Supabase, the open-source Postgres company that has turned into a go-to backend for the canvassing-and-AI-era app builder, has raised a $100 million Series E that values the firm at $5 billion; it’s been just four months since investors valued it at only $2 billion.

The round is being led by Accel, which is also joined by Peak XV Partners, and it’s coming at a time when developer infrastructure for building applications that are based on generative algorithms — where the output may be undocumented and/or less easy to predict (for example those based on GPT-3) — is getting re-evaluated in terms of estimation both relative to more traditional AI implementations and specifically around how much value they can provide.

- A breakneck jump in Supabase’s valuation in one quarter

- Open-source Postgres at the core of Supabase’s stack

- Funding timeline and backers behind Supabase’s surge

- Why the market is paying up for an open Postgres stack

- Competition and execution risks in a crowded market

- Community ownership as a signal of open-source ethos

- What to watch next as Supabase pursues enterprise scale

A breakneck jump in Supabase’s valuation in one quarter

A 2.5x step-up in a single quarter is something you don’t see hardly at all anymore in today’s private markets. That’s an even larger leap when you look at the prior 12 months: PitchBook pegged Supabase’s Series C post-money valuation to be around $765 million, which also implies that the company’s paper worth has appreciated by more than five-fold over one year. The company claims to have raised $500 million total now.

This renewed excitement is a result of two trends that met at an intersection: the boom in AI-driven application innovation and the revival of Postgres as the de facto database layer for modern stacks. Supabase is at that intersection, offering a managed Postgres core and developer-friendly building blocks.

Open-source Postgres at the core of Supabase’s stack

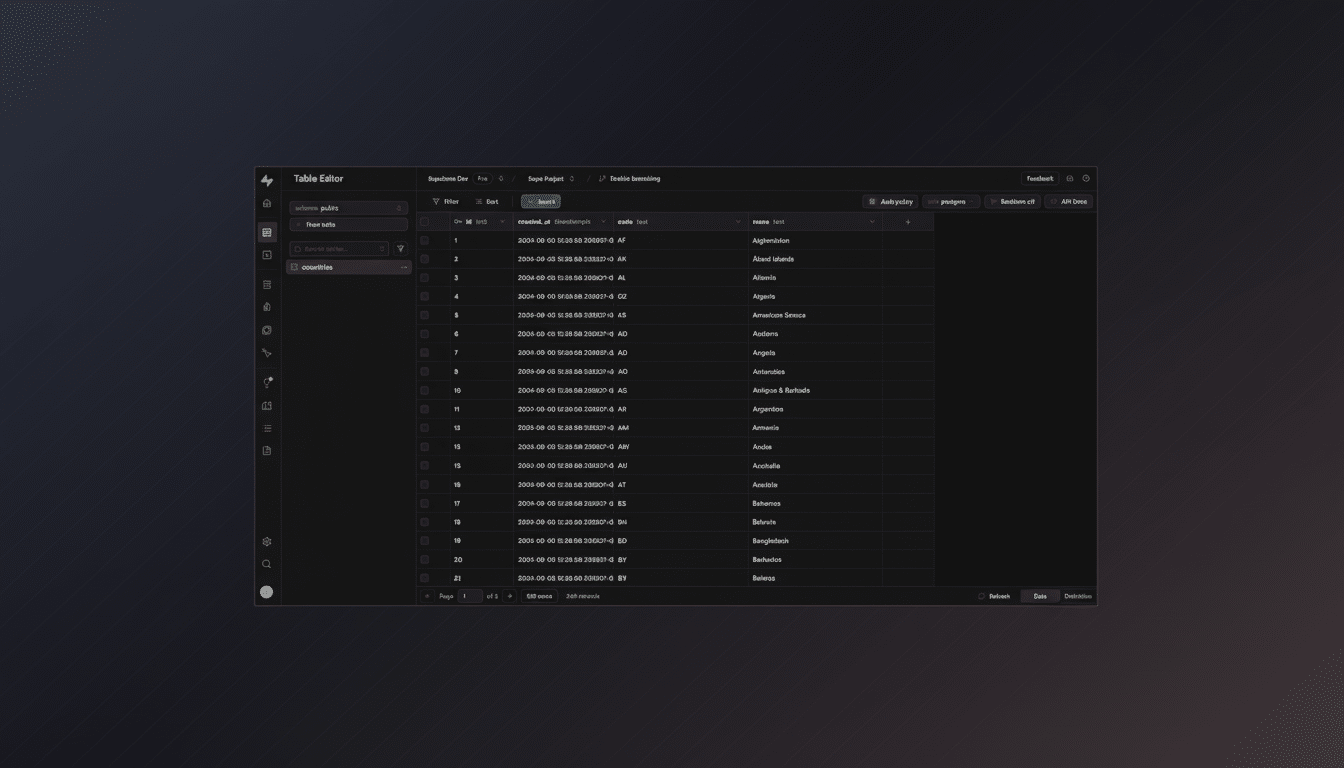

Supabase, founded in 2020 by Paul Copplestone and Ant Wilson, is an open-source alternative to proprietary backends — a space dominated for years by Google’s Firebase. On top of Postgres, Supabase layers authentication, auto-generated REST and GraphQL APIs, file storage, real-time features, and a performant vector toolkit for production workloads; reducing the time required to stand up new services from days to minutes.

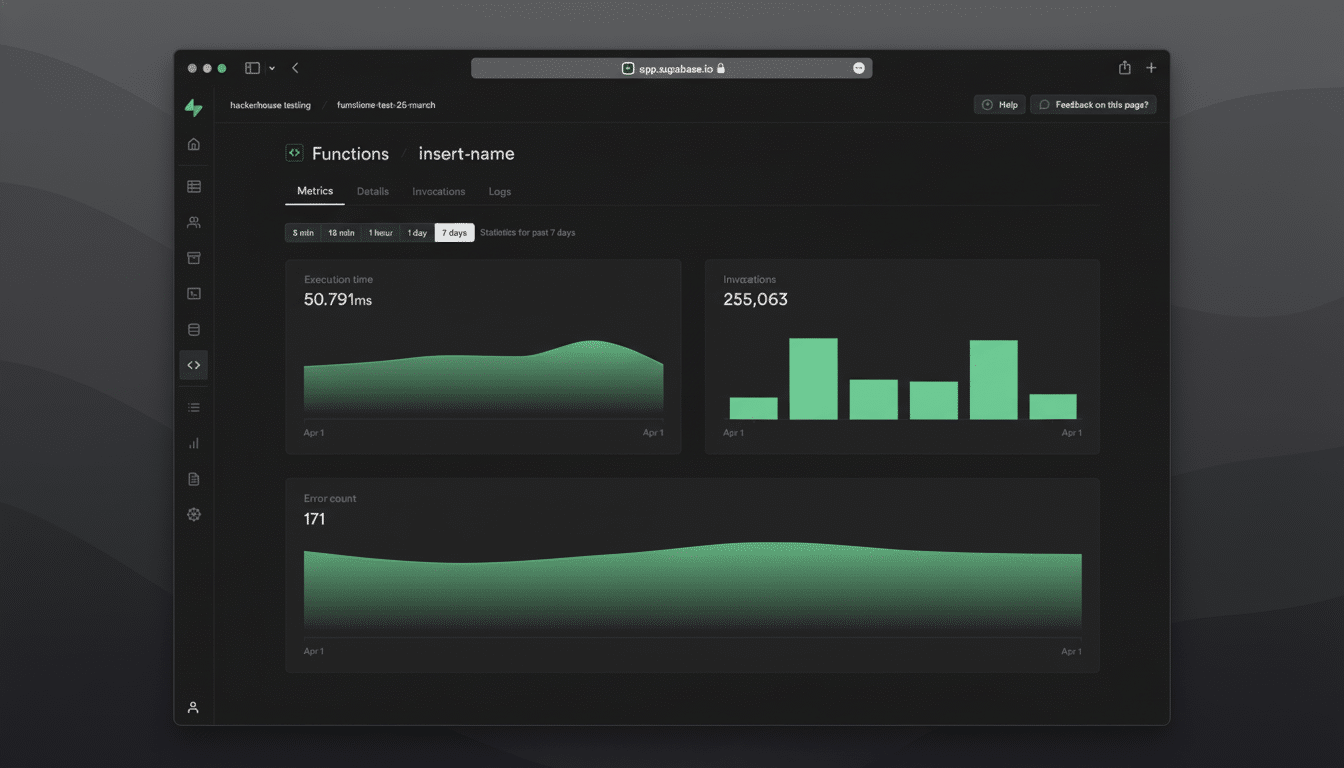

That vector support matters. Retrieval-augmented generation and embedding-indexed retrieval have reached production in many AI products, as well as Postgres — via extensions like pgvector — as the pragmatic choice for how to store and query embeddings alongside transactional data. Supabase wraps that complexity into a service that is managed.

Funding timeline and backers behind Supabase’s surge

The new financing comes on the heels of a $200 million Series D led by Accel, which valued the company at $2 billion. Seven months before that, Supabase announced an $80 million Series C led by Peak XV Partners (the Sequoia India and Southeast Asia spinoff) and Craft Ventures. The company has yet to disclose revenue, but the investor cadence — C, D and E in a flurry — points to confidence around growth and market pull.

Accel and Peak XV are now the co-leads in the new round — a pairing that at least not coincidentally hails from two regions where demand for developer infrastructure is particularly strong. Peak XV — which stands for 15, the number of days a team can spend testing with customers — brings to light the traction of the platform across India and Southeast Asia, while Accel’s history in database and developer tools gives it instantaneous credibility with enterprise buyers.

Why the market is paying up for an open Postgres stack

Supabase says it has a community of 4 million developers. The platform has already become a popular option for teams building “natural language access to apps” workflows, whether through integration with ecosystems like Replit, Cursor and Claude Code — or integrations that appear inside design and prototyping workflows. The land-and-expand motion — start free, scale usage as projects graduate to production — maps well to buyer behavior today.

Macro tailwinds help. Postgres keeps popping up in the top 5 databases on DB-Engines and Stack Overflow’s Developer Survey, and Gartner is predicting double-digit growth for cloud database management services. Investors also appreciate the open-source model: it decreases acquisition costs, creates community goodwill and enhances product feedback loops.

Competition and execution risks in a crowded market

The race is crowded. Among proprietary offerings, Firebase and MongoDB Atlas continue to be strong incumbents. In the SQL-native world, serverless Postgres providers like Neon and cloud datastores like Amazon Aurora and Google AlloyDB are stepping up competition. Also: PlanetScale (MySQL) and, more generally, platforms like Fly.io and Railway are also competing for the same developer workflows.

Supabase’s value proposition is that it provides an integrated, batteries-included development experience without locking users into proprietary abstractions. The problem: In slow- and fast-path applications with vectors and real-time features, the workloads can be heavy with computations and storage. Balancing predictable unit economics with generous free tiers, a strong security posture and enterprise-grade compliance will be some of the ways to help legitimize a $5B price tag.

Community ownership as a signal of open-source ethos

In keeping with its open-source DNA, the company is reserving a portion of the Series E for community members to buy in. Community participation in private rounds is indeed a rare thing, but we have seen it before with developer-led companies trying to align stakeholders beyond the typical employees and VCs.

Done carefully — clear criteria, fair pricing and open communication — this framework can increase retention and advocacy among hard-core users that contribute code, tutorials and extensions.

What to watch next as Supabase pursues enterprise scale

Watch for how well the company can make inroads into enterprise adoption, as well as multi-region reliability or HA metrics, and for how deep tooling becomes, especially around vectors and RAG within Postgres. They’re also keeping an eye on partnerships that will put Supabase closer to where apps are being deployed (edge networks, serverless platforms, cloud marketplaces).

Also be on the lookout for indications of monetization discipline:

- Paid conversion rates from the free tier

- Gross margins across storage and compute

- Speed of security and compliance certifications

At the moment, the market’s message is pretty clear: a Postgres-first, AI-era development-tuned open-source stack can attract premium investor attention. Supabase’s next act is going to be about demonstrating that developer love scales into sustainable, efficient revenue at enterprise grade.