Tesla just posted the best sales quarter in its history as buyers raced to take advantage of the $7,500 federal electric vehicle tax credit before it began to sunset, a classic pull-forward that brought deliveries to fresh records and established a new yardstick for the EV market.

The company said that it had delivered 497,099 vehicles globally in the quarter, a 29 percent increase from the previous period and about 7 percent more than a year ago. The spike came as the total EV share in the U.S. likely rose to a record close to 10% of new-vehicle sales, according to forecasts from Cox Automotive, highlighting how potent incentives are in a price-sensitive market.

Why It Mattered That There Was a “Rush” for the Tax Credit

Federal credits lower prices, but they also change timing. When a sprawling incentive is about to expire, shoppers hasten the choice, dealers run inventory down and automakers work toward matching builds that will count. Analysts at S&P Global Mobility and Edmunds have seen evidence of this “pull-ahead” effect in previous tax and policy shifts, and the trend repeated itself as the credit drew to a close.

Effectively, the $7,500 benefit had been working as a temporary price cut that stacked on top of what Tesla itself has put in place over the past year. Combine it with rebates and financing deals in some areas, and that made some configurations of the Model 3 and Model Y as cheap as they’ve been in years, convincing fence-sitters to place orders before they lost out on incentives.

The Math Behind Tesla’s Milestone Quarter

Half a million deliveries in a quarter is an achievement for any automaker, and it came at a crucial time for Tesla. The growth rate had slowed earlier this year because of increased competition and a maturing order book that also strained margins with continued price cuts. Performance for the quarter steadies the path, although average selling prices probably remained below previous peaks.

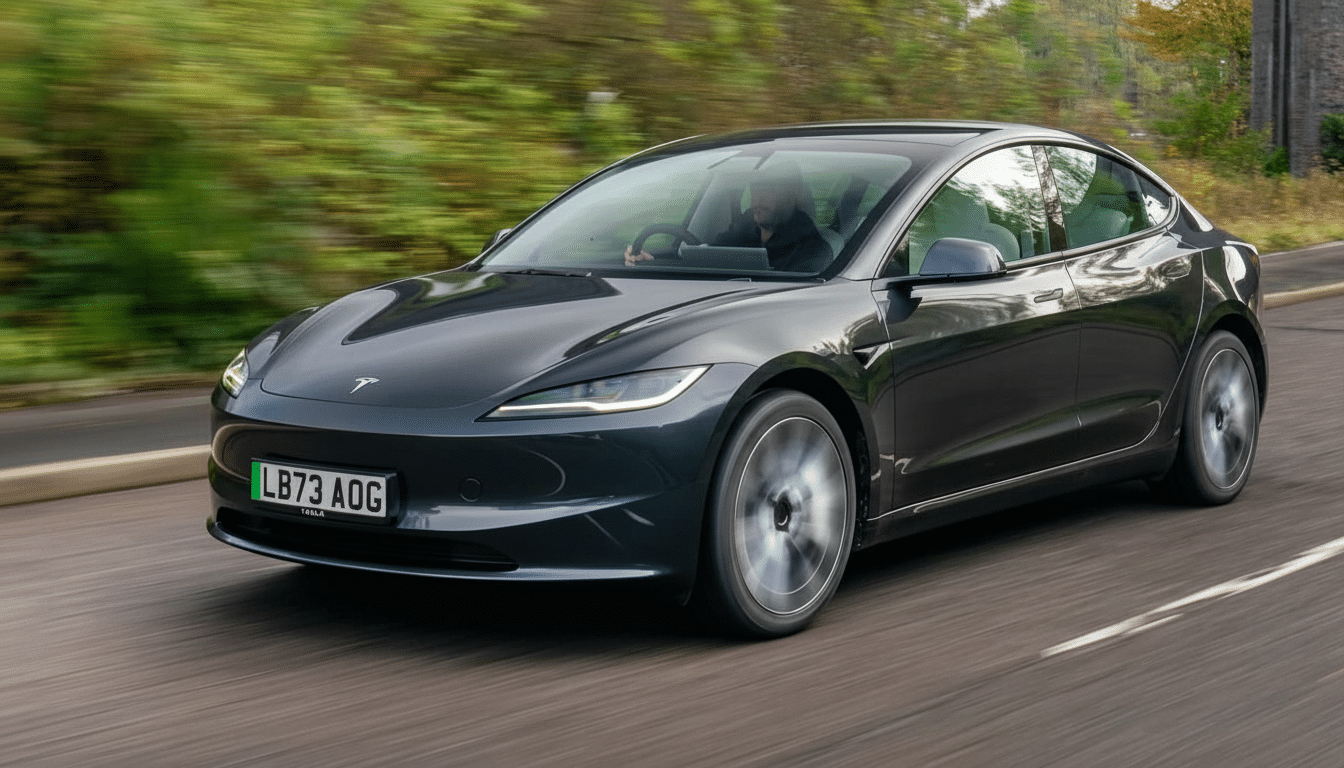

Model Y still propped up the lineup, with Model 3 offering some volume growth, but only just after recent refreshes broadened its appeal. Higher-priced models also had a small contribution, and the Cybertruck was still a halo product in development, as the company is still early in ramping. It will matter for profitability. A Monday note from S&P Global Mobility registration data shows that crossovers like the Model Y tend to lead EV adoption in most regions of the U.S., where incentives had outsized impact.

Context matters, too. Across the industry, carmakers pulled up demand as the incentive sunset. Cox Automotive has estimated that sales of EVs across the U.S. at several brands doubled from one quarter to the next, while data at the state level from organizations like the California Energy Commission frequently reflect sharp spikes in advance of policy changes. Tesla’s scale amplified that effect.

Is There a Post-Credit Hangover for EV Demand?

The real question is what comes next. When incentives cease, sales frequently fall, seeking a new equilibrium. It is a real risk for Tesla and the rest of the EV market, where affordability remains constrained by financing costs and consumers are carefully considering charging access.

Some rivals are ready to mitigate the pain. Ford and General Motors have said they will fill some of the gap in a lost credit on certain leases, effectively passing through savings via financing mechanisms. Leasing has been a ray of light for EVs, and Edmunds data indicate lease penetration tends to climb when purchase incentives dwindle. If Tesla ramps up similar offers, it could help cushion the demand air pocket in the months ahead.

Pricing and Product in Place to Keep Momentum Strong

Tesla’s most direct lever is still price and configuration. The company is able to fine-tune trims, options and software bundles to hit psychological price thresholds that matter when multiplied for monthly payments. Meanwhile, the lower-cost Model Y variant in the works, long talked about by industry watchers, could hit that low side and creep into the 30s range (again, depending on specification); that starts to get into similar addressable territory.

Above sticker price, operational execution—factory throughput, logistics and delivery cadence—will dictate whether Tesla can maintain share as stimulus abates. The company’s production-and-deliveries cadence has gotten better over the past couple of years, and there have been fewer end-of-quarter spikes in delivery and inventory days on hand, a development that tends to stabilize pricing power.

Competition Landscape and Market Share Outlook

Ironically, a harder-hitting incentive environment could benefit Tesla for now. A number of incumbent carmakers have postponed releases of EVs, or shifted their focus more toward hybrids — rearrangements reported by company updates, followed by BloombergNEF and industry briefings. Fewer fresh nameplates mean less immediate pressure on Tesla’s core segments, even as its established rivals rely on lease subsidies to keep up.

But globally, the answer is more complicated. Chinese brands are still flying across the runway at home and in some export markets, but U.S. buyers have been hamstrung by limited availability amid tariffs and trade policy while several firms descended into bankruptcy. That gives Tesla and a few incumbents outsized influence over U.S. EV adoption in the near term.

The Bottom Line on Tesla’s Record EV Quarter

As incentives wind down, Tesla continues to post record quarters, making clear that price and policy still reign as the two most consequential levers in driving EV adoption.

The question now is whether that one-time surge can be turned into sustained, profitable growth. In other words, Tesla has both smart pricing and expanded trims as well as selectively available financing to smooth the way — but the next quarter will show us how much of this boom was borrowed from the future.