Western Digital says every slot of its hard drive production for this year is already spoken for, with demand from AI-fueled data centers soaking up supply far faster than usual. On the company’s latest earnings call, CEO Irving Tan told analysts that capacity is “essentially sold out,” driven by a handful of hyperscale buyers that have pre-booked high-capacity drives well ahead of schedule.

Most of the output is going to the firm’s top seven customers, according to Tan, and some of those buyers have locked in additional supply for subsequent years. The consumer business, he added, now contributes only about 5% of the company’s revenue—an unmistakable signal that enterprise AI workloads are calling the shots on storage.

AI Data Centers Are Swallowing Nearline HDD Supply

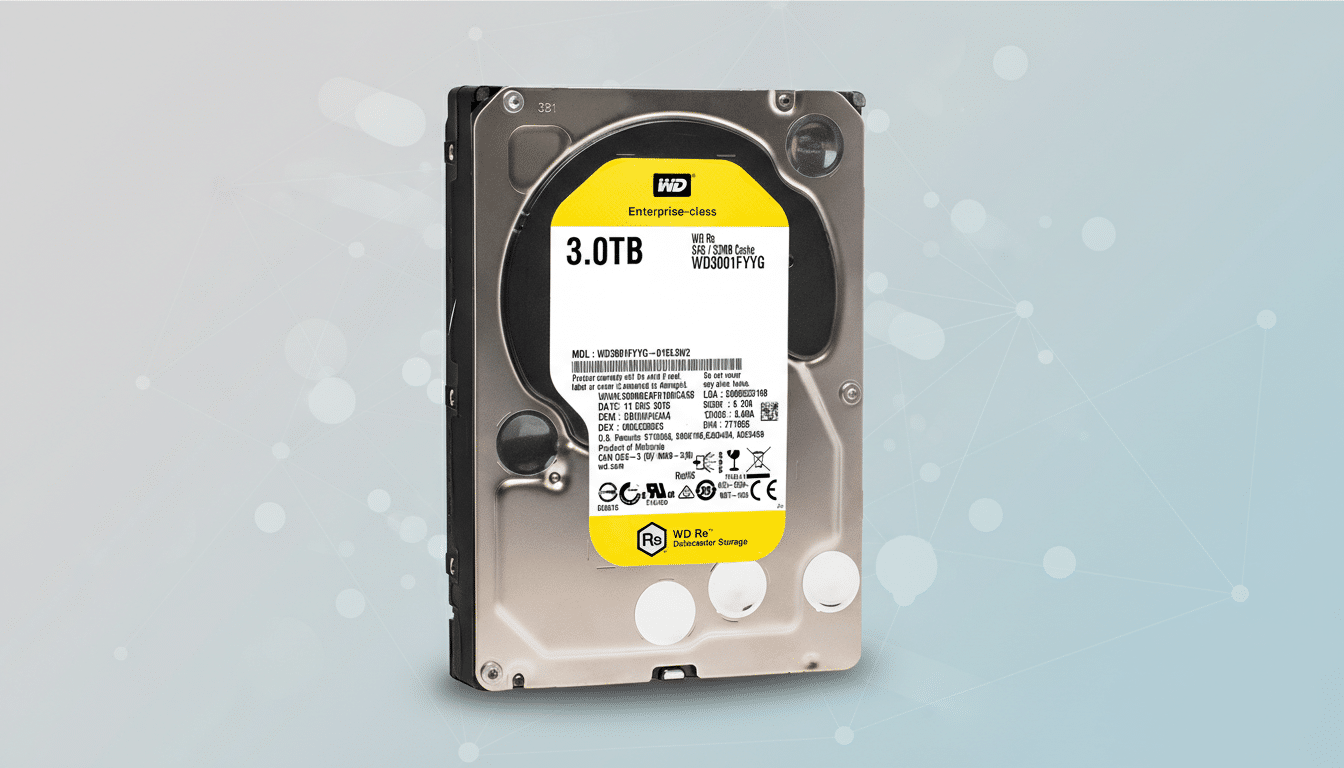

Training and running large AI models requires oceans of data and cost-optimized storage to feed GPU clusters. That’s why nearline hard drives—helium-filled, 3.5-inch HDDs tuned for cloud-scale racks—remain indispensable despite the rise of flash. At multi-megawatt campuses, $/TB still rules, and high-capacity HDDs in the 20TB-plus range deliver it.

Industry trackers such as Trendfocus and IDC have flagged a sharp rebound in nearline HDD shipments and average capacities as cloud providers expand AI infrastructure. Western Digital’s own mix has tilted heavily toward ultra–high-capacity models, including drives using technologies like energy-assisted PMR and UltraSMR that squeeze more bits on each platter to keep cost per terabyte falling.

Enterprise Wins as Consumers Lose in HDD Allocation

When a few hyperscalers guarantee massive volumes, consumer channels move to the back of the line. With retail and small-business NAS buyers representing a sliver of Western Digital’s revenue, the company has little incentive to divert scarce nearline inventory away from data center contracts.

Expect tighter availability on high-capacity external drives and NAS-class HDDs, and likely sticker shock on the most sought-after models. Market researchers at Context and Trendfocus have already noted firmer HDD pricing, echoing what’s happened in memory where DRAM and HBM demand from AI has pushed PC and server component prices higher.

Supply Constraints Run Deeper Than Demand

Even if Western Digital wanted to open the floodgates, scaling HDD output isn’t like spinning up another cloud instance. The ecosystem depends on specialized parts—glass or aluminum substrates, heads, media, helium enclosures—and bottleneck tools such as servo writers. Building or retooling lines to raise yields on 22TB–30TB-class drives takes time and capital.

That’s one reason vendors guide customers to book ahead. It de-risks factory utilization and lets suppliers phase in new recording technologies. Competitors face similar realities: Seagate is ramping heat-assisted magnetic recording for its next wave of ultra-high-capacity drives, while Toshiba continues to push conventional and SMR designs. None can flip a switch to satisfy a sudden AI spending surge.

Who Is Buying All the Disks in the AI Data Boom

The usual suspects: cloud and social platforms building retrieval-augmented generation pipelines, vector databases, and ever-larger training corpora. Think hyperscalers that already dominate nearline HDD consumption—companies that archive trillions of objects and refresh fleets on tight cycles to maximize density per rack and watts per terabyte.

Analysts at Gartner and IDC have emphasized that storage capacity growth is increasingly tied to AI data pipelines rather than traditional web workloads. That shift favors nearline HDDs for bulk and tiered storage, with SSDs handling hot data and caching. The result is synchronized demand across the stack—and little slack anywhere.

What It Means For The Rest Of The Market

Short term, tight supply typically means higher prices and longer lead times for consumers, system builders, and even some OEMs outside the hyperscale club. Channel inventories of popular 16TB–22TB NAS and external models could thin, and promotions may be scarce.

Longer term, watch two variables: AI capital spending and the pace of technology transitions. If hyperscale AI buildouts keep accelerating, nearline HDDs will stay supply-constrained even as vendors bring new capacities online. If spending normalizes, relief could ripple through the channel. For now, Western Digital’s sold-out status makes one thing clear—the AI boom has turned hard drives into hot commodities again.