Sterling Stock Picker, an OpenAI-powered research platform built to streamline equity analysis for individual investors, is being offered for $55.19, down from a list price of $486. The steep discount turns what is typically a pro-style toolkit into a wallet-friendly way to pressure-test ideas, monitor holdings, and cut through market noise.

Unlike a brokerage or robo-advisor, this is a decision-support system. It won’t place trades or replace a financial professional, but it does aim to speed up the grunt work with an AI assistant that surfaces signals you might otherwise spend hours hunting down.

What this Sterling Stock Picker discount deal includes

At the center of the software is an AI financial coach named Finley. Drawing on real-time market data, Finley translates piles of fundamentals and price action into concise judgments on whether a ticker looks like a buy, hold, sell, or avoid—then explains why in plain language. A patent-pending North Star personalization system calibrates these insights to your risk tolerance and style, so a conservative income seeker isn’t handed the same playbook as a momentum trader.

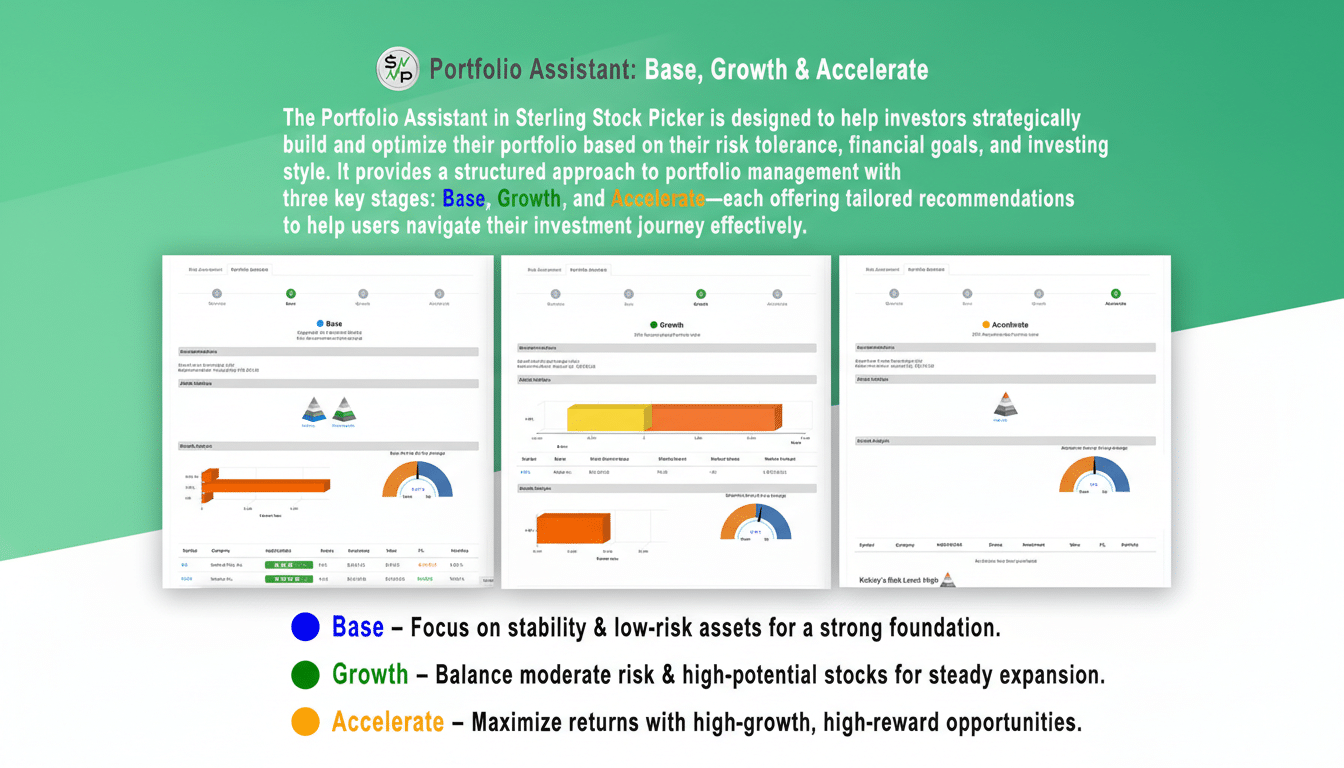

The platform goes beyond single-name snapshots. A quick risk questionnaire helps set guardrails, a streamlined portfolio builder supports diversification, and ongoing monitoring tracks pillars such as financial health, growth, and risk. Sector heat maps and earnings breakdowns help you see which forces are lifting or dragging on your positions before, during, and after reporting season.

How the Sterling Stock Picker AI works in real practice

Say you’re screening mid-cap semiconductor stocks ahead of earnings. Instead of combing through multiple filings and analyst notes, you can ask Finley to summarize revenue trends, margin trajectories, balance-sheet leverage, and competitive positioning. The assistant can highlight red flags—like expanding inventory days or rising interest expense—and point out green shoots such as accelerating free cash flow or share gain versus peers.

If your goal is stability and income, you could set your North Star to prioritize dividend durability and low volatility. The system would weight metrics like payout ratios, cash coverage, and drawdown history more heavily, offering rebalancing suggestions when a holding’s risk profile drifts from your target.

Why AI investing tools are rapidly gaining ground today

Generative AI is quickly moving from novelty to necessity in research workflows. McKinsey estimates these models could add $2.6T to $4.4T in annual economic value across industries, with banking and capital markets among the most affected. For retail investors, the draw is simple: less time stitching together spreadsheets, more time evaluating the bigger picture and making decisions.

This kind of augmentation can be particularly useful when markets are choppy and headlines are noisy. Tools that translate dense data into digestible narratives help newer investors climb the learning curve, while veterans can use them as a second set of eyes to challenge priors or spot inconsistencies.

Limitations to consider and key investor protections explained

AI is not infallible. Model outputs depend on data quality and design choices, and they can occasionally miss context or overfit to recent patterns. The platform does not execute trades and should not be treated as personalized financial advice. It’s best used to inform judgment, not replace it.

Regulators have also warned about “AI washing,” where firms overstate their use of advanced models. The Securities and Exchange Commission has urged investors to scrutinize claims and understand how recommendations are generated. Sensible safeguards—like cross-checking key numbers against company filings and independent research providers—still apply.

Bottom line: affordable entry to AI-driven stock research

At $55.19, Sterling Stock Picker offers an approachable way to bring OpenAI-driven analysis into your research stack without committing to an expensive subscription. If you want fast, intelligible readouts on stocks, portfolio-level diagnostics, and guardrails tied to your risk profile, this is a notably low barrier to entry. As always, pricing and availability can change, and the best results come when AI-enhanced insights are paired with disciplined, human decision-making.