Titan OS has raised €50 million ($58 million) in fresh funds led by Highland Europe, a bet that neutral smart TV operating systems can unlock new sources of post-sale revenue for manufacturers and can ride the bumper wave of ad-supported streaming. The Series A follows a seed round in the double-digit millions raised last year, led by Mangrove Capital Partners.

Funding Fuels A Neutral OS Play For TV Makers

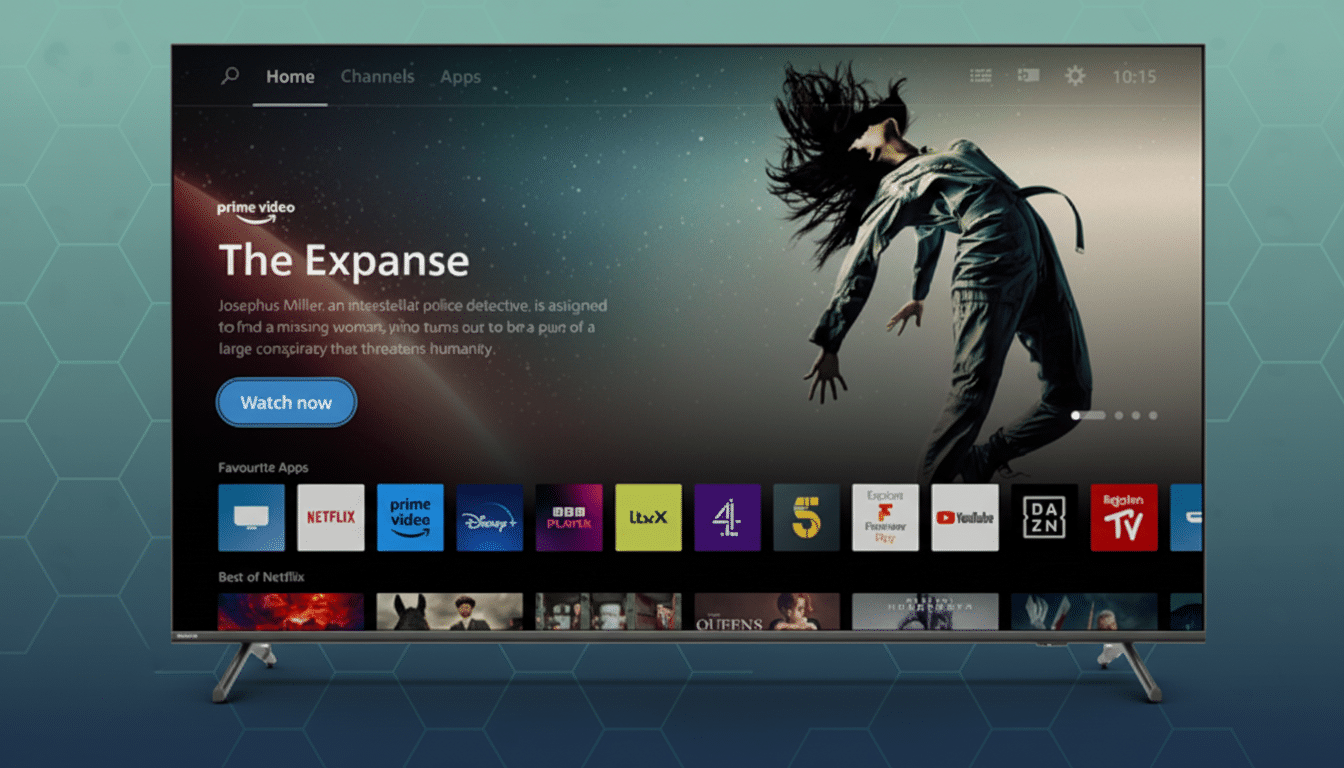

Launched in 2023 and based in Barcelona, where it was founded by Jacinto Roca (CEO), Timothy Edwards (COO), Miquel Barba (CTO), and Tobias Pfalzgraff, Titan OS describes itself as an “independent” layer between TV brands and the “divisive streaming market.” Roca previously built Wuaki.tv, which Rakuten acquired (some co-founders also went on to hold executive positions at Rakuten).

Titan OS claims to have a base of 18 million users throughout Europe and Latin America, thanks to licensing deals with the likes of Philips and JVC. The company has 200 employees in Barcelona, Amsterdam, and Taipei, and intends to use the new capital to grow its product, sales, and partner integrations while speeding up local content and ad initiatives.

Why TV Makers Want Another Type Of Operating System

TV hardware margins have steadily compressed with increased competition as well as retail promotions as the norm. That dynamic drives manufacturers to seek lifetime value in the post-sale—largely content placement, advertising, data, and subscriptions. A neutral OS such as Titan provides a way to participate in those economics without completely ceding the home screen to platforms owned by global tech giants.

Discovery is an area of pain that can be turned into money. Nielsen’s State of Play 2023 reported that viewers spend upwards of 10 minutes each viewing session trying to find something they want to watch, with many eventually abandoning the search. Titan OS claims to combine broadcasting, subscription apps, and free ad-supported television (FAST) channels in one interface that reduces search time and increases user engagement—delivering content generated from local preferences, language considerations, and real-time performance.

Monetization Engine Built On FAST And Ads

Titan OS is monetized in several ways: curated distribution for FAST services to reach country-specific audiences; advertising on the TV’s home screen and across viewing sessions; and commerce-driven formats like shoppable ads with QR codes. The company says revenue has increased 10x in the last two years, due to the rise of FAST consumption and better yield on owned surfaces.

The thesis dovetails with wider industry trends. Omdia expects the global FAST market to reach close to $12 billion by 2028 as additional broadcast libraries and sports-adjacent programming migrate into ad-supported, free environments. eMarketer predicts that connected TV ad spend will continue to soar well into the tens of billions as buyers push more linear budgets to performance-loving formats. Titan OS plays into both by localizing channels, selling inventory on the high-impact home screen, and providing measurement for advertisers who want incremental reach without a linear price tag.

The platform is also wooing event-heavy genres—news, sports, and entertainment specials—that over-index on time spent and ad recall. IAB Europe suggests that tentpole event-related CTV placements can deliver completion rates far above what’s feasible on desktop or mobile video, a tailwind for OS-level demand aggregation.

Crowded Field With International Heavyweights

Titan OS is attempting to distinguish itself in a market that’s dominated by vertically integrated platforms like Samsung Tizen, LG webOS, Google/Android TV, Amazon Fire TV, and Roku. It also competes with an array of independent players such as Xperi’s TiVo and Whale TV that sell OEMs on home-screen control or a share in ad revenue. The differentiator Titan is stressing is that it’s European and has locally tailored channel curation on a per-country basis—offering OEMs more customized discovery rails than a one-size-fits-all catalog.

Highland Europe speaks with admiration about Titan’s combined OS-and-advertising play, based on the types of consumer platforms it has experience working on that are monetized via advertising. A neutral, ad-optimized OS can be especially tempting for mid-tier and value TV brands that also want access to the CTV ad boom without having to receive a huge capital transfer from white-labeling a platform themselves.

Execution Priorities And What To Watch Next

Short term, Titan OS is focused on deepening relationships with FAST providers and further scaling home-screen merchandising as well as shoppable ad experiments in which QR-enabled placements deliver measurable conversions. The company claims that it already has 100+ localized channels across the main European markets and anticipates that number to grow as it locks down rights and builds editorial programming lanes.

Sustaining that momentum will ride on three fronts:

- Continuing to add more OEMs without sacrificing future revenue share

- Providing visible proof that Titan-powered TVs generate higher average revenue per user (ARPU) for manufacturers than incumbent platforms

- Validating discovery algorithms that shorten time-to-content and raise watch time

If it can demonstrate steady gains on those fronts, the €50 million could help make Titan OS a serious option for TV brands looking for more control—and a greater chunk of CTV ad budgets.