ClickHouse has raised $400 million at a $15 billion valuation, a sharp step up for the open source analytics database maker that positions it more squarely against Snowflake and Databricks in the battle for modern data workloads. Bloomberg reported the valuation and round size, while the company named Dragoneer Investment Group as lead investor alongside Bessemer Venture Partners, GIC, Index Ventures, Khosla Ventures, and Lightspeed Venture Partners.

The financing is roughly two and a half times the company’s prior valuation of $6.35 billion and follows surging demand for real-time analytics and AI-centric data infrastructure. ClickHouse said annual recurring revenue from its managed cloud service grew more than 250% year over year, citing customer wins and expansion at enterprises including Meta, Tesla, Capital One, Lovable, Decagon, and Polymarket.

Why Investors Are Paying Up for ClickHouse’s Growth

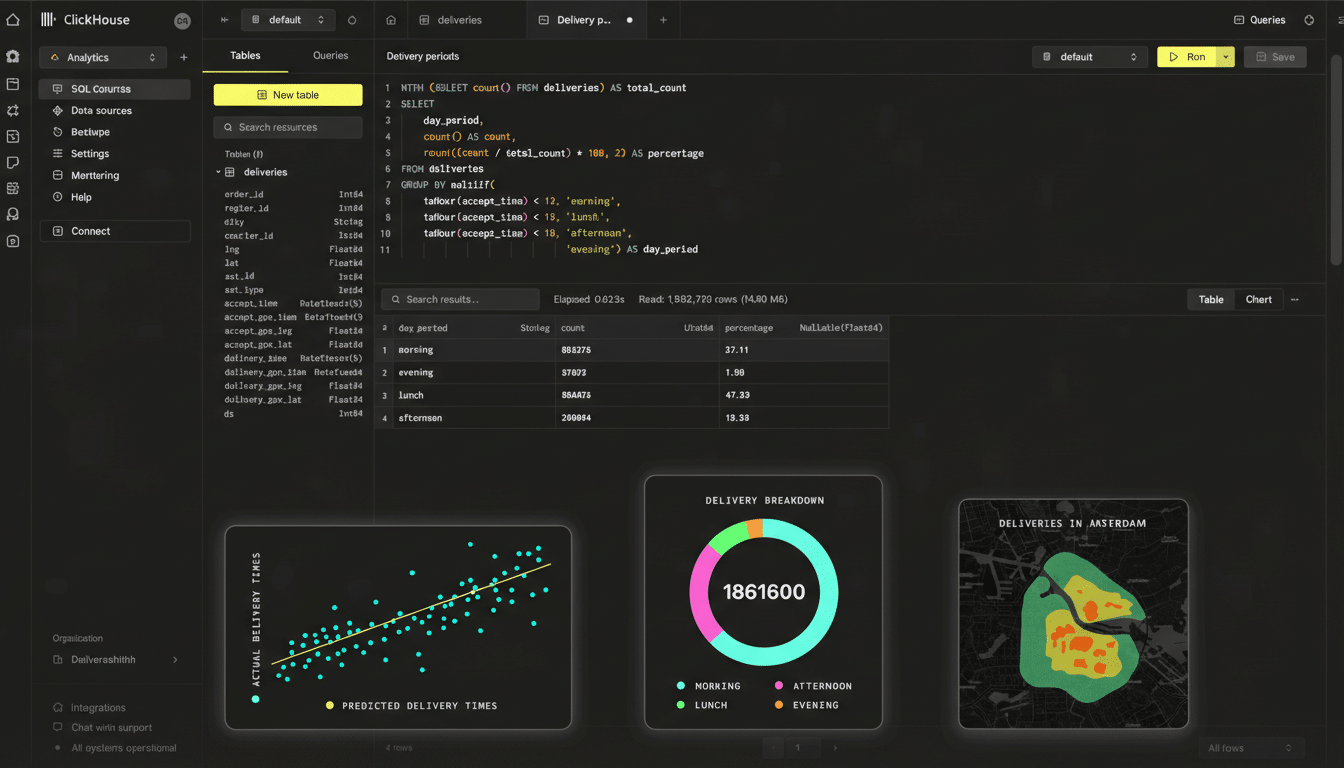

ClickHouse’s core appeal is performance-to-cost leverage for analytic queries at extreme scale. Its columnar, vectorized execution engine and compression techniques are built for sub-second scans over billions of rows, a pattern common in product analytics, clickstream processing, observability, and AI feature stores. By open sourcing the database and monetizing through ClickHouse Cloud, the company taps a developer-led adoption funnel while offering enterprises a fully managed, consumption-based path.

The shift pairs neatly with data teams’ priorities: faster time-to-insight with predictable spend. Industry analysts have noted that buyers are consolidating around engines that can ingest high-velocity events, serve interactive BI, and support emerging AI needs without sprawling data copies. ClickHouse’s trajectory reflects that convergence.

A Strategic Bet on AI Observability at Scale

ClickHouse also announced the acquisition of Langfuse, a startup focused on monitoring, tracing, and evaluating AI agents in production. The deal puts ClickHouse closer to the operational edge of AI workloads, complementing its role as the analytical backbone. Langfuse competes directly with LangSmith, the observability platform from LangChain, and its tooling helps teams measure agent performance, costs, and guardrail efficacy—a priority as enterprises move from pilots to governed production systems.

By pairing high-throughput analytics with AI observability, ClickHouse aims to shorten the loop between data capture, model behavior, and business outcomes. For customers, the value proposition is a simpler stack for evaluating prompts, embeddings, and agent decisions using the same engine that powers broader analytics.

Stack Positioning Against Snowflake And Databricks

The competitive lines are clear. Snowflake’s cloud data warehouse remains a dominant platform for governed analytics and data sharing, while Databricks leads in lakehouse architectures that blend data engineering, AI/ML, and SQL analytics. ClickHouse has carved out a lane for ultra-fast, cost-efficient OLAP on streaming and event-heavy datasets, and has been steadily expanding into adjacent features such as vector search, tiered storage, and serverless options in its cloud service.

That differentiation resonates in a market where many teams now run mixed workloads: BI dashboards, real-time product metrics, and AI retrieval all hitting the same data. Gartner and other research firms have highlighted this convergence, with buyers favoring platforms that minimize data movement and latency. ClickHouse’s bet is that an open, performance-first engine can win a sizable chunk of those queries even inside heterogeneous stacks.

From Yandex Spin-Out To Enterprise Standard

Originally developed inside Yandex and spun out as an independent company in 2021, ClickHouse has become a staple for teams that want real-time analytics without prohibitively high query costs. Its community roots have helped the project spread, while the managed cloud product has matured with features enterprises expect, including fine-grained access controls, managed backups, and multi-availability zone resilience.

The funding signals confidence that ClickHouse can scale its go-to-market and R&D cadence to match incumbent pace. Investors such as Dragoneer, Index, and Lightspeed have backed several infrastructure leaders through growth inflection points, and their participation suggests expectations for continued category share gains.

What the $15B Marker Means for ClickHouse and AI Data

A $15 billion valuation places ClickHouse among the most valuable private data infrastructure companies. While the company did not disclose revenue, the reported ARR growth of over 250% indicates strong land-and-expand dynamics as workloads consolidate on its cloud. If sustained, that trajectory gives ClickHouse room to push deeper into enterprise accounts and broaden its platform with AI-native features, governance, and ecosystem integrations.

The broader takeaway: the center of gravity in analytics is shifting toward engines that deliver interactive speed on fresh, high-volume data—and that play nicely with AI. ClickHouse’s raise, coupled with its move into AI observability via Langfuse, underscores how that thesis is informing both product roadmaps and investor appetites across the data stack.