Serve Robotics is moving beyond sidewalks and into hallways. The company best known for autonomous sidewalk delivery announced it is acquiring Diligent Robotics, maker of the Moxi hospital assistant robot. The transaction values Diligent’s common stock at $29 million, signaling a strategic bet that the same autonomy that navigates city streets can deliver in clinical corridors.

Backed by prominent strategic investors and operating one of the largest autonomous delivery fleets, Serve is buying more than a product line. It is purchasing a mature workflow, hospital integrations, and a foothold in a massive service automation market under pressure to do more with fewer people.

- Why Healthcare Is the Next Frontier for Service Robots

- What Diligent Brings to the Table in Hospital Automation

- Sidewalk-to-Hallway Synergies for Scalable Robotics

- Deal Economics and the Industry Signal for Robotics

- Integration Plan and Execution Risks in Healthcare

- What to Watch Next as Serve Enters Healthcare Robotics

Why Healthcare Is the Next Frontier for Service Robots

Hospitals are dense, high-variability environments filled with people—exactly the kind of real-world complexity Serve’s robots already handle outdoors. As Serve leadership frames it, once you solve autonomy among people at scale, the “where” becomes a matter of domain adaptation.

There is also a clear demand signal. The American Hospital Association has described persistent workforce shortages and burnout, while Kaufman Hall reports hospital labor expenses per adjusted discharge remain well above pre-pandemic baselines, often by more than 20%. McKinsey has projected substantial nurse shortfalls, reinforcing the need to offload nonclinical tasks. Automating supply runs, lab deliveries, and linen transport frees clinicians to practice at the top of their licenses—hard ROI in a margin-constrained sector.

What Diligent Brings to the Table in Hospital Automation

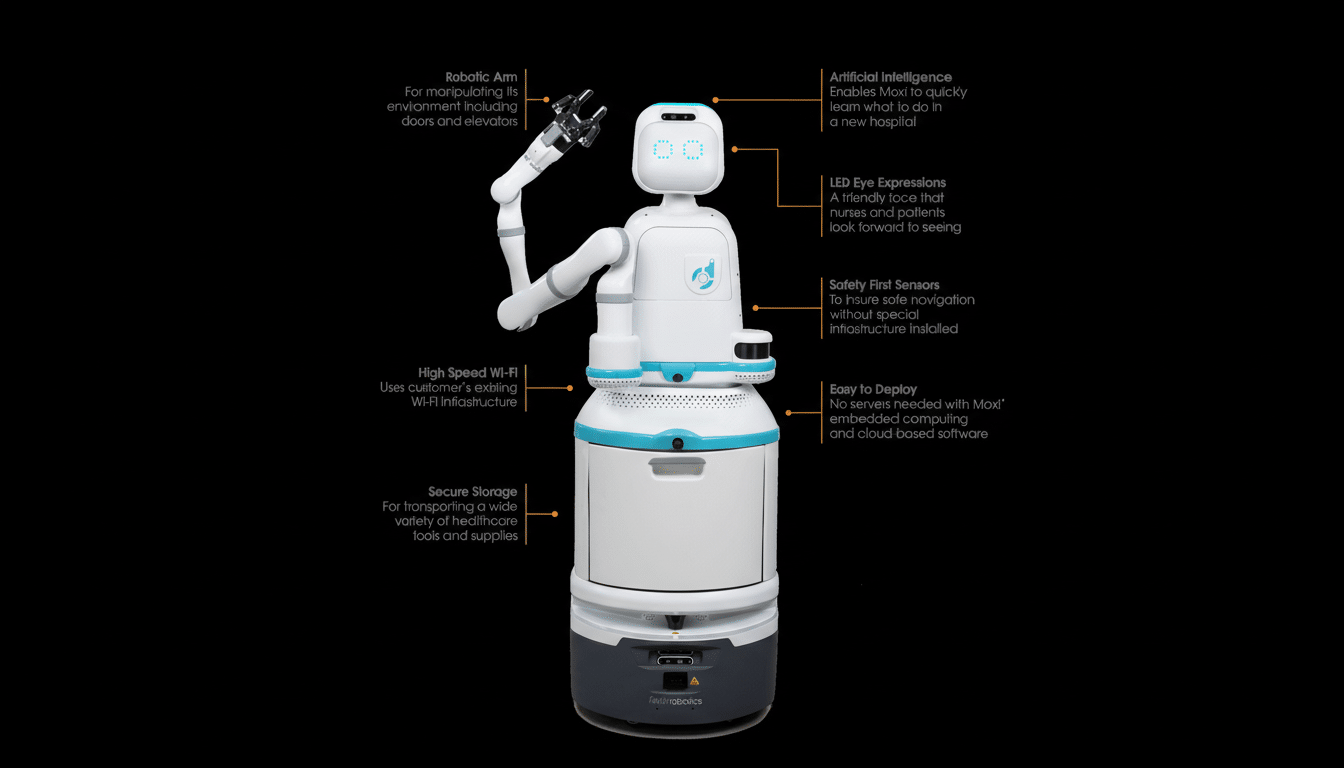

Diligent’s Moxi has been built for hospital realities: secure badge access, elevator integration, and reliable handoffs for items like lab samples, supplies, and linens. The team has raised more than $75 million to date and, critically, has learned the hard lessons of clinical workflow design—how to fit into sterile spaces, avoid disrupting patient care, and earn staff trust.

Equally important is operational maturity. Diligent has executed deployments across multiple U.S. health systems, meaning it brings templates for change management, staff training, and service-level commitments. Those playbooks are difficult to replicate in a lab and often take years to refine.

Sidewalk-to-Hallway Synergies for Scalable Robotics

Serve’s strengths—large-scale routing, remote assist, fleet management, and high uptime—map neatly onto hospital use cases. The same platform that coordinates thousands of curbside deliveries can optimize elevator usage, orchestrate multi-stop missions, and balance charging schedules across an indoor fleet.

Expect Serve to plug its autonomy stack, teleoperations tooling, and data pipelines into Moxi’s workflow layer. That should improve mean-time-between-assists, reduce mission drop-offs, and increase robots-per-operator ratios. In practical terms, hospitals could see faster deployments, higher on-time delivery rates, and tighter integration with existing logistics systems.

Deal Economics and the Industry Signal for Robotics

The $29 million valuation is notably below the capital Diligent has raised, underscoring ongoing consolidation in robotics as companies seek scale, distribution, and shared software platforms. For Serve, the purchase is a relatively low-cost entry into a category with durable, subscription-like revenue and long contract cycles.

The revenue models also rhyme. Serve’s pay-per-drop and route-based pricing translate conceptually to hospital robotics-as-a-service, where monthly subscriptions combine with per-mission fees and service SLAs. With a larger installed fleet, Serve can amortize R&D across two markets and improve unit economics through shared components, common autonomy, and centralized operations.

Integration Plan and Execution Risks in Healthcare

Serve says Diligent will operate with relative independence while tapping Serve’s software and tools. That’s a sensible approach; hospital robotics requires discipline around validation and verification, infection control, and change management that differs from food delivery ops.

Key risks include maintaining reliability thresholds in clinical environments, safeguarding patient privacy, and navigating facility-by-facility differences in elevators, doors, and security protocols. Adoption depends as much on staff experience as on autonomy—robots must be easy for nurses and technicians to summon, track, and trust.

What to Watch Next as Serve Enters Healthcare Robotics

Indicators of success will include growth in hospital deployments, utilization rates per robot, and on-time task completion. Look for tighter integrations with elevator control systems and hospital materials management software, along with published time-saved metrics for clinical staff.

For Serve, the bigger story is platform leverage. If its autonomy, teleops, and fleet software can perform across sidewalks and hospital corridors, the company earns the right to expand into other people-dense environments like airports, campuses, and hotels—without diluting focus. The acquisition of Diligent Robotics is not a pivot so much as a proof point for a broader thesis: once robots reliably move among people, the addressable market becomes the built world itself.