Venture investor Jennifer Neundorfer is calling on founders to stop building look-alike generative AI apps and instead ship products that fundamentally alter the behavior of a user. In aiming to predict the future, she takes a contrarian view in which there is no bubble per se but rather more of an investor fatigue today than during any time in 2018; that it’s not, in fact, as previously suggested “déjà boom,” and when it comes, looking across financial markets for what will trigger one isn’t likely to matter. Only teams building category-defining companies are poised to break through. Her firm is using AI as well for its own work — it helps speed the process of doing diligence and competitive scans — and that underlines a broader point: the bar is being raised on both sides of the table.

Build New Behaviors, Not Just Faster Features

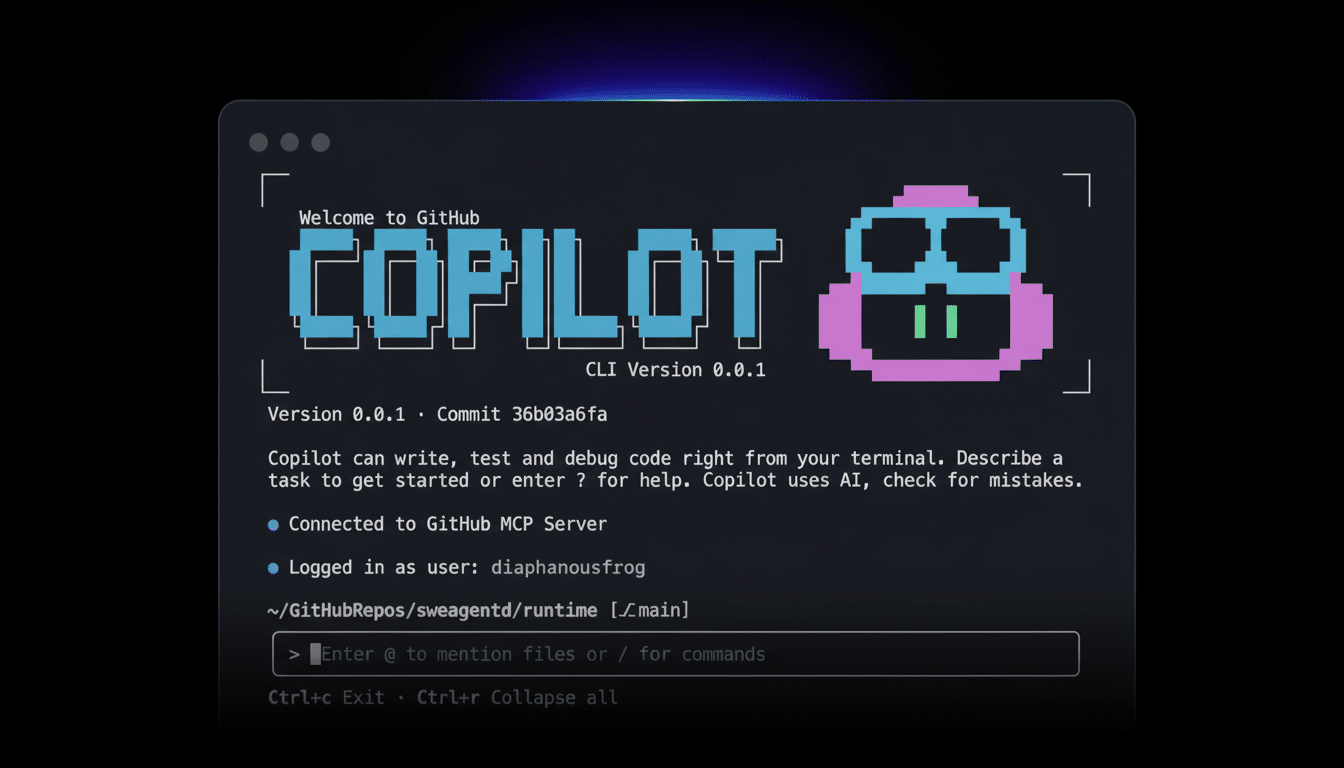

Neundorfer’s guiding principle is simple: don’t make an old task 10x faster if you can design a workflow that was never even possible before. It’s a transition from productivity booster to behavior changer that distinguishes frothy tools from lasting platforms. Consider how GitHub Copilot has re-legitimized AI pair programming; GitHub’s research showed that developers could get things done up to 55% faster with certain coding tasks, but what was arguably even more significant is the fact that engineers are now used to starting work with an AI assistant by default.

Founders who succeed, she says, map AI to moments with high friction and redesign the end-to-end flow. Answer engines like Perplexity recast search from “links” to “decisions,” as a new baseline interaction can be turned into your product moat.

Win With Data Moats And Get Distribution

With frontier models being commoditized so fast, Neundorfer looks for startups able to lock up hard-to-replicate data and distribution. Ownership rights of operational data, embedded feedback loops and domain-specific labeling pipelines cumulate over time. So in regulated markets like health and financial services, founders who can negotiate lasting data access, while remaining compliant, erect moats that aren’t built on the backs of models alone.

Distribution beats demos. Enterprise buyers are already evaluating scores of AI tools, according to CIO surveys conducted by Gartner and Deloitte. The ones that scale hit them through channel partnerships, land in existing workflows (EHRs, CRMs, PLM suites), align with buyers who have budget and urgency. Neundorfer seeks go-to-market plans that go beyond “post on social” to tangible paths — systems integrators, marketplaces or OEM bundles — that shorten sales cycles.

Demonstrate ROI And Stability Right Away

Investor decks full of model benchmarks will not make up for poor business fundamentals. Neundorfer would like to see cold-start time-to-value in days rather than quarters; payback periods within a couple of months; and usage that scales organically as teams adopt the workflow. So it does not just come down to clever prompting — reliability is as important as any such mind game: leaders set up formal evals, red-teaming, and guardrails that drive down error rates on the precise tasks customers pay for.

McKinsey’s State of AI reports always find that value comes when AI is integrated into core processes, not appended to them. Founders need to quantify impact in customer terms: fewer support tickets, shorter claim cycles, higher win rates. That evidence brings the next meeting, even when events conspire to make the market a bit choppy.

Show Founder-Market Fit With Clear Differentiation

Clarity is a weapon in a crowded space. Neundorfer tells founders to describe in a single breath why your product is different from the dozen near-neighbors and why your team alone can win. Lived expertise — constructing in a hospital revenue cycle, shipping safety-critical ML, negotiating data governance — translates into speed and better instincts about what customers will actually adopt.

Data beats rhetoric: named design partners, structured pilots with target KPIs, and letters of intent demonstrate pull. Note that Neundorfer has access to 50+ investments at January Ventures, and pattern recognition on her part reflects a fundamental truth: early traction from the right users is the strongest signal in the noise.

Prepare For A Shakeout And Build For What’s Next

Looking ahead, whether or not you call it a bubble, Neundorfer crosses her fingers for a shakeout. With drawdowns and unsustainable unit economics, companies with shallow moats will find it difficult once capital normalizes. She tells founders to be agnostic with respect to models, architect for portability and follow gross margins closely as inference costs vary. Invest now in retrieval, evaluation frameworks and ops discipline to avoid painful rewrites later.

She also encourages teams to develop at the edge of what’s possible, and aim for where the puck is going: agentic workflows that help close tickets, true multimodal reasoning tied to a business case and privacy-respecting deployments that will make it through your enterprise audits. Gartner and other analysts report that security and governance continue to be the top blockers; clearing those hurdles may become a competitive advantage.

Tune Out the Noise and Focus on Shipping Value

Neundorfer offers mentorship broadly, including through Techstars, and her advice to first-time and diverse founders is universally applicable today: just focus on shipping an awesome product and serving customers.

Focus on what you can control: unit economics, reliability and a clear path to distribution matter more than the leaderboard of models or the hype cycles of the week.

Her playbook is brisk and exacting: develop new habits, nail down data and channels, demonstrate ROI quickly, make it clear that your team is the one. In a market flooded with AI demos, this is how real companies are built — and survive.