Tesla has removed its standard Autopilot package from vehicles in the US and Canada, shifting core lane-centering capability behind a $99-per-month Full Self-Driving (FSD) subscription. Owners retain Traffic-Aware Cruise Control at no extra cost, but Autosteer—the feature many associate with Autopilot on highways—now sits behind the FSD paywall, first reported by Electrek.

What Changes for Owners as Autosteer Moves Behind FSD Paywall

Previously, every new Tesla shipped with a baseline driver-assist suite that included Autosteer for lane centering and curve handling on marked roads. Going forward, that capability requires FSD. Basic cruise with following distance remains, but the hallmark hands-on, eyes-on lane-centering assist is no longer free.

- What Changes for Owners as Autosteer Moves Behind FSD Paywall

- Why Tesla Is Pivoting to Subscriptions for Driver Assist

- Regulatory and Safety Pressures Driving Tesla’s Strategy

- How FSD Differs from Autopilot in Features and Oversight

- How This Shift Compares to Rivals’ Driver-Assist Pricing

- What Owners Should Consider Before Paying for FSD Access

Tesla is also offering a one-time $8,000 FSD purchase option for a limited period, a move positioned as “lifetime” access to the software on a given car. At the current subscription rate, that upfront buy pencils out after roughly 81 months. CEO Elon Musk has said FSD pricing is likely to rise as the feature set expands, complicating the math for shoppers weighing short-term cost versus long-term value.

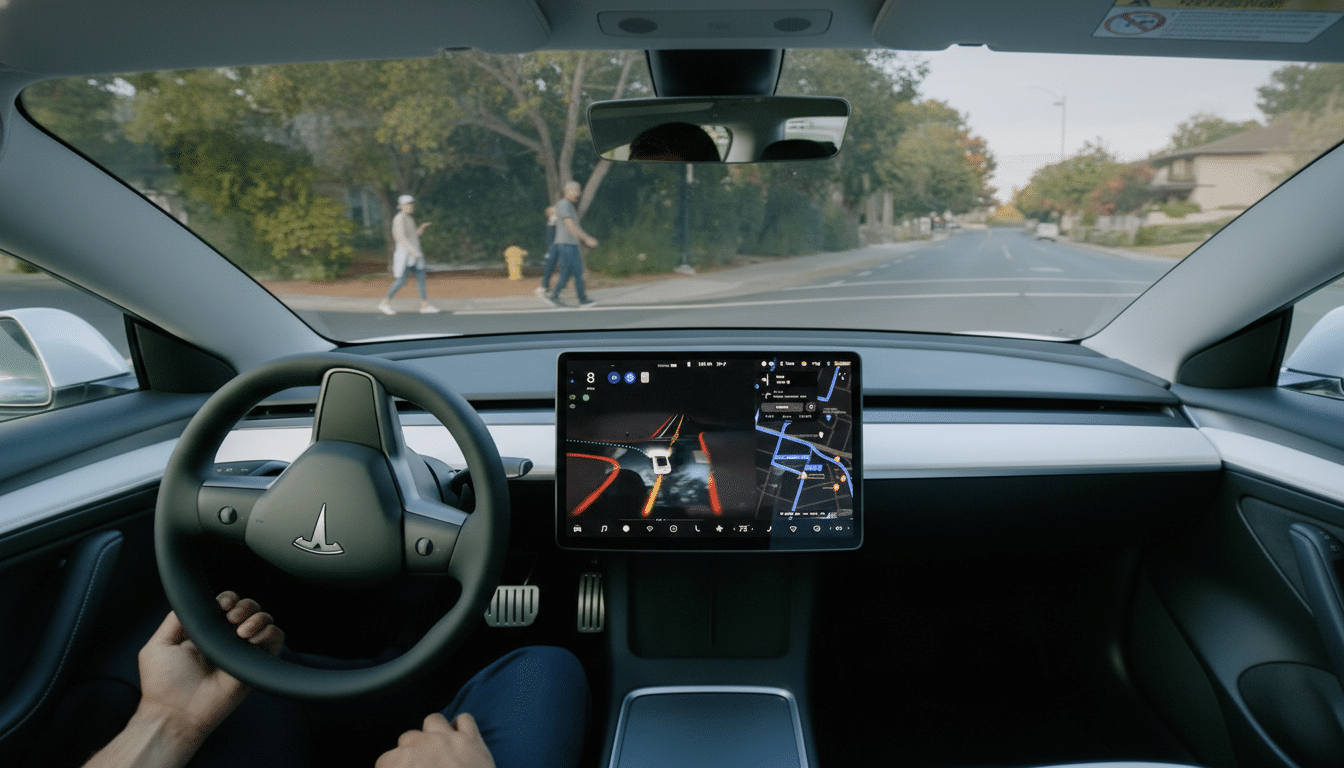

FSD adds features beyond Autosteer, including automated lane changes, highway navigation, parking maneuvers, and supervised city-street driving in supported areas. It relies on Tesla’s camera-only “Vision” stack and the company’s in-car compute hardware to interpret scenes and plan maneuvers, with the human driver remaining fully responsible.

Why Tesla Is Pivoting to Subscriptions for Driver Assist

This shift aligns Tesla with a broader auto industry move to monetize software post-sale. High-margin software revenue provides a buffer against hardware price cuts and cyclical demand. Analysts frequently estimate driver-assist software can carry gross margins above 70%, far richer than vehicle margins pressured by component costs and competitive pricing.

The company has long telegraphed ambitions to scale FSD usage. One target highlighted by EV industry watchers, including Teslarati, is a milestone tied to millions of active FSD subscriptions. Moving Autosteer into FSD could accelerate adoption by making the monthly plan the default path for the assistance many owners use daily.

Regulatory and Safety Pressures Driving Tesla’s Strategy

The timing isn’t accidental. Tesla’s driver-assist branding and behavior have been under scrutiny from regulators. The California Department of Motor Vehicles warned the company over the use of terms such as “Autopilot” and “Full Self-Driving,” arguing the labels could mislead consumers. Meanwhile, the National Highway Traffic Safety Administration has ongoing investigations into Autopilot’s real-world performance and earlier oversaw a broad safety recall that tightened controls on Autosteer engagement.

Autopilot has also featured prominently in litigation after high-profile crashes. Reframing and paywalling lane-centering may not end those challenges, but it does mark a strategic reset that narrows what’s included by default and makes ongoing, supervised use more of a conscious purchase decision.

How FSD Differs from Autopilot in Features and Oversight

FSD, sometimes presented by Tesla as “FSD (Supervised),” extends beyond highway assistance. It attempts routing-aware driving through surface streets, handling turns, traffic lights, and roundabouts under human supervision. On highways, FSD can suggest or execute lane changes, manage interchanges, and take exits within defined parameters, while features like Autopark aim to automate tight maneuvers.

Importantly, FSD remains an SAE Level 2 system. The driver must stay alert, keep hands on the wheel when prompted, and be prepared to take over instantly. Tesla’s camera-based approach, which dropped radar on recent models, relies on neural networks trained on vast driving datasets. Performance can vary by region, road markings, weather, and hardware generation.

How This Shift Compares to Rivals’ Driver-Assist Pricing

Tesla isn’t alone in charging for advanced driver assistance. Ford offers BlueCruise as a subscription following an initial trial, and GM’s Super Cruise is tied to service plans and select trims. The competitive twist is Tesla’s decision to move a previously standard lane-centering function behind its top-tier software, making a monthly plan the gateway to what many brands still bundle with mid- to high-level packages.

What Owners Should Consider Before Paying for FSD Access

Before subscribing, weigh commute patterns and road types. Frequent highway drivers who leaned on Autosteer will feel the change most. The $99 monthly fee may be worth it for daily long-haul commuters; occasional users might activate FSD only for road trips. For buyers eyeing the $8,000 option, consider vehicle ownership length, potential FSD resale value, and Tesla’s history of changing software pricing and packaging.

Independent trackers such as TroyTeslike have previously estimated FSD take rates in the low double digits, suggesting many owners have been hesitant to pay extra. Moving Autosteer into FSD could lift that adoption, but it also risks backlash from drivers who expected lane-centering as part of the base experience.

Bottom line: Tesla is re-basing its driver-assist stack around a subscription that can grow with software updates. For owners, the decision now comes down to whether Autosteer and FSD’s extra capabilities are worth a recurring charge—and whether the long-term bet on vision-first autonomy matches how and where they drive.