The US semiconductor market spent the year in constant motion, as policy reversals, executive shakeups, and blockbuster chip demand collided. From export control whiplash to foundry restructuring and surprise dealmaking, the timeline of 2025 reads like an industry learning to navigate AI-era geopolitics while racing to deliver capacity and performance at scale.

Policy Whiplash And Tightening AI Export Controls

Rules governing AI chips swung repeatedly, reshaping sales plans quarter by quarter. A proposed tiered export regime, subsequent rescissions, and new licensing requirements created a patchwork that companies had to interpret in real time. The US Department of Commerce and its Bureau of Industry and Security emerged as the central arbiters, with guidance that stretched beyond country borders to the use of certain Chinese AI accelerators anywhere in the world.

- Policy Whiplash And Tightening AI Export Controls

- Boardroom Shifts And Strategy Pivots Across The Industry

- Deals, Capital Flows, And Unusual Industry Arrangements

- Manufacturing Milestones And Setbacks In US Fabs

- China Crosswinds And Evolving Market Access Realities

- Earnings Power And AI Demand Reshape Vendor Results

- Why The 2025 Timeline Matters For US Chip Strategy

Licenses for midrange and high-end AI accelerators became pivotal, and in some cases, sales were greenlit with added conditions—such as reporting obligations or revenue sharing tied to shipments into sensitive markets. Analysts at CSIS described the shift as moving from blanket bans to “behavioral guardrails,” forcing chipmakers and customers to prove compliance rather than simply avoid restricted SKUs.

Boardroom Shifts And Strategy Pivots Across The Industry

Corporate strategy evolved just as fast as policy. Intel installed new leadership with a mandate to refocus on engineering excellence and shed non-core assets. Management flattened layers, restructured its foundry unit, and signaled a willingness to spin out or jointly operate businesses that could distract from regaining process leadership.

Nvidia, propelled by unprecedented AI accelerator demand, recalibrated its expectations for China amid licensing uncertainty and leaned harder into data center platforms. AMD, meanwhile, accelerated an acqui-hire and a software-centric acquisition streak aimed at making its AI stack more approachable for developers accustomed to Nvidia tooling. Across the board, the 2025 mantra was speed: faster roadmaps, faster hiring in critical design roles, and faster exits from distractions.

Deals, Capital Flows, And Unusual Industry Arrangements

Mergers, acqui-hires, and inventive capital structures defined the year. AI software optimization startups became hot targets as chip designers sought to simplify porting models across heterogeneous hardware. One-off licensing frameworks with the US government to enable shipments into restricted markets surfaced as a novel tool, with fee structures linked to revenue from those geographies—an approach that blurred the line between trade policy and corporate strategy.

There was also a resurgence of cross-border, cross-competitor alliances and rumors of joint operating ventures around fabs. While not all discussions resulted in binding deals, they underscored a pragmatic reality: getting leading-edge capacity online requires partners with complementary strengths in process, packaging, and supply chain muscle.

Manufacturing Milestones And Setbacks In US Fabs

Onshore manufacturing advanced and stumbled in equal measure. US-based fabs moved from ribbon-cuttings to the hard work of tool install and yield ramp, with timelines under pressure from labor shortages, supply constraints in lithography and advanced packaging, and the sheer complexity of leading nodes. The price tag for state-of-the-art facilities—often above $20 billion per site—kept capital intensity high even as CHIPS Act incentives flowed.

Intel’s process ambitions remained in focus. Plans to bring next-generation nodes to US factories took a step forward with an 18A-era client processor roadmap aimed at recapturing performance-per-watt leadership, even as the company pruned projects, consolidated test operations, and delayed select builds to align with demand. Industry groups like SIA and BCG continued to emphasize the structural gap: US share of global manufacturing capacity hovered near 12%, highlighting how far onshoring still has to go.

China Crosswinds And Evolving Market Access Realities

Access to the Chinese market was tested from multiple directions. Chinese regulators scrutinized past acquisitions, local agencies pushed domestic buyers toward homegrown accelerators, and overseas governments added their own permit layers for re-exports of US-made AI chips. The result was a year where sales channels could open and close in weeks, compelling vendors to create China-specific products and pricing—then rework those plans as rules shifted again.

For US firms, the calculus evolved from “Can we sell?” to “Can we support and service what we sell?” Even when hardware shipments were approved, concerns about gray-market diversion and compliance audits drove more conservative revenue forecasting. At the same time, hyperscalers outside China kept buying at a furious pace, muting the near-term financial impact for leading suppliers.

Earnings Power And AI Demand Reshape Vendor Results

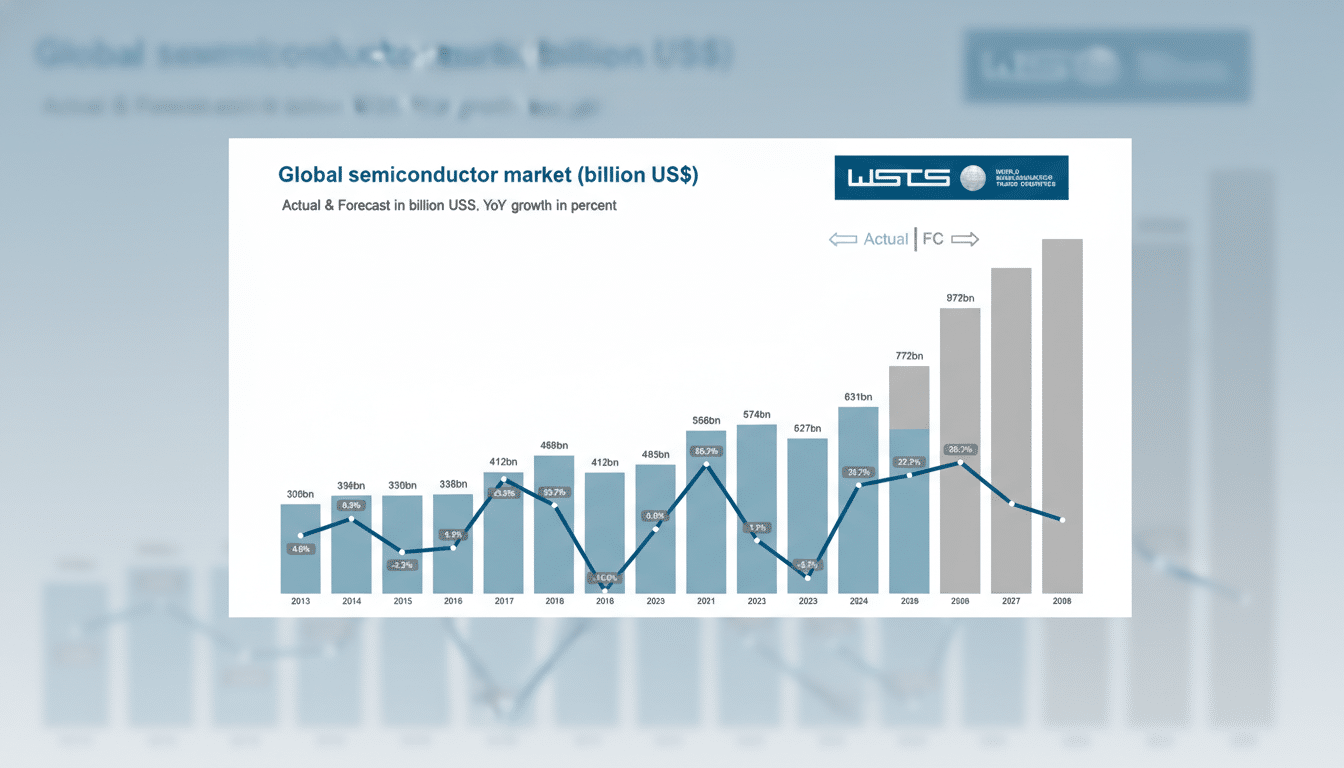

AI accelerators dominated capital spending by cloud and enterprise buyers, reshaping vendor P&Ls. Data center units became the primary growth engines, offsetting softer demand in PCs and certain embedded segments. Industry trackers like WSTS and Gartner pointed to a broad cyclical recovery helped by memory pricing stabilization and AI-led unit growth, even as automotive and IoT saw uneven trends.

Importantly, 2025 cemented a shift from component sales to platform sales: chips bundled with networking, software stacks, and service agreements. That bundling deepened customer lock-in but also increased the strategic risk if export rules or tariffs forced abrupt changes in deployment locales.

Why The 2025 Timeline Matters For US Chip Strategy

The year’s throughline is clear: the US chip industry moved from reacting to policy to building strategies around it. Export licensing became a product-management input, foundry partnerships turned into national competitiveness issues, and acquisitions targeted software as much as silicon. For policymakers, the lessons were equally sharp—guardrails work best when predictable; firms invest most when rules are stable.

If 2025 was the year the market learned to operate under AI-era constraints, the next chapter will test execution: bringing new US capacity online, scaling advanced packaging, and translating astonishing AI demand into sustainable margins without overbuilding. On that, investors, customers, and regulators are unusually aligned—clarity beats volatility, and delivery beats promises.