T-Mobile is reportedly changing how it pays out device trade-in promos, and the move could simplify bills while tightening the carrier’s retention grip. Insider chatter circulating on Reddit suggests existing customers will receive their full promotional value as monthly recurring device credits over 24 months, rather than a mix of upfront instant credit and monthly credits.

What Is Allegedly Changing in T-Mobile Trade-In Credits

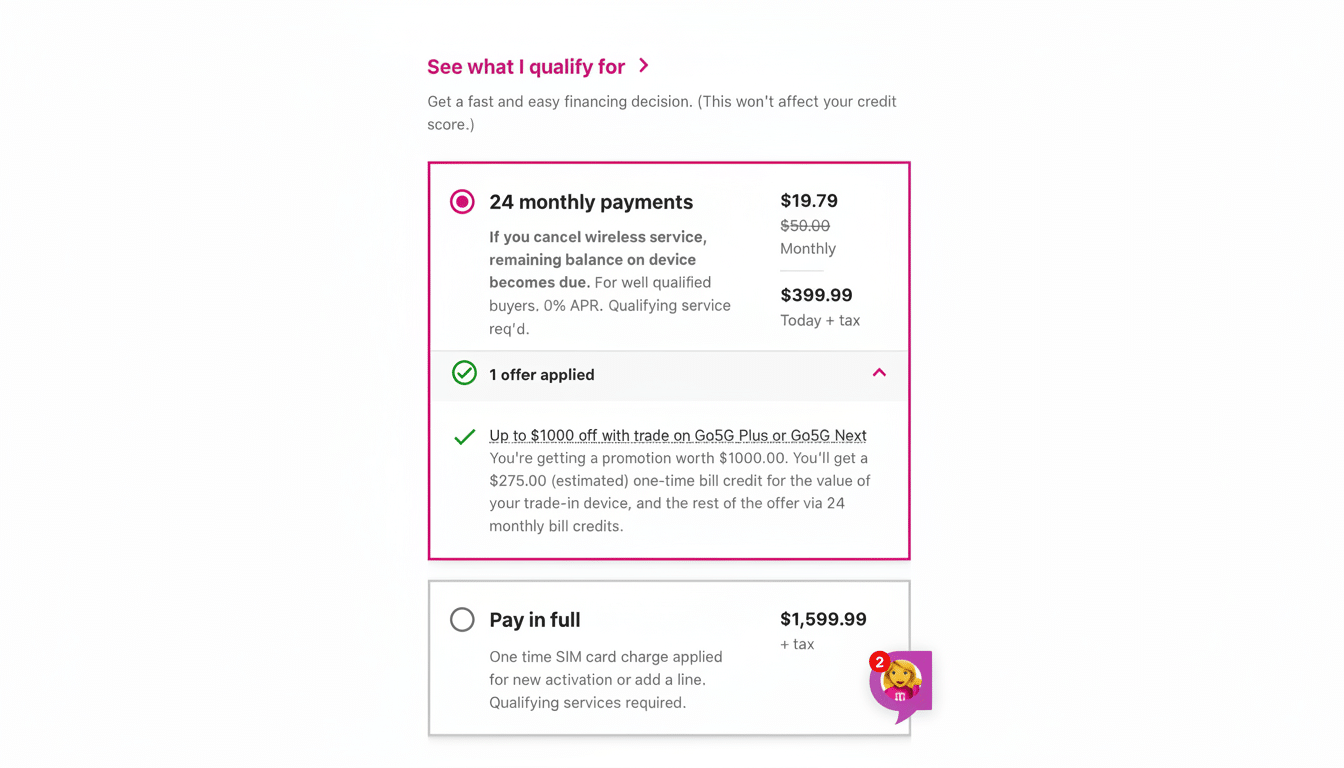

Historically, T-Mobile offers have blended an immediate bill or purchase reduction with recurring credits that offset the device installment each month. Under the reported shift, existing subscribers would see no upfront bump; instead, the entire incentive would be spread evenly across the term as recurring device credits.

- What Is Allegedly Changing in T-Mobile Trade-In Credits

- Why This Could Help Customers With Billing Clarity

- The Catch: Retention and Upfront Value for Customers

- New Versus Existing Accounts: How Incentives Differ

- How To Evaluate A Trade-In Under The New Model

- Bottom Line on the Rumor: What It Means for You

For new customers, the rumor mill points to a split approach continuing for now — an instant credit paired with monthly credits — though some sources suggest T-Mobile could standardize to recurring credits only. Carriers frequently test and iterate on promo structures, so it would not be unusual to see a phased rollout or channel-specific variation.

Why This Could Help Customers With Billing Clarity

Predictability is the headline benefit. A single recurring credit creates a steady bill, reducing the “first-month dip, second-month spike” effect that confuses many buyers when an upfront credit temporarily lowers charges. J.D. Power’s U.S. wireless studies routinely rank price transparency and billing clarity as top drivers of customer satisfaction; this tweak squarely targets those friction points.

It also simplifies personal budgeting. Customers who upgrade on a schedule can map their device costs with fewer surprises, and the math becomes straight-line: a set installment minus a consistent monthly credit for the life of the promo.

The Catch: Retention and Upfront Value for Customers

The flip side is lock-in. Monthly credits generally require the line to remain active and the device to stay on installment; cancel early and any remaining promotional credits vanish, leaving the unpaid device balance due. That dynamic boosts retention — an area where T-Mobile already competes aggressively, posting some of the industry’s lowest postpaid phone churn in recent company filings.

There’s also the matter of immediate value. Consider an $800 promo: under the old split model, a customer might get $250 upfront and ~$550 spread over 24 months (~$22.92 per month). Under the rumored model, the entire $800 appears as ~$33.33 monthly credits, with no instant discount at checkout. Leave after six months and you’ve received just ~$200 in credits versus ~$250 upfront plus ~$137 in prior scenarios.

New Versus Existing Accounts: How Incentives Differ

Acquisition math differs from retention math. Upfront credits lower perceived switching costs and can help close sales — a reason sources say new accounts may still see an instant credit component. For existing customers who already have service, emphasis shifts to lifecycle value and reduced churn, which recurring-only credits reinforce.

If T-Mobile ultimately unifies the policy across all customers, expect it to be framed around consistency and transparency. Competitors have used similar structures for years, and they’re effective at curbing short-term deal-hopping without raising headline prices.

How To Evaluate A Trade-In Under The New Model

Run the math against your timeline. If you keep phones for two years and rarely switch carriers, a larger monthly credit may be just as valuable as an upfront discount. But if you prefer flexibility, the loss of instant value could matter — especially if you anticipate moving lines or paying off early.

Compare carrier offers with manufacturer and retailer trade-ins, which sometimes provide immediate value at checkout. Industry trackers like Assurant’s Mobile Trade-in and Upgrade reports have highlighted rising trade-in participation and steady payout levels in recent years, but the structure — instant versus monthly — can change the calculus for your budget even when headline values look similar.

Bottom Line on the Rumor: What It Means for You

If confirmed, T-Mobile’s shift to all-monthly trade-in credits for existing customers would bring cleaner bills and fewer surprises, while quietly strengthening the company’s hand on retention. For consumers, it’s a trade-off between predictability and upfront cash — a double-edged sword that rewards those who stay put and raises the cost of an early exit.

T-Mobile has not publicly detailed the policy change, and details for new customers remain murky. Until official guidance lands, treat offers carefully, read the promo fine print, and model your total cost through the end of the credit term.