Uber and Momenta are readying a trial of autonomous ride-hailing in Munich, launching a high-profile push into one of Europe’s most challenging automotive markets. The companies say the service will initially be staffed with safety operators trained to intervene if necessary and service will be available in designated areas of the city with rides arranged through the Uber app.

Why Munich Matters

Munich is a logical launchpad. It’s host to tens of thousands of automotive and mobility companies: from the BMW Group headquarters to Tier 1 parts suppliers to mapping and sensing tens of thousands of automotive and mobility companies: from the BMW Group headquarters to Tier 1 parts suppliers to mapping and sensing startups to insurance and certification companies that formulate vehicle safety practice. Uber has described Munich as a door to a wider European push for autonomy, touting the city’s engineering talent and gracious approach to testing.

The pilot marks a significant European milestone for Momenta. The Beijing company has been developing and deploying autonomous systems almost from the time it was born, and has focused on a two-track approach: commercializing advanced driver assistance systems while moving up levels of automation in robotaxis. The company says that its assisted-driving software is already installed on several hundred thousand vehicles owned by customers due to partnerships with automakers, among them German premium brands.

What the Pilot Will Be Like

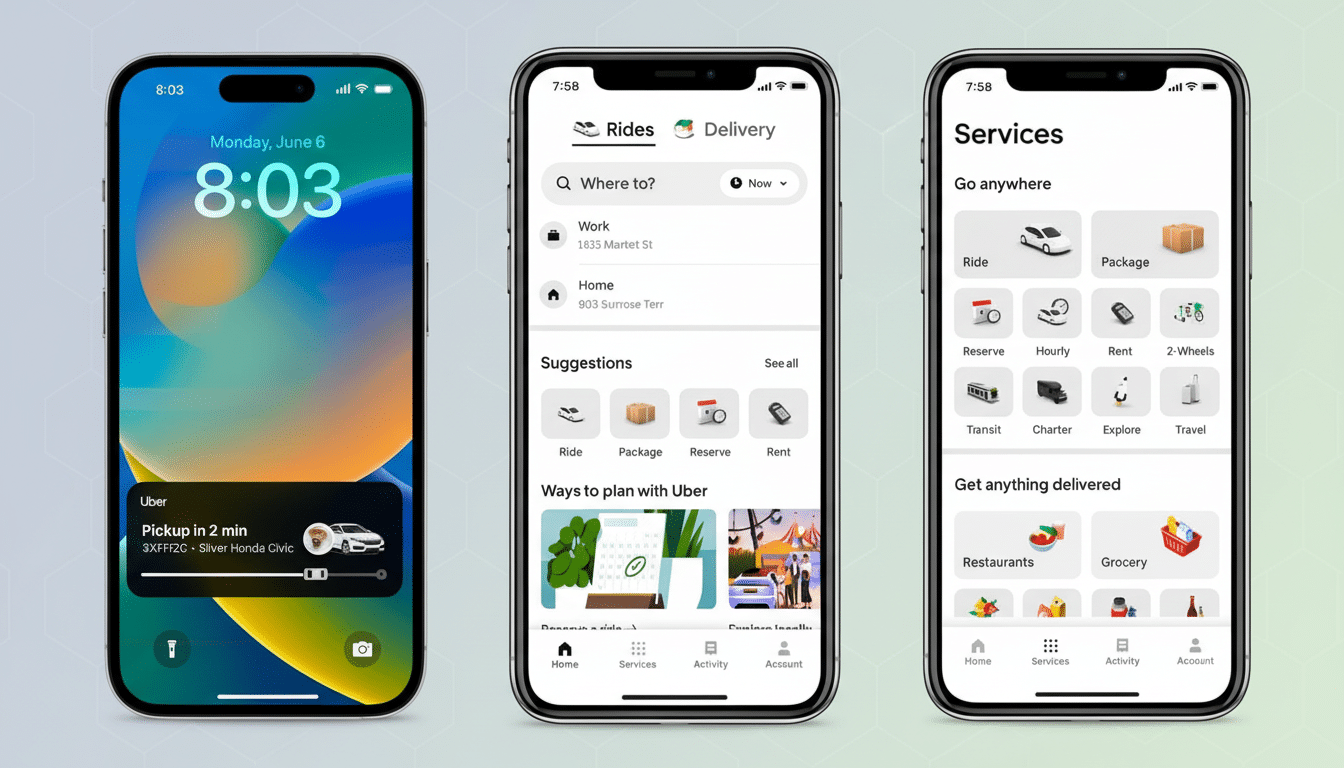

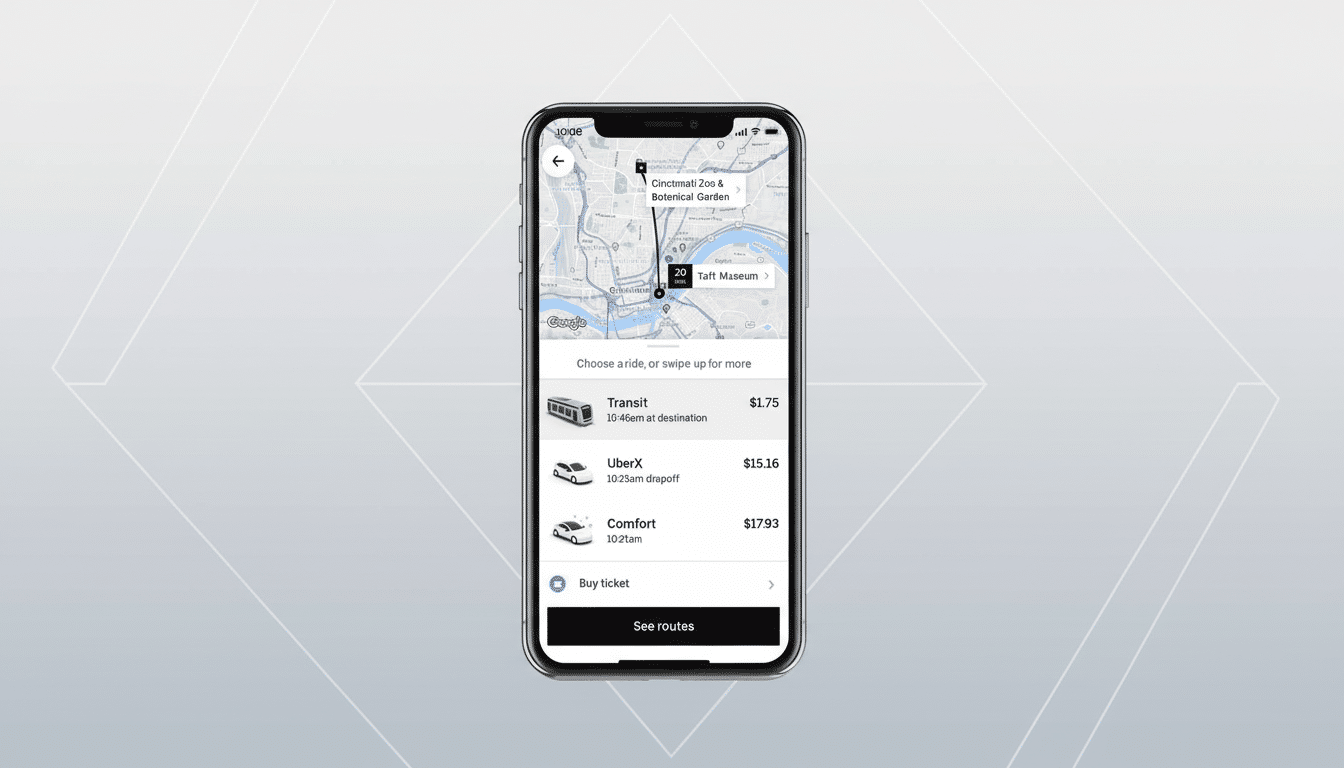

Look for a geofenced rollout and conservative operating conditions, at least at first. Vehicles will travel on mapped corridors, and they will probably favor wide arterial streets, commercial areas and predictable pick-up points. In early phases, there will still be human safety operators in the driver’s seat, overseeing the driving service and ready to take over if necessary. However, that would be in line with how Uber has implemented third party self driving in other markets – with the rides showing up in the same app, but with clear in-app disclaimers and safety messaging.

The nominal goal is SAE International’s Level 4 autonomy: self-driving within a defined operational design domain without human intervention (though a backup driver still might be in place in testing). Performance metrics often include the number of kilometers per interventions, high-reliability behavior handling of the long-tail of the edge cases, and safety around cyclists, buses, and construction. Munich’s mix of tramlines, bike lanes, and medieval street geometry will test perception and prediction systems in ways that are not the same as grid-dominated U.S. cities.

Regulatory Greenlight in Germany

Germany is one of the only countries that has a national regulation of the use of Level 4 technology for public road traffic. The Autonomous Driving Act has been implemented by the Federal Ministry for Digital and Transport (BMDV), which allows for an unmanned operation in delimited areas, provided that it is accompanied by a technical supervision. Permits are issued by the Kraftfahrt-Bundesamt (KBA) and assessments and audits are performed by qualified technical services, like TÜV companies. This layered supervision is meant to be predictable for industry, but safe and transparent for the public.

That framework makes for a potent local careworn offering. Germany already allows qualified Level 3 systems from traditional automakers on low-speed motorway stretches, and cities including Hamburg and Munich have launched automated shuttle pilots running on fixed routes. These precedents established a legal and operational basis for more sophisticated urban robotaxi services.

How Uber and Momenta Fit

Uber has pursued a partner-first strategy with autonomy, adding various self-driving providers into its ride-hailing, delivery, and freight networks. The company claims these partnerships together represent an annual run rate of about 1.5 million autonomous and supervised-automation trips across modalities. In passenger connections already, Uber displays robotaxis from others in some U.S. cities and has autonomy pilots live in the Middle East with Chinese AV partners.

Momenta brings a software stack that has undergone extensive road-testing and a data engine that it has fuelled with mass-market assisted-driving deployments. That ADAS footprint provides real-world corner cases — from unusual lane markings to erratic merges — that are useful for training and validating the higher-autonomy stack as it approaches European cities. For a Munich launch, this will involve working with local OEMs and fleet partners on vehicle platforms, redundancy and service operations.

Competitive Pressure Is Building

Europe’s robotaxi race is tightening. Lyft has just unveiled a partnership with Baidu to make self-driving rides a reality in European countries, beginning with Germany and the United Kingdom. Finally, Waymo has expanded U.S. coverage of robotaxi service and continues to set the bar for safety case thoroughness. The German OEMs are moving from assisted to conditional automation on highways and suppliers like Mobileye are doing fleet pilots in Europe with European partners. Uber’s Munich push with Momenta puts a global ride-hailing platform into the mix and is a test of whether data generated by app usage can speed in-the-flesh schooling at city level.

Key Hurdles: Safety, Cost and Trust

Autonomous fleets will rise or fall on safety cases and operating cost. Regulators will look at incident reporting, software updates and procedures for remote support. Insurers will seek to dissect risk models and liability sharing. On the cost side, companies need to reduce the cost of sensors, compute, and maintenance, so that pricing can be competitive with human-driven rides, especially outside periods of peak demand.

Public sentiment also matters. Surveys conducted by European automotive associations and consultancies reveal that German consumers are tentatively open to the idea of autonomy, but want transparency on safety and clear lines of responsibility. Early, well-run pilots — especially ones that speak directly (and in plain language) through the app, at the curb, and over local media — can change perceptions in ways a lab demo never will.

What to Watch Next

Look for the size of the initial fleet, geofencing range, and whether service will run with streetlights off and in bad weather — both heavy lifts for full-bore urban operations. Follow if and how Uber and Momenta are reporting performance data to the authorities, and if the pilot expands to include other German cities, such as Hamburg or Berlin. If Munich does end up achieving solid reliability and safety, the program could serve as a model for more widespread European robotaxi rollouts.