While markets raced to new highs, technology’s best-known billionaires quietly reaped even more billions. Insiders sold over $16 billion of stock, an analysis of insider filings compiled by Bloomberg shows, a wave of profit-taking that followed the year’s AI-fueled rally.

Who sold and how much tech insiders unloaded in the rally

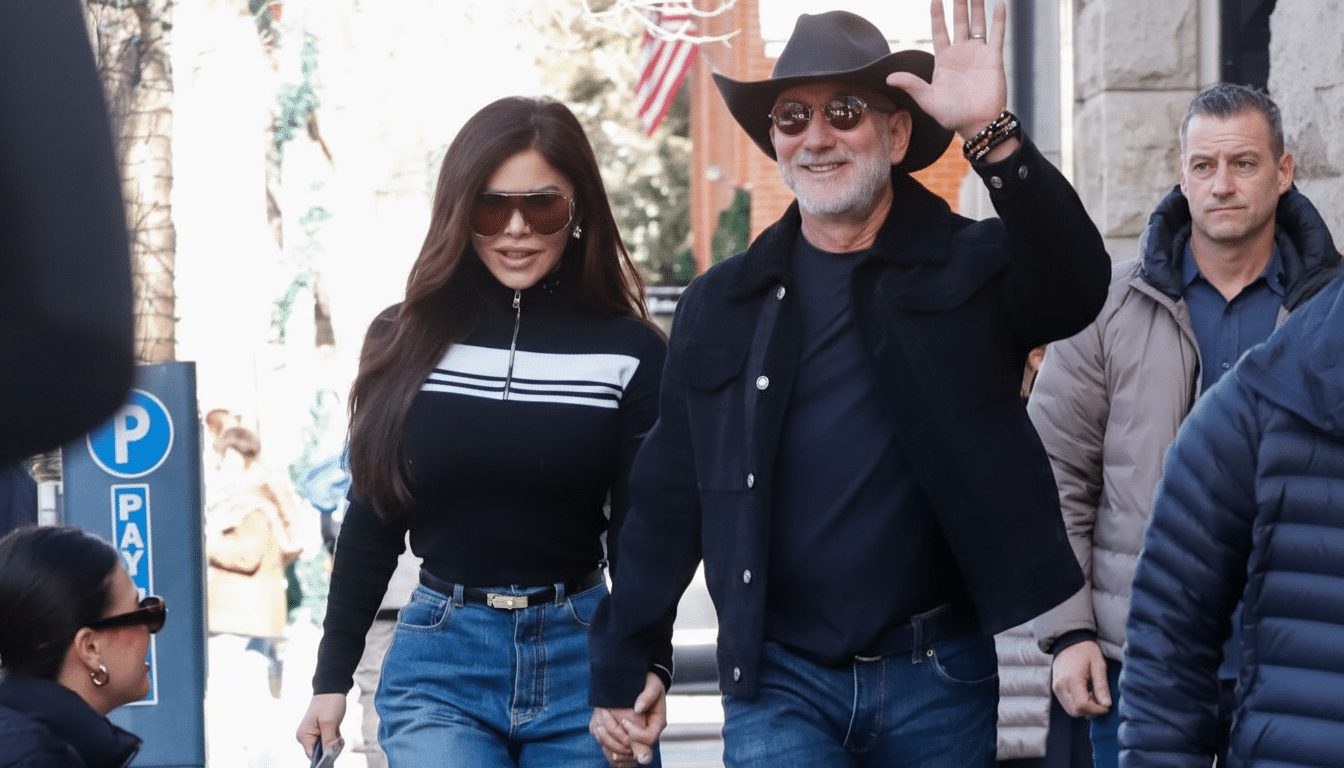

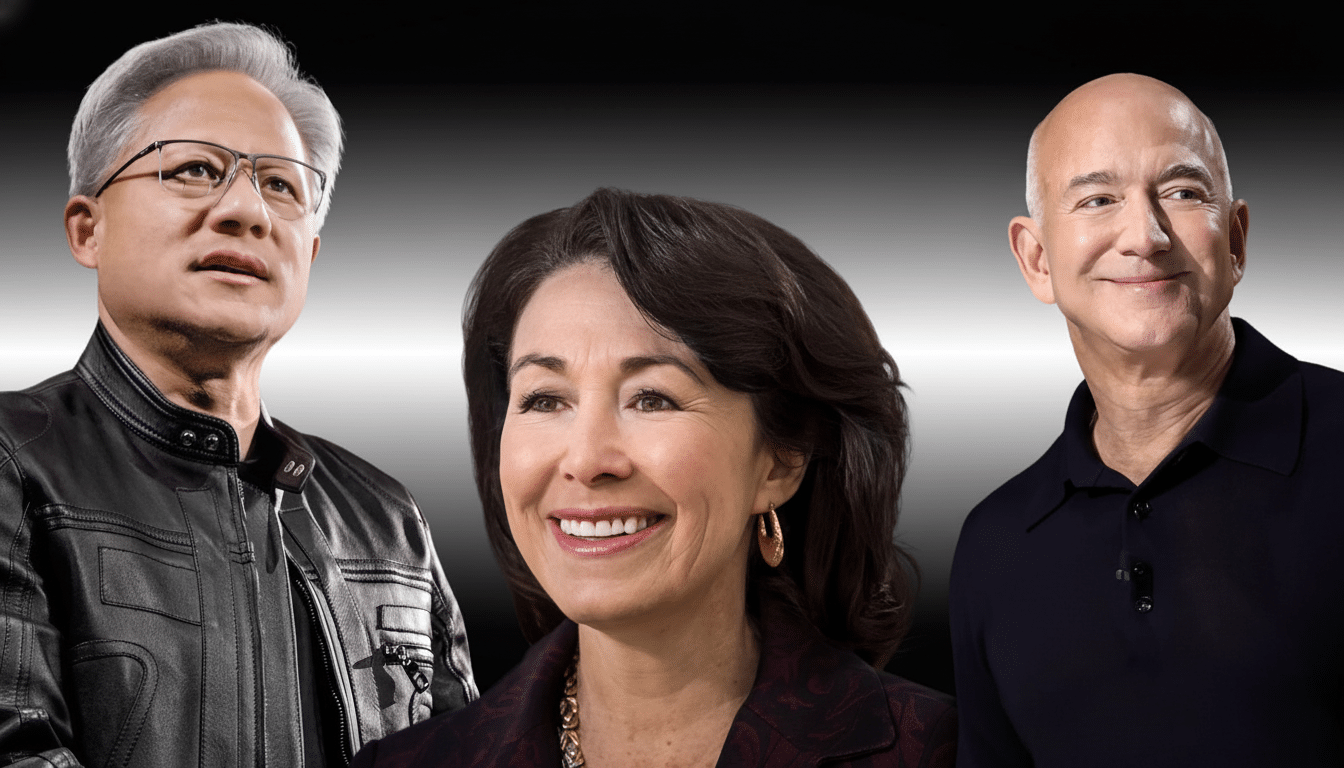

Jeff Bezos was at the front of the line, having sold nearly 25 million shares of Amazon for about $5.7 billion over early-summer trading windows. The transactions were carried out under prearranged trading plans and occurred following a surge in Amazon’s stock price on the back of cloud strength and generative AI wind at its back.

Oracle’s Safra Catz scored about $2.5 billion and Michael Dell made about $2.2 billion as investors continued to love infrastructure and enterprise software involved in AI build-outs.

The rationale sounds a little familiar: Diversify concentrated wealth, create liquidity — and do it within the guardrails of compliance.

Nvidia’s Jensen Huang, head of the company that briefly won its way to being the first to surpass a $5 trillion market value, disposed of about $1 billion. Jayshree Ullal, the chief of another networking company, Arista Networks, also cashed in, coming close to a $1 billion gain as demand for high-speed networking equipment surged and her net worth soared past $6 billion.

Meta’s Mark Zuckerberg shuffled around $945 million through his foundation, a reminder that granting philanthropies often act as sellers when equity rallies push up capacity to make gifts. Other notable dispositions were above $700 million for Nikesh Arora, the CEO of Palo Alto Networks, and that amount also for Baiju Bhatt, a co-founder at Robinhood.

How the AI boom paved the way for heavy insider sales

What unifies them is the AI investment cycle. Hyperscalers shoveled capital into data centers, inventories of chips remained tight and equipment vendors coasted on capacity upgrades. That ecosystem lift pushed everything from electronics supply firms to semiconductor leaders to software suppliers and security platforms higher, creating windows of opportunity where long-dated equity in an insider finally traded above target prices.

“Insider selling is still perceived as a red flag to some investors, but it’s all about context,” the J.P. Morgan site Dealbreaker cautioned recently. Most of these sales were planned well in advance of the latest surge, and their dollar volume amounts to years’ worth of equity appreciation, not one-off bets. As mega-cap share prices soared, even routine plan-driven sales made mega-huge headlines.

How trading plans mold the tape and shape insider activity

The vast majority of the transactions cited were made through Rule 10b5-1 plans — prearranged schedules allowing executives to sell at predetermined times or price points. In the wake of a series of updates by the U.S. Securities and Exchange Commission, officers and directors have cooling-off periods, defined limitations on overlapping plans, and increased disclosure. In practice, that leads to fewer spur-of-the-moment trades and more predictable, recurring selling patterns.

Those plans exist for good reason. They lower legal risk, give the market visibility into the stock, and assist insiders in diversifying what can be concentrated positions built up over decades. They also distinguish personal liquidity events — tax, philanthropy, estate planning — from price-sensitive information, helping dull the idea that every sale is a judgment on valuation.

What the $16 billion in insider sales signals to investors

First, liquidity follows momentum. And when AI FOMO inflates mega-cap market caps by the hundreds of billions, then even modest percentage clips from insiders can carve out blockbuster dollar figures. Second, the gamut of sellers — from e-commerce to chips to networking, cybersecurity, and fintech — underscores just how broadly the AI cycle is hitting tech balance sheets and incentives.

Third: Insider sales are not monolithic signals. Some are tax-driven, some philanthropic, some for regular diversification. Witnesses should pay attention to Form 4 footnotes, the existence of trading plans, and cadence around earnings windows. Analysts at firms that track insider activity — including Bloomberg’s data team and governance researchers — generally look for patterns: clustered, unscheduled sales or departures from historical behavior, rather than a single headline number.

The road ahead for insider selling as the AI cycle evolves

If the AI buildout continues to accelerate — with cloud providers, chipmakers and network vendors adding more capacity — expect to see more plan-driven selling as equity grants vest and price-based sell triggers take effect. Or, if volatility does return to the markets, new 10b5-1 plans may be staggered or the prices reset in light of cooling-off periods and blackout windows.

For now, the point is simple: record runs beget rebalancing. The $16 billion windfall makes clear just how much paper wealth the AI epoch has minted — and how disciplined insiders have become in extracting some of it without investors seeing a strategic withdrawal.