Verizon is back on offense. The carrier added more than half a million postpaid phone lines in the latest quarter, reporting 616,000 net additions and signaling a sharp reversal from earlier subscriber losses. The turnaround was powered by aggressive deals that pulled households off the sidelines and persuaded existing customers to add more lines.

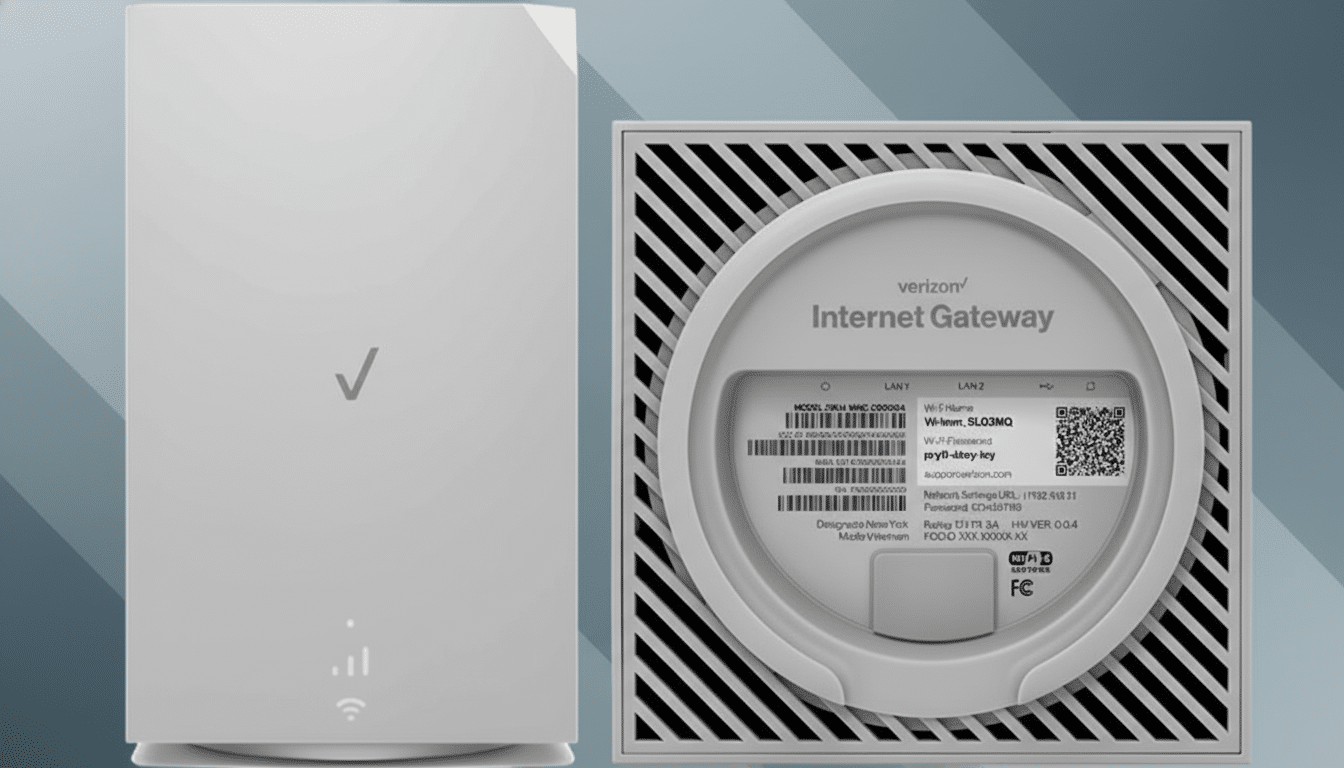

The growth wasn’t limited to mobile. Verizon also recorded 372,000 broadband additions, reflecting ongoing traction for its 5G Home and business internet offerings alongside fiber. Taken together, the results give the company a much-needed jolt of momentum as it battles perception and price pressure in a fiercely competitive market.

What Drove the Surge in Verizon’s Subscriber Growth

Verizon leaned into promotions designed to reduce sticker shock for families and small businesses. Offers like four lines for $25 each and free BYOD lines for existing accounts lowered the barrier to switching and upsizing. Those deals, combined with seasonal device launches and trade-in credits, boosted gross adds and slowed churn at the same time.

The company’s modular myPlan structure also played a role. By letting customers pick base plans and bolt on perks such as streaming or cloud storage, Verizon created a clearer value proposition without having to cut headline prices across the board. Analysts at firms like MoffettNathanson have long noted that multi-line discounts and BYOD promos can be especially powerful levers for postpaid growth because they stack with family plan economics.

Network perception still matters. Independent testers tell a nuanced story: RootMetrics has repeatedly cited Verizon for reliability, while Opensignal and Ookla reports often show T-Mobile leading in 5G speed. Verizon’s broad mid-band 5G footprint and ongoing capacity upgrades gave it room to load up on subscribers without degrading the experience, which is essential when promos spur rapid line growth.

Can the Momentum Last Beyond One Strong Quarter?

Sustaining this pace is the harder problem. Rich incentives can compress service margins and put pressure on ARPU, particularly when free lines and deep credits dominate the mix. Historically, industry churn hovers near or below 1% for premium carriers, so incremental gains often require ever-stronger offers or better network differentiation. Verizon will need both smarter promos and sharper network storytelling to turn a single strong quarter into a trend.

There are reasons to think the strategy can endure, if calibrated. T-Mobile used “free line” campaigns for years to build account depth, and AT&T leaned on straightforward pricing and retention to keep churn low. Verizon’s path likely blends both: measured promotional activity to keep the funnel full, combined with network and customer-experience improvements that reduce the need for constant discounts. Company filings and earnings calls suggest leadership is intent on balancing growth with cash flow discipline, rather than chasing volume at any cost.

Broadband Gains Point To Fixed Wireless Strength

The 372,000 broadband additions underscore a broader shift in home internet. Fixed Wireless Access (FWA) has become a credible alternative to cable for many households, capitalizing on mid-band 5G capacity upgrades. Verizon’s strategy has been to “harvest” excess capacity during off-peak hours for home internet, improving utilization without massive incremental build costs.

That formula is working in markets where cable’s price hikes and promotional fatigue have created openings. Research groups like Leichtman Research have chronicled a multi-quarter trend of FWA gains versus cable softness. The key risk is capacity: if mobile usage spikes or uptake outpaces spectrum headroom, speeds can suffer. Verizon’s continued C-band expansion and targeted fiber investment are intended to keep that balance intact.

What It Means for Customers and Wireless Rivals Now

For customers, the headline is simple—there are better deals on the table than there were not long ago. Just read the fine print. Many offers hinge on autopay, trade-in values, bill credits spread over device terms, and eligibility rules that reward multi-line accounts. Savvy shoppers who are willing to switch or add lines can now extract real savings without downgrading to bargain networks.

For competitors, Verizon’s resurgence sets up an intense stretch. AT&T has prioritized consistency and value, while T-Mobile continues to market speed and perks. If Verizon maintains promotional pressure and couples it with credible reliability and home internet bundles, the battleground will shift from single-line deals to whole-household packages that blend wireless, broadband, and services in one bill.

The headline number—616,000 postpaid phone net adds—marks a clear pivot. Whether it becomes a new trajectory depends on how effectively Verizon turns promotional wins into durable relationships, and how quickly it can reinforce those gains with network performance and customer experience that keep people from shopping again when the bill credits run out.