Across all kinds of online business, customer expectations have evolved a lot in recent years. The ubiquity of same day deliveries and instant messages have made people conditioned to immediate transactions. This is even more important for businesses that are multi transactional with customers, in that payments regularly go both ways. Customers are used to immediate purchase payments, so why should they wait days for their payouts to be sent to them?

This article will look at why fast payouts are not only essential for customers, but how they also make commercial sense for any business that needs them. It will then analyse the best ways to implement fast payouts in the modern market, and some of the integration pain points you’ll need to be aware of before you get the ball rolling.

Why Fast Payouts Are Now Expected by Customers

More people than ever are working online, where fast payouts are even more important. Between the rise of mobile banking, social media creators, crypto and freelance work platforms and gambling, people expect their money to arrive quickly. And they can be almost anywhere in the world, at any time, when they ask for it.

Research shows that 57% of people who receive an instant payout from a platform would consider using it as their primary service provider in that area. In the US, some 38% of people now regularly receive instant or very fast payouts from a private business.

Quickly, in most cases, is now determined as within 24 hours of the withdrawal or payment request. But many customers expect this to be even quicker, especially when dealing with e-wallets and cryptocurrencies.

For example, the fastest payout online casinos are often among the most popular in the game. Gamblers, especially high limit players, can be very particular with where and how they play – and casinos that pay quickly always get good marks. Check out a great comparison site to see for yourself which operators experts and gamblers rate highly.

The Business Case is Also Strong – Investment in Fast Payouts Pays Your Business in the Long Run

Being able to send payments and have them received quickly by customers is a huge driver of retention, loyalty and brand perception in many business sectors.

When people are relying on a platform to pay them for work, which could be paying their bills, slow payouts can cause people to switch to competitors. In gambling, the immediate thrill of victory, which is liable to drive repeat custom, can be soured in players’ minds if they end up needing to wait days or talk to customer support before they get their winnings.

One study in 2024 found that 70% of online casino customers said slow payouts would turn them off a particular operator.

Old-school business operators might tell you faster payouts can cause cash flow pressures. Or they increase the burden on security and data processing teams. But in the modern business environment, many of these things can be outsourced or automated at a low cost. Having fast payouts will also increase cash flow through more repeat custom, and also less burden for processing teams as they get less complaints and questions to deal with.

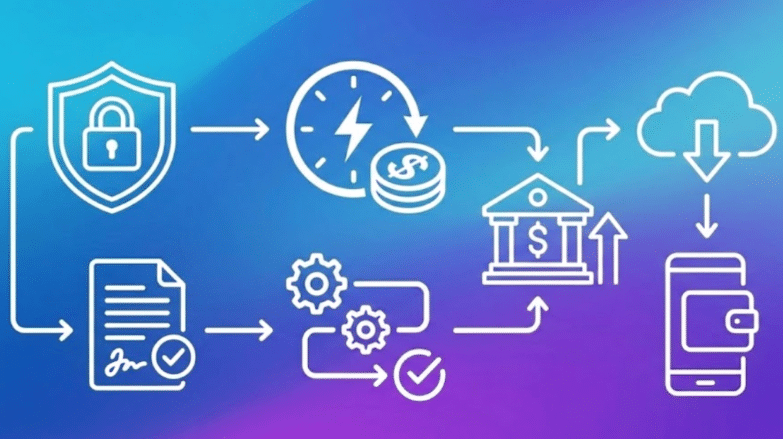

How Businesses Can Make Payouts Faster Without Risk

So, how do business implement faster payouts? Modernising work flows, processes and technology is usually the easiest way. Slower payments are usually caused by legacy banking issues, manual review or batch processing.

Batch processing is fine for freelance platforms, creator economy and gig work – as workers don’t mind waiting until a certain day of the week or month for payments, since this is standard. But any delays to the payment on that date, and they will mind. Just ask any freelancer you know.

However, it isn’t good for online casinos and more ad-hoc arrangements like trading platforms, where things run 24 hours and a big payout could come at any time. These kinds of businesses with transactions at scale, ongoing all the time, cannot afford to be using manual reviews. Almost all online casinos will have software that automatically monitors transactions for suspicious patterns before requesting manual review.

Promoting e-wallets and cryptocurrencies as an alternative option, while working with banks to find their fastest and newest payment systems, can all help your customers get their payments faster.

Other options include:

- Automate low risk withdrawals completely

- Ensure customers only have to verify information once

- If Know Your Customer checks are needed, try to integrate them with customer onboarding so there’s less friction at the point of payout

The final step to think about is communication and transparency. This doesn’t make payouts faster, but it will help customers understand the time frame. Don’t overpromise and under deliver. If there will be any initial delays, such as in regulatory needed checks, make sure customers are informed.