Tesla is relying heavily on Master Plan Part 4 to drum up support for a proposed $1 trillion compensation package for Elon Musk, yet the roadmap stubbornly lacks much in the way of details. The company has cast the document as a blueprint for “sustainable abundance,” but several months after its release, it contains scant measurable targets, timelines and financial contours. That disconnect is now at the heart of a high-stakes vote which, if it passes, would hand the biggest potential pay award in corporate history and give Musk control of Tesla’s most daring wagers.

A vision without a map: Master Plan 4 lacks specifics

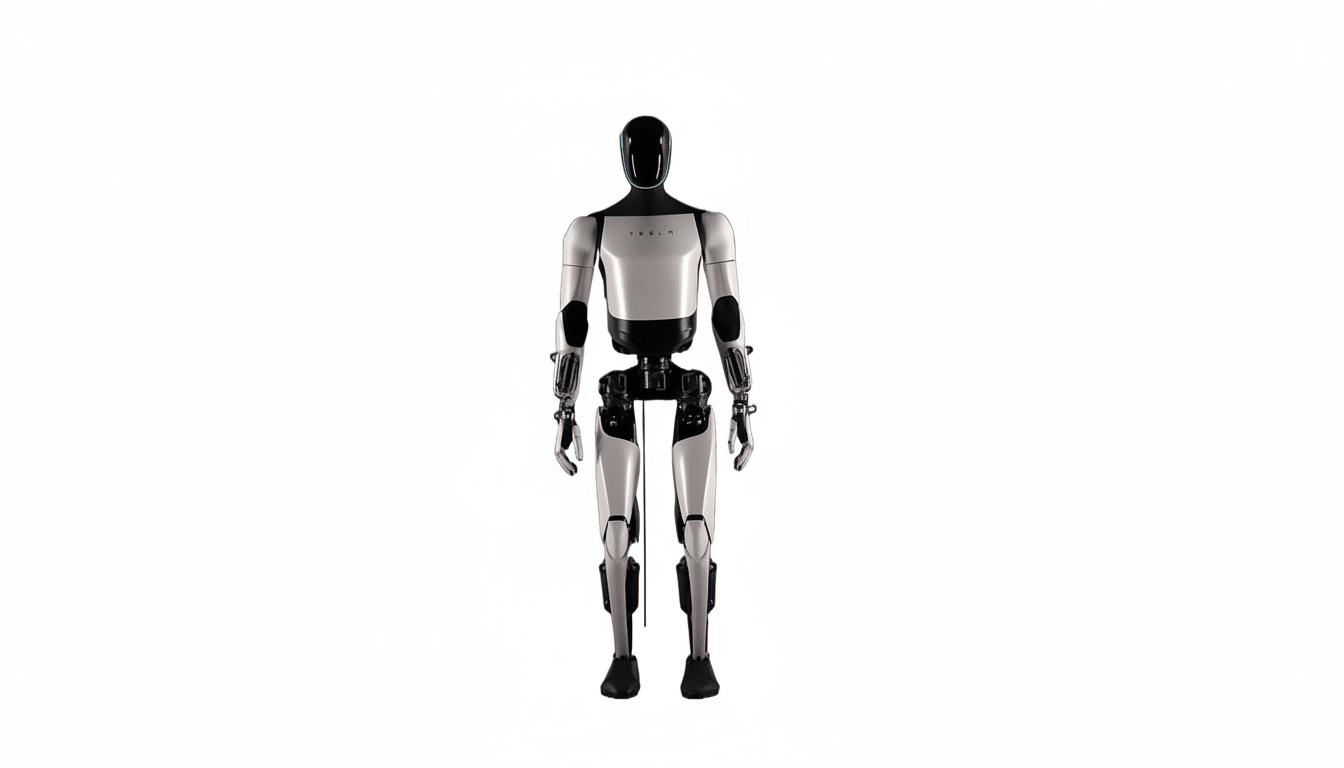

Master Plan 4 draws an expansive future anchored by autonomy, humanoid robotics and scaled energy systems including products like Full Self-Driving, the Optimus robot and a robotaxi network. It sounds more like the statement of a mission than a product plan. Musk conceded it was vague when it first came out, promised more detail, and then none materialized. Yet it dominates shareholder materials, is mentioned in Tesla’s quarterly communications and has been parroted by board leaders to explain their endorsement of the compensation plan.

The missing piece in the bait-and-switch here is operational yardsticks that investors can use to assess execution risk: phased milestones for autonomy, cost curves for Optimus, regulatory pathways for robotaxis, and capital requirements for AI training and fleet deployment. Without them, the plan is more a matter of faith in Musk’s past performance than in realistic goals.

How It Compares With Previous Master Plans

Earlier Tesla master plans brought a mix of aspiration and specific targets. The 2006 roadmap is the famous staircase from premium sports car to mass-market EV. In its 2016 revision, it ventured also into solar, energy storage and autonomy plus a shared fleet construct. In 2023, Tesla released a 41-page white paper that detailed a global roadmap to creating a sustainable energy economy — packed with charts, cost assumptions and unit economics. Compare that with Part 4, which provides much less of the detailed numbers and dependencies, even as it relies on technologies with far more aggressive regulatory and safety gates than anything Tesla has had to grapple with.

The gap is significant because numerous previous promises — like extensive, unsupervised autonomy — are still in the works. U.S. safety regulators have focused attention on driver-assistance features, with a recall of Autopilot and investigations by the National Highway Traffic Safety Administration still pending. That context sets a high bar for publicly expressing exactly when and how these safeguards and timelines would underlie a commercial robotaxi service.

Here’s What Is at Stake in the $1T Package

Tesla’s board contends the package ties Musk’s rewards to world-changing AI, robotics and energy goals. The company has pointed to Master Plan 4 as proof of a transformational next chapter. Musk has claimed that the money is secondary to retaining control of Tesla’s AI and robotics efforts — and hinted he’d scale back his role if the vote flops. That casts the decision, for shareholders, as both a compensation question — voiding or triggering a major contract with cause results in very different pay packages — and a governance referendum on key-man risk, strategic focus and accountability.

Institutional investors generally seek transparent performance gates related to value creation. Here, the most impactful growth levers — robotaxi, general purpose humanoid robots, and vertically integrated AI infrastructure — also bring uncertain regulatory paths; massive compute and capital demands; and hard-to-predict adoption curves. Without interim milestones or checkpoints, it’s tough to gauge how, when and even whether the plan converts into lasting cash flows.

What investors want to know about Master Plan 4

To judge the merits of Master Plan 4, investors seek some concrete signposts that decrease executional uncertainty. Examples include:

- Autonomy: supervised-to-unsupervised metrics, safety measures including miles per intervention and disengagement rates by operational domain, regulatory acceptance timelines by geography, and commercial service liability frameworks.

- Robotaxi: phased rollout dates, fleet purchase vs. owner-partnering model, hours of operation per-vehicle monthly (estimated/required), target cost/mile vs. ride-hailing incumbents (“cost per mile” details like fully loaded CPM are REQUIRED) and city-by-city regulatory plans.

- Optimus: BOM targets, manufacturing scale plans, early use cases inside Tesla’s factories with resulting productivity gains and a roadmap to external commercialization along with which vendors they should be targeting and initial price bands.

- AI and compute: training and inference capacity long-term roadmaps; expected capex, energy demands for data centers; partnerships or supplier dependencies with silicon and networking providers.

- Financials: gross margin targets by program, break-evens and sensitivities of how much later approvals or slower adoption slows cash generation and dilution.

Governance and credibility questions for Tesla and Musk

At the heart of Tesla’s case is the one thing Musk can do that no one else really can: mobilize talent and move at speed. But the meeting point of CEO control, a far-reaching personal portfolio that includes a stand-alone AI company and a scale of compensation never before seen in tech also escalates concerns about focus and conflict management. Proxy advisers and big asset managers usually check for performance awards that can be tied to auditable results rather than aspirational stories. That scrutiny is heightened with Master Plan 4 still unspecified.

On the other hand, Tesla’s track record suggests that staking out ambitious direction can spur whole industries — from battery supplies to in-vehicle software development. The company’s long-term bulls maintain that the upside in autonomy and robotics far outweighs near-term opaqueness, assuming Tesla can convert ambition into tangible execution.

Bottom line: a bold vision demands measurable milestones now

Master Plan 4 is a broad vision with slender scaffolding. With shareholders pondering this unrivaled pay package, the central question isn’t whether Tesla should go after autonomy, robots, and AI at scale (it already is) but whether the company is willing to publicly commit to specific milestones that can measure progress. Without that, the vote turns into a referendum on trust rather than an evaluation based on transparent performance criteria.