Lucid Motors chief engineer and Senior Vice President of Product Eric Bach is making an exit after a ten-year tenure shaping the company’s technology and vehicle lineup, the automotive manufacturer has confirmed. (The exit fits as Lucid turns from showing off its engineering chops to hitting a sustained production and sales ramp, with the recently released Gravity SUV serving as the growth engine.)

In addition to Bach’s exit, Lucid elevated Senior Vice President of Powertrain Emad Dlala to head the combined “Engineering and Digital” organization. The company also announced that Vice President of Quality Jeri Ford will retire and quality leadership will be handed over to industry veteran Marnie Levergood, who joins from Scout Motors. The company is being led by interim CEO Marc Winterhoff while a search proceeds for a permanent chief executive.

Who’s Leaving at Lucid and Who Takes Over Next

Bach joined Lucid in 2015 following stints at Tesla and Volkswagen, where he had worked closely with former CEO and CTO Peter Rawlinson. As chief engineer and later SVP of Product, he played a key role in shaping the architecture, supplier strategy, and feature roadmap for the Air sedan — communicating technical details around engineering rigor to customer-facing product priorities.

Since 2015, Dlala has played an essential role in the company’s powertrain advancements, such as high-efficiency motors, compact integrated drive units, and a set of high-voltage electrical architectures.

Integrating software and electronics under his purview implies that Lucid is working toward harmonizing hardware, controls, and the software-defined vehicle stack to expedite feature development while mitigating organizational friction.

Quality-wise, Lucid is bringing in Levergood from Scout Motors for fresh launch discipline as it scales out Gravity. A focused quality leader with clean-sheet program experience is a welcome member of the team at a go/no-go point where first-build repeatability can make or break a luxury SUV’s reputation.

Why This Matters for Lucid’s Product and Model Roadmap

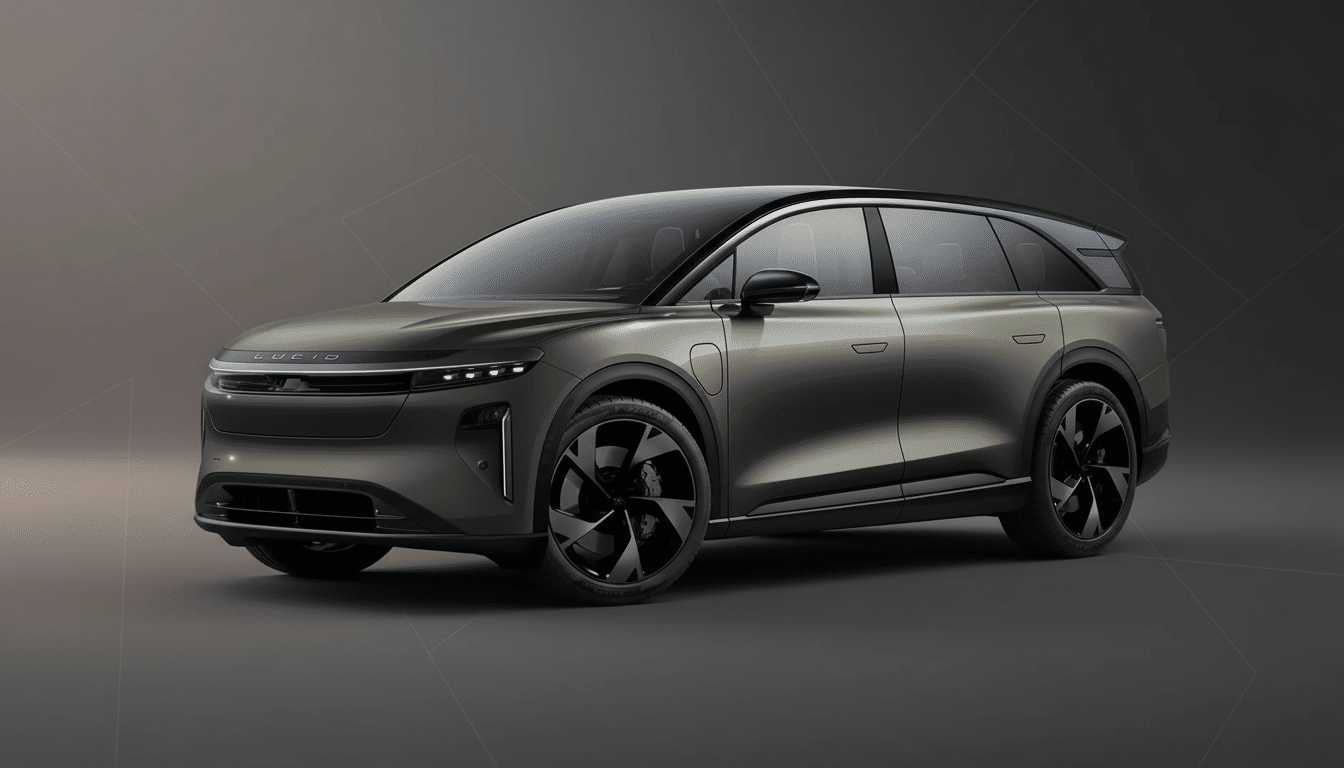

Lucid’s future hinges on Gravity. SUVs represent far more than 70% of new vehicle sales in the U.S., according to S&P Global Mobility, giving Gravity a much bigger addressable market compared to the Air sedan. The company has admitted that Air sales fell short of expectations, so a successful ramp for Gravity looks critical for revenue scale, brand relevance, and dealer-alternative direct-sales momentum.

Lucid is also working on a mid-size car that it expects to slot around its $50,000 vehicle. Hitting that price point will take aggressive cost-downs across batteries, electronics, and manufacturing, along with tighter software integration to reduce component complexity. Public filings have indicated ongoing capital needs and, with a heavy dose of Saudi Arabia’s Public Investment Fund backing it, investors in the start-up will be watching to see how Lucid walks its fine line between immediate cash burn and capex needs minus premium dilution.

Bach’s Mark on Lucid Engineering and Product Vision

Under Bach’s watch, the Air established industry standards: an EPA-estimated 516-mile maximum range, class-leading energy efficiency, and one of the market’s most advanced 900-volt architectures for near-instantaneous DC fast charging. Lucid’s compact, high-performance motors and its in-house “Wunderbox” charging hardware served as calling cards for the brand’s engineering-first identity.

Lucid’s technology heritage can be traced to Atieva; the company provided the batteries that powered Formula E’s second-generation race cars — a proof point for its pack engineering and thermal management know-how. Packing that legacy under one roof — the Casa Grande, Arizona factory — Lucid married motor, inverter, and software to realize real-world gains in efficiency that many would-be rivals are still chasing. A great deal of that technical DNA has Bach’s fingerprints on it.

Leadership Churn and Execution Risk for Lucid Motors

Bach’s departure comes after a series of exits, including executives in investor relations, operations, European management, software quality, and marketing. High turnover at the top can slow programs and muddy accountability when one wants predictable execution more than ever. That being said, executive reshuffles have been a part of high-growth EV companies; Tesla experienced turnover amid the Model 3 ramp and ultimately delivered the Model Y launch, while Rivian rearranged as it scaled up plans for its R1S and commercial vans.

What makes a difference to Lucid is timing. Gravity has to successfully lift off, margins will need to approach breakeven, and a mid-size program must remain on schedule. The newly merged Engineering and Digital division offers Dlala a broad canvas to simplify decision-making — if he can coordinate software releases, electronics purchasing, and manufacturing changeovers without complicating collaboration.

What to Watch Next as Lucid Scales Gravity and Beyond

Key rises and falls in upcoming quarters include:

- Production cadence of Gravity

- Order intake versus cancellations

- Early customer quality scores

- Software update pace and new feature releases over the air

- Evidence that Air demand is stabilizing as price/mix strategies unfold

Investors will also be looking for progress on the CEO search, how much the new engineering organizational structure sticks, and Lucid’s liquidity runway. Partnering with suppliers, potential technology licensing, or additional funding from strategic backers might dictate how swiftly Lucid can move beyond two nameplates while still guarding the efficiency edge that it has staked its brand on.