media, with independent clients such as Tweetbot by Tapbots and Twitterrific by Iconfactory, as well as integrations covering scheduling tools and research platforms. The move to paid access, changes in rates, and policy churn following the acquisition all contributed to an exodus of apps and partners.

Major consumer integrations also receded. Microsoft pulled Twitter sharing from the Xbox in 2023, Sony killed PlayStation’s X features later that year and Nintendo halted direct posting from the Switch in 2024. Those decisions were broadly attributed by industry observers to API pricing and ambiguity over access.

What Beta Testers Will Want to Keep an Eye On

Among the key questions are whether metered pricing is accompanied by reliable caps, clear rate-limit behavior and transparent enforcement. Builders will be curious about which endpoints get rolled in, how X handles streaming or search quotas, and whether academic or nonprofit access is granted special treatment, akin to the way it used to be.

Trade-offs are illustrated with practical scenarios. Consider a social tool that reads 50,000 posts in a month: It would incur about $250 in read costs; a publishing app that pushes out 10,000 posts would then incur, say, $100 in write costs. Combine the two and the bill can escalate rapidly. For a team handling many small customers, per-request economics could be more difficult to anticipate than with a flat plan.

Competitive and Strategic Context for X’s API Pricing

Metered billing is a normal practice in cloud services, and it has expanded to AI and data platforms because it links cost to consumption. Social platforms vary: Meta’s Graph API relies more heavily on partner programs and strict use cases, while Reddit’s 2023 pricing rework precipitated a string of high-profile third-party client shutdowns. In that light, X’s beta test is one node in a more extensive market recalibration around the costs of data access and monetization.

The strategic bet is that predictable, granular pricing will attract developers who were priced out by the old tiers, without opening the door to abuse or scraping. The success will rise or fall depending on stable policies, clear documentation and trust that pricing won’t whip around as apps grow.

For the time being, the beta’s value proposition is nuanced: more flexible on paper, potentially cheaper in niche or low-volume uses, but costlier for anything that looks like the robust clients and tools with which the platform was once associated.

Developers will be watching how X adjusts the meters before this pilot becomes standard.