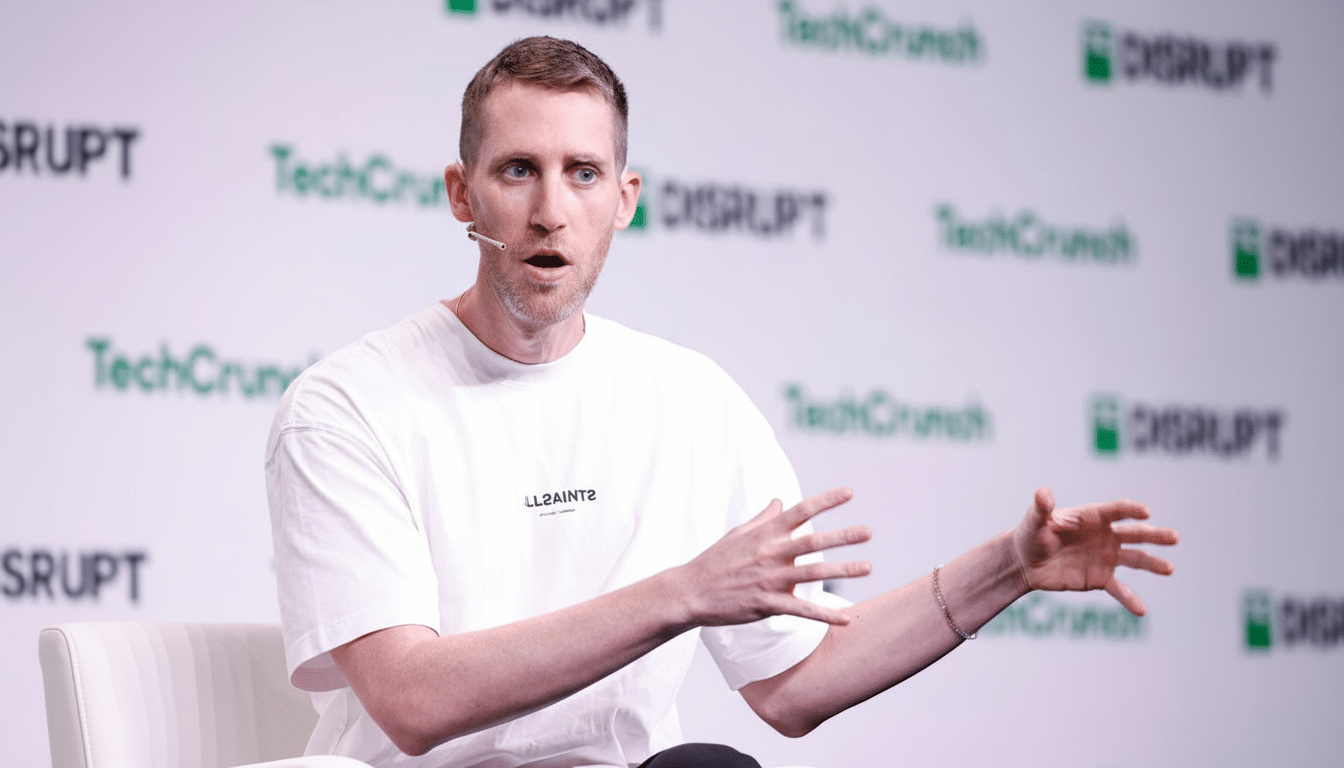

Google has received U.S. antitrust approval to buy cloud security startup Wiz for $32 billion, bringing one of the largest-ever cybersecurity deals a major step closer to closing. The sign-off, revealed by Wiz chief executive Assaf Rappaport at a Wall Street Journal event and reported by Reuters, removes the largest regulatory obstacle in the United States, although other approvals and closing conditions still exist.

The green light comes after months of scrutiny, with Bloomberg reporting that the Department of Justice was looking at the deal. Reuters has reported that the deal is expected to close in early 2026. It would add to a security portfolio spanning multicloud and application protection for Google, and provide Wiz with the distribution and engineering scale of a top-three cloud provider.

Why the DOJ green light matters for the $32B Wiz deal

U.S. antitrust clearance indicates that regulators did not see evidence the deal would meaningfully reduce competition in cloud security, which is marked by rapid innovation and home to many incumbents. The DOJ’s review, which happened under the Hart-Scott-Rodino Act framework, probably focused on whether Google would be able to engage in anticompetitive behavior by packaging Wiz or disabling some of its multicloud capabilities. The result indicates that enforcers perceive strong competitive discipline from companies like Palo Alto Networks, CrowdStrike, Microsoft, and Check Point, among others.

It is also the type of deal that has won in recent months: Google’s 2022 acquisition of Mandiant received approval, and so did other big security combinations where product overlap was low. Even so, the broader antitrust environment remains quite wary of platform power, with execution and continued commitments around openness remaining under scrutiny.

Why Wiz is valued at $32B in Google’s planned acquisition

Started by former Microsoft Azure security veterans Assaf Rappaport and Ami Luttwak, Wiz spearheaded an agentless model that performs ongoing scanning over cloud workloads, containers, identities, and configurations of AWS, Azure, and Google Cloud. Their value prop is about speed of deployment and a single risk model that exposes the most critical traffic exposures versus overwhelming teams with alerts.

The company reportedly rejected a $23 billion buyout offer from Google in 2024 before revisiting discussions at an increased price that reflects demand for cloud-native security platforms. Wiz’s rapid revenue growth and large enterprise footprint are among the things that have led industry analysts to attribute its premium valuation. The most direct competitors to the company are platforms like Palo Alto Networks Prisma Cloud, Microsoft Defender for Cloud, CrowdStrike’s cloud security suite, and Orca Security.

What it means for Google Cloud customers after the Wiz deal

If built out, Wiz would join Google’s already impressive talent roster that includes the likes of Mandiant, Chronicle, VirusTotal, and Security Command Center while giving it a deep bench across detection and response, threat intelligence information, and cloud posture management.

Customers should anticipate closer integrations that will simplify risk discovery through to incident response, and single-pane dashboards and shared telemetry across Google’s security portfolio.

One big question is multicloud neutrality. The promise of Wiz has been to automatically lock down environments in AWS, Azure, and Google Cloud without slowing down. It will be key to customer confidence that it can maintain this capacity. Wiz multicloud should logically continue to be multicloud—noting it is all but inevitable that Google/Microsoft will maintain Wiz’s customer base, particularly among enterprises already using both clouds (just like with Red Hat) and also exclusive of any possible regulatory consideration: enterprise apps are significantly multicloud (for redundancy, resiliency, etc.).

Competitive landscape and market context for cloud security

Security is still one of the fastest-growing sectors in enterprise software. Gartner predicts that global security and risk management spending will exceed $200 billion, with cloud security one of the fastest-growing categories, growing at around mid-20% rates as businesses modernize infrastructure. That tailwind has driven consolidation, led by Cisco’s $28 billion acquisition of Splunk and a constant drumbeat of platform rollups from strategic buyers as well as private equity.

For competitors, the Google maneuver steps on the gas in a race to provide an end-to-end cloud security platform covering posture management, runtime protection, data security, and identity controls. Palo Alto Networks, Microsoft, CrowdStrike, and Check Point have all been building out their cloud security portfolios, while stand-alone specialists such as Wiz and Orca have driven the category forward with agentless scanning and graph-based risk correlation.

What still needs to occur before the Google–Wiz deal closes

U.S. clearance is important, but the deal still needs to complete remaining regulatory reviews in other countries and standard closing conditions. Integration planning needs to account for overlapping product roadmaps, data policy and treatment, and customer migration paths as well as ensuring that Wiz’s engineering team stays in place—all so Google can conserve innovation velocity following the acquisition.

Wiz and Google will continue to operate independently until the deal is closed. Enterprise customers need to work with their IDM providers as they roll out enhancements according to what is in the best interest of these organizations, not according to the roadmap or SLA—it’s shifting, we know. In the interim, buyers need to treat any and all roadmaps and/or SLAs as status quo and make decisions based on potential post-close benefits (common policy engine or security analytics) against vendor lock-in risk. As Bloomberg, the Wall Street Journal, and Reuters have reported, the deal has a certain resonance at the hotly contested crossroads of cloud platform competition and a consolidating security market. Further in the distance, but now far more in sight: a finish line, with U.S. approval in hand.