$55.19 with code SAVE20 for a lifetime license to Sterling Stock Picker. A robust equity research tool becomes an easy yes for budget-minded investors at that price.

You invest in stocks and securities, but you don’t have the time or money to buy expensive research tools as well. It’s not fair and it doesn’t make sense, so sign up now. Honeydill/Flickr.

With many research platforms billing monthly, a one‑time fee well under most annual subscriptions is something to take note of when the MSRP goes for $486.

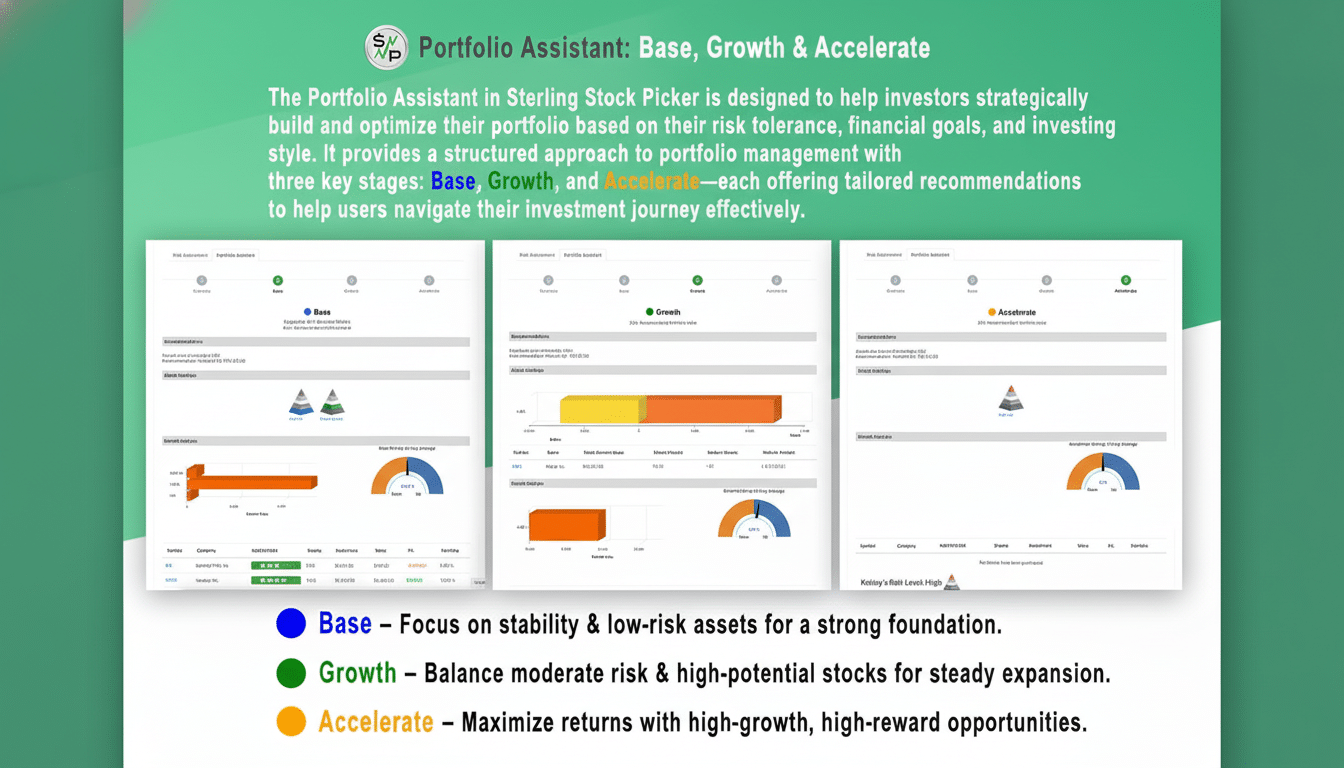

Designed to simplify stock selection and portfolio construction, Sterling Stock Picker uses AI-assisted analysis, straightforward signals and plain-English explanations. Its virtual coach, Finley (loosely powered by OpenAI), allows you to ask questions in plain text, pressure‑test ideas and turn complex data into tangible steps — from getting you ready for your first trade to refining an existing strategy.

The central promise here is speed and clarity: surface candidates that match your risk tolerance and goals, then make informed decisions without need for a dozen spreadsheets.

For self‑directed investors who’d like help cutting through the clutter, our value is not so much about one hot stock as it is process — repeatable, rules‑based and documented.

What Sterling Stock Picker does to simplify stock selection

It is based on tailored advice matched to your risk profile, time horizon, and values. Its unique, patent‑pending North Star scoring measures fundamentals, momentum, and quality factors to provide you with a simple, one‑glance, actionable, wherever‑you‑are system for onboarding fulfillments. The idea is to make triage easy — what needs a closer look, and what doesn’t.

Built‑in portfolio builder features allow you to map diversification, highlight concentration risk and test scenarios before allocating capital. You’ll get sector and industry snapshots, tactical advice and education that demystifies magic words — from free cash flow to drawdown (don’t worry, the jargon doesn’t assume a finance degree).

Example: a 35‑year‑old investor looking for moderate growth and to receive dividends might request that Finley emphasize cash‑generative companies with long histories of payouts, screen out high‑debt balance sheets and exclude the sectors they want no part of. With one click they would immediately see candidates, the reason for any rating and how adding these names would alter the risk and sector mix of their portfolio in seconds.

Who Sterling Stock Picker is best suited for and why

Newer investors who are paralyzed with information might welcome the guardrails. For years the long‑running DALBAR Quantitative Analysis of Investor Behavior, which looks at timing mistakes and emotional trading, says retail investors who sell good investments and buy bad ones generally trail market benchmarks over time. A structured framework — alerts, ranks and rationales — serves as a counter to those pitfalls.

Sterling can serve as a tool for experienced investors to get idea flow and sanity checking. It’s a good way to pre‑screen large universes, pressure‑test convictions and write down why something makes it into the portfolio. Because results from S&P Dow Jones Indices’ SPIVA reports demonstrate that most active managers underperform their benchmarks over 10‑ to 15‑year periods, a disciplined, factor‑aware process is not a luxury — it’s table stakes.

How it compares to typical investing tools and robo-advisors

Cost is the headline. Robo‑advisors, as well as both traditional and new advisor services, typically retain 0.25% to 1.00% of assets each year. That’s $25 to $100 a year on a $10,000 portfolio; $125 to $500 on 50 grand. High-end stock screeners and research packages can cost $20 to $60 per month. With that in mind, a one‑time $55.19 for lifetime access is substantially cheaper, assuming the toolkit falls within your workflow.

At its core, Sterling combines screening with portfolio analytics, as well as conversational guidance. The AI layer is less important for hype and more for usability: asking “Show me large‑cap compounders with rising margins and manageable leverage” is quicker than constructing a complex user query from scratch. Those shortlists, fewer dead ends and clearer notes taken to get there — that productivity is going to keep compounding over time.

Important considerations and limitations before you sign up

No tool eliminates market risk. Backtested results, ratings and factor grades are not guarantees of future performance. The U.S. Securities and Exchange Commission reminds investors often that past performance is no guarantee of future results; anything you do should take any platform into account as one input, not the only decision maker. Diversification and discipline continue to do the heavy lifting.

Do some back‑of‑the‑envelope diligence: How is data refreshed, what factors contribute to the North Star score and how are conflicts avoided? Credible research generally describes its methods. Privacy counts, too — you should review how your portfolio data is being stored and used. Stand‑alone materials from the CFA Institute and FINRA Foundation provide helpful primers on how to vet investment tools and avoid behavioral traps.

Bottom line on value, pricing, and using this tool wisely

If you’re looking for a way to bid farewell to S&P 500 stock picking and play around with AI analysis of securities, then Sterling Stock Picker’s lifetime deal stands out in its value. At $55.19 with code SAVE20 (regularly priced at $486), it comes in well under the usual price of research and advisory costs, even on a shoestring budget. As is the case with any investment software, pair this with good judgment and a plan. Pricing and availability may change.