Tesla has updated the fine print for Full Self-Driving, signaling a decisive shift to a software-as-a-service future for its driver-assistance tech. The company’s website now emphasizes a monthly subscription as the primary path to FSD and explicitly states that both pricing and feature availability may change over time—a notable expansion from the more routine “price may change” language shoppers are used to seeing.

The change lands just as Tesla removes its one-time, “lifetime” FSD buy-in, which had most recently been listed at $8,000. With the up-front option gone, drivers are pushed toward subscriptions that currently start at $99 per month—though Elon Musk has signaled those fees will rise as capabilities grow.

What Changed in the Fine Print for Tesla FSD

Previously, Tesla’s footnote read like a standard pricing disclaimer. Now it calls out the monthly subscription model and adds that specific features can shift. That last clause is doing the heavy lifting. It gives Tesla permission to evolve what is inside the FSD bundle—adding, removing, or reclassifying features—without reissuing the product itself.

Practically, that could look like tiered plans, time-limited trials, or bundling FSD with other software perks. Musk has already experimented with tiers and cross-product bundles at his other companies, including premium subscriptions that unlock AI tools. FSD could follow a similar playbook, with feature gates and upsells aligned to software rollouts.

From One-Time Buy to Subscription Plays for FSD

The subscription-only pivot reshapes the value equation for owners. At $99 per month, a three-year horizon runs roughly $3,564—less than the former $8,000 fee, but it keeps the meter running indefinitely. For households that keep cars longer or frequently rely on advanced driver-assistance, lifetime cost could surpass the prior up-front model.

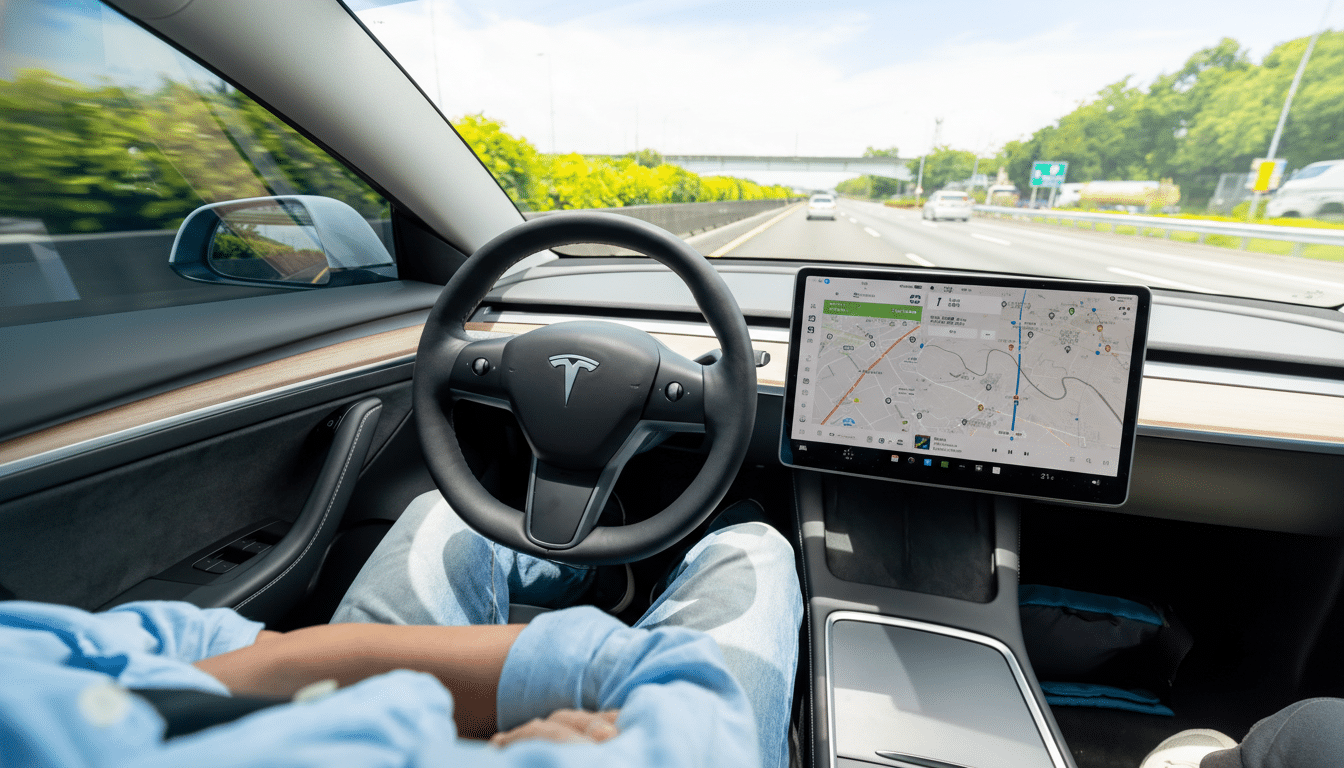

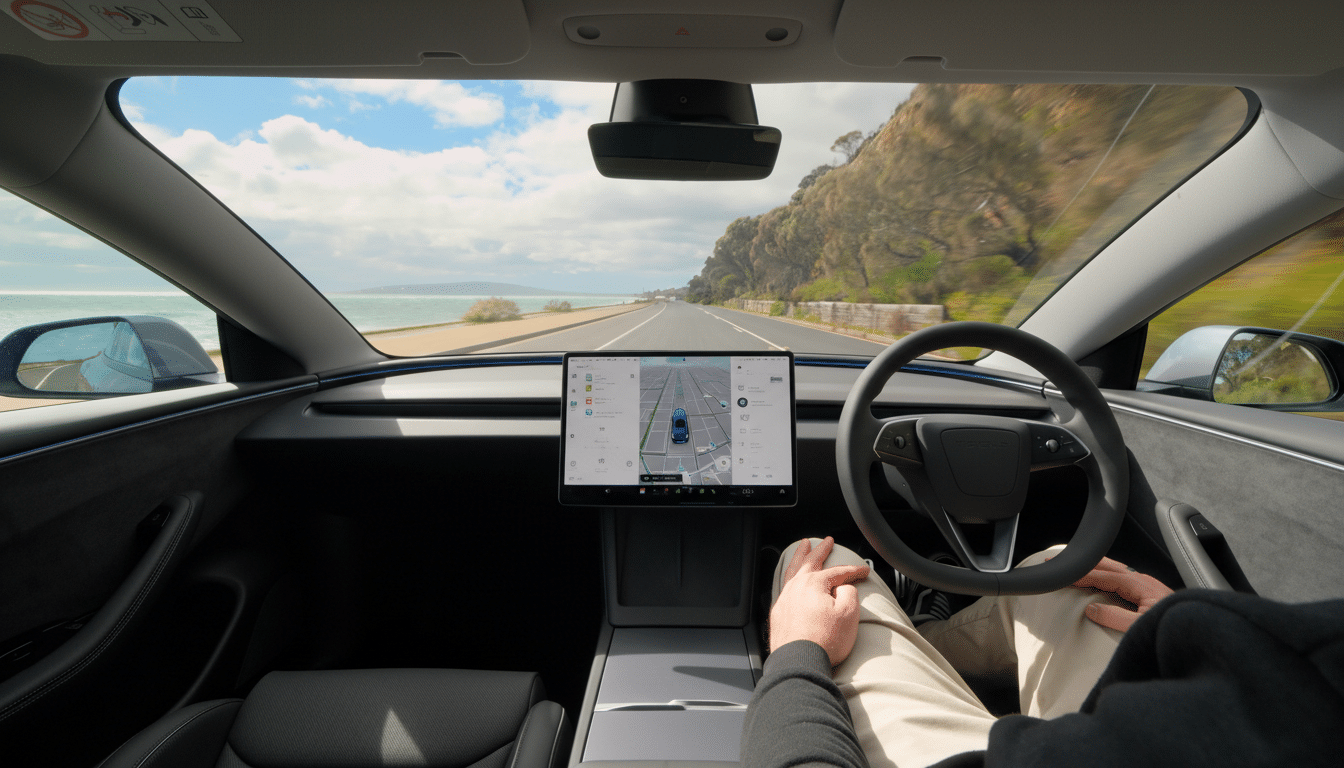

Tesla has also moved Autosteer—a lane-centering function long associated with Autopilot—behind the FSD paywall. And the company has stopped marketing “Autopilot” as a standalone product altogether. Those decisions tighten Tesla’s control over core driver-assist features and may push more drivers to sample FSD, even if only intermittently for road trips or seasonal driving.

Other automakers have tested similar strategies. BMW faced blowback for a heated-seat subscription, and Mercedes-Benz offers a paid acceleration boost on certain EVs. Tesla is taking the idea further by applying it to a halo software product central to its brand story.

Regulatory Backdrop and Safety Caveats for FSD

Tesla’s updated language arrives amid ongoing scrutiny of how driver-assistance systems are marketed and used. The California Department of Motor Vehicles previously determined that “Autopilot” could mislead consumers and pressed for changes; Tesla subsequently ended the Autopilot product designation nationwide. The National Highway Traffic Safety Administration has kept Tesla’s systems under the microscope for years, culminating in a broad 2023 software recall to strengthen Autopilot safeguards across nearly the entire U.S. fleet.

Feature fluidity will also raise disclosure questions. The Federal Trade Commission has warned companies that “negative option” subscriptions—where fees continue unless consumers cancel—must include clear consent, reminders, and simple cancellations. If features central to FSD’s value proposition are reshuffled mid-subscription, expect regulators and consumer advocates to scrutinize how those changes are communicated.

What It Means for Owners and Shoppers Considering FSD

For current Tesla drivers, the upside of subscriptions is flexibility: pay only when you need FSD, cancel when you don’t, and avoid a hefty up-front commitment. The risk is volatility—prices can climb, and core features can migrate between tiers. Documentation of exactly what you’re getting, and for how long, becomes essential.

Resale dynamics may also shift. In the purchase era, FSD’s value sometimes stuck with the vehicle and sometimes didn’t, depending on Tesla’s policies at the time. With subscriptions, the value increasingly sits with the account holder and the current billing status, which could make used-car valuations more dependent on whether a new buyer intends to maintain a monthly plan.

Bottom line: Tesla has given itself room to treat FSD like a living software service, not a static feature. That aligns with the company’s over-the-air ethos and could accelerate development and deployment. But it also puts more burden on consumers to track changes, budget for ongoing costs, and read the fine print—because with Tesla’s new terms, the fine print is where the product lives.