The head of Samsung’s top mobile division warned consumers to prepare for higher prices on televisions and big home appliances, which are now caught in the crosshairs.

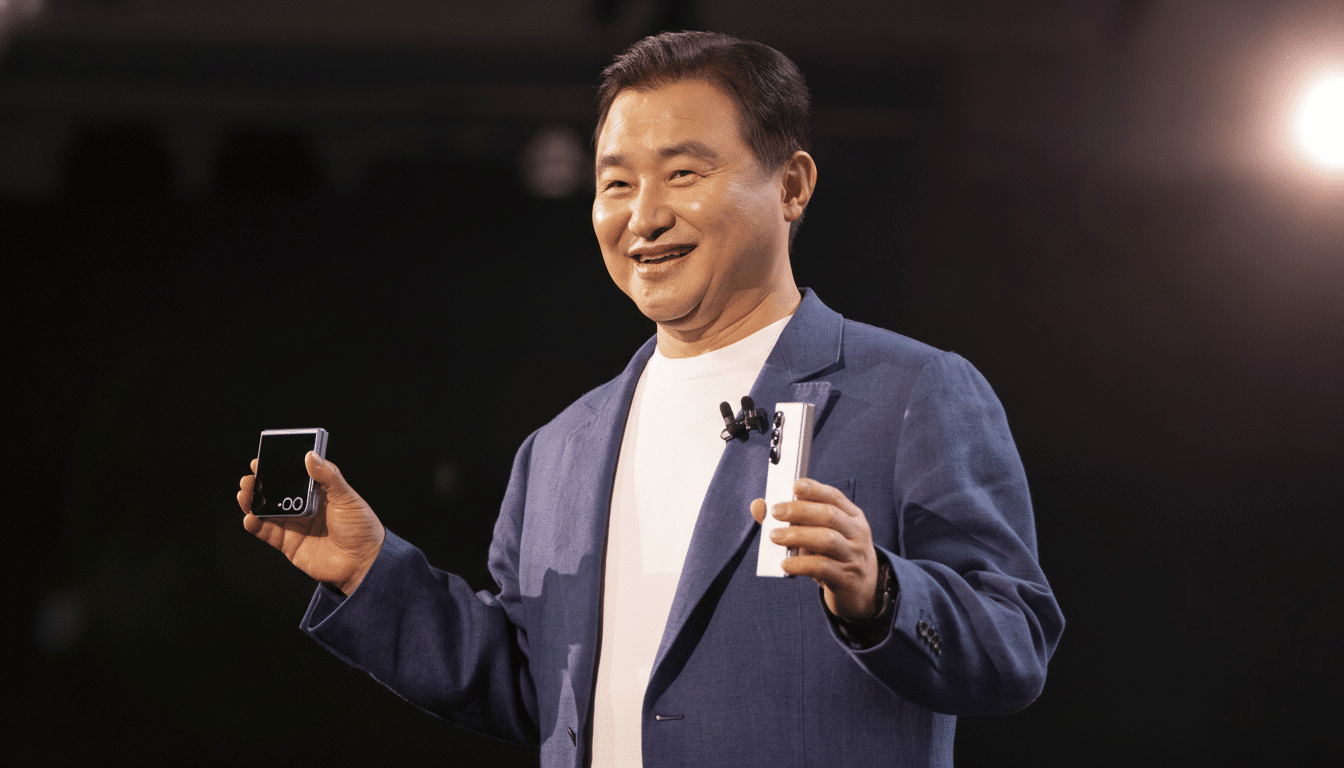

In an interview this month, TM Roh said the “inevitable” effect of a global memory shortage was felt across the company’s product lines and underscored how a DRAM crunch is no longer just about smartphones.

Why a Memory Crunch Takes a Toll on Everyday Electronics

DRAM is the unspoken workhorse of modern electronics. It keeps apps snappy on phones, buffers frames on TVs, and enables connected features in appliances. When DRAM supply gets tight, manufacturers must pay more for components or wait a longer amount of time — and sometimes both. The demand surge for AI servers has exacerbated the squeeze by drawing more and more advanced memory capacity into data centers, starving consumer devices of chips.

Today’s smart TVs are usually powered by LPDDR memory and eMMC or UFS storage for operating systems, voice control, and streaming apps. Big appliances — from refrigerators with touchscreens to washers equipped with Wi-Fi — are increasingly powered by more capable controllers and memory that can process connectivity, diagnostics, and smart-home integrations. When memory prices spike, the cost pressures make their way to the living room and kitchen.

Samsung Sees Higher Tags on DRAM Squeeze

Roh’s warning was echoed, though, by his acknowledgment that even Samsung, despite being large and vertically integrated (it integrates the production from components to final products), wasn’t totally immune to an “unprecedented” supply backdrop. While he was talking specifically about mobile devices initially, the disruption could also come to other consumer electronics — TVs and home appliances will be in its crosshairs. For the world’s biggest TV maker and a major appliance brand, even modest changes in component costs can add up over millions of units.

Industry forecasts suggest where things are heading already. IDC has warned that prices for smartphones could rise by 6% to 8% in the event of a dramatic reduction in DRAM. In related regional reporting, it sounds like Samsung’s next flagship phone lineup might also step up in price — potentially by more than $50 on the base model — though the company has not confirmed final retail decisions. Collectively, the guidance indicates broader pricing firmness across product lines in the event that memory stays tight.

Supply Pressures and the Price Math for TVs and Appliances

Memory analysts at outfits like TrendForce have been tracking double-digit spot rises for DRAM contract prices over the past handful of quarters as chipmakers shift supply to high-bandwidth memory for AI workloads and struggle with constrained capacity for mobile- and consumer-grade chips. As suppliers redistribute wafer starts to hotter segments, mainstream DRAM grades become even scarcer and quotes top asking prices for TV and appliance parts.

There are costs on top of the chips themselves. Costs for panels and materials in TVs have risen in fits and starts, while logistics and labor costs are unpredictable. Currency fluctuations — particularly of the won against the dollar — can magnify or counter these effects for export-heavy brands. The result is a delicate pricing calculus: jack up MSRPs, scale back promotions, or reset features to guard margins.

What It Means for TVs and Home Appliances

In a high-end, 65-inch TV set, memory’s only a small slice of the bill of materials, but it’s not insignificant. Even a few dollars more per module times millions to be sold worldwide is real money. Manufacturers can take options — reduced deep discounting, shorter periods for sales, or small spec changes — to handle cost inflation without suddenly hitting shoppers with blanket across-the-board hikes. In previous chip shortages, retailers tended to rely on temporary deals rather than aggressive permanent markdowns, and appliances had skimpier promotional cycles.

Connectivity features are increasingly par for the course for big appliances — and that means more silicon. If we are right, though, and memory remains tight, expect high-feature displays like these (with smart integrations) to have stickier pricing. Entry-level systems may remain stable for longer, but they are not insulated from a continuing increase in component costs.

AI Ambitions Add Cost Pressure Across Devices

Roh also laid out an ambitious goal to increase the number of Samsung devices shipped with on-device AI capabilities twofold, to over 800 million units. On-device AI — be it for camera processing, voice, or personalization — generally needs more memory and stronger processors. That raises the cost base, and in a constrained DRAM market, it’s another tick higher pressure on ASPs (average selling price) of phones, tablets, and increasingly, TVs boasting local AI capabilities.

What to Watch Next as Memory Market Pressures Build

Signals to watch include earnings guidance from manufacturers on component costs, contract prices for DRAM (dynamic random-access memory) published by research houses like TrendForce, and the pace of retail promotions around major sales events. If supply slackens or demand goes tepid, the pressure could soften; if AI-fueled memory demand remains white-hot, discipline on price should also remain. For now, Samsung’s message is straightforward: The memory market is contributing to the price tag on your next TV or appliance.