Newly released Justice Department files show that David Stern, a close adviser to Prince Andrew and the behind-the-scenes organizer of the prince’s startup initiative, pitched Jeffrey Epstein on investing in electric vehicle startups during a critical funding window for the sector. The emails and memos detail approaches to Lucid Motors, Faraday Future, and later Canoo, embedding Epstein in the margins of the EV boom even as his legal history made him a reputational risk.

Emails Outline EV Investment Pitches to Epstein

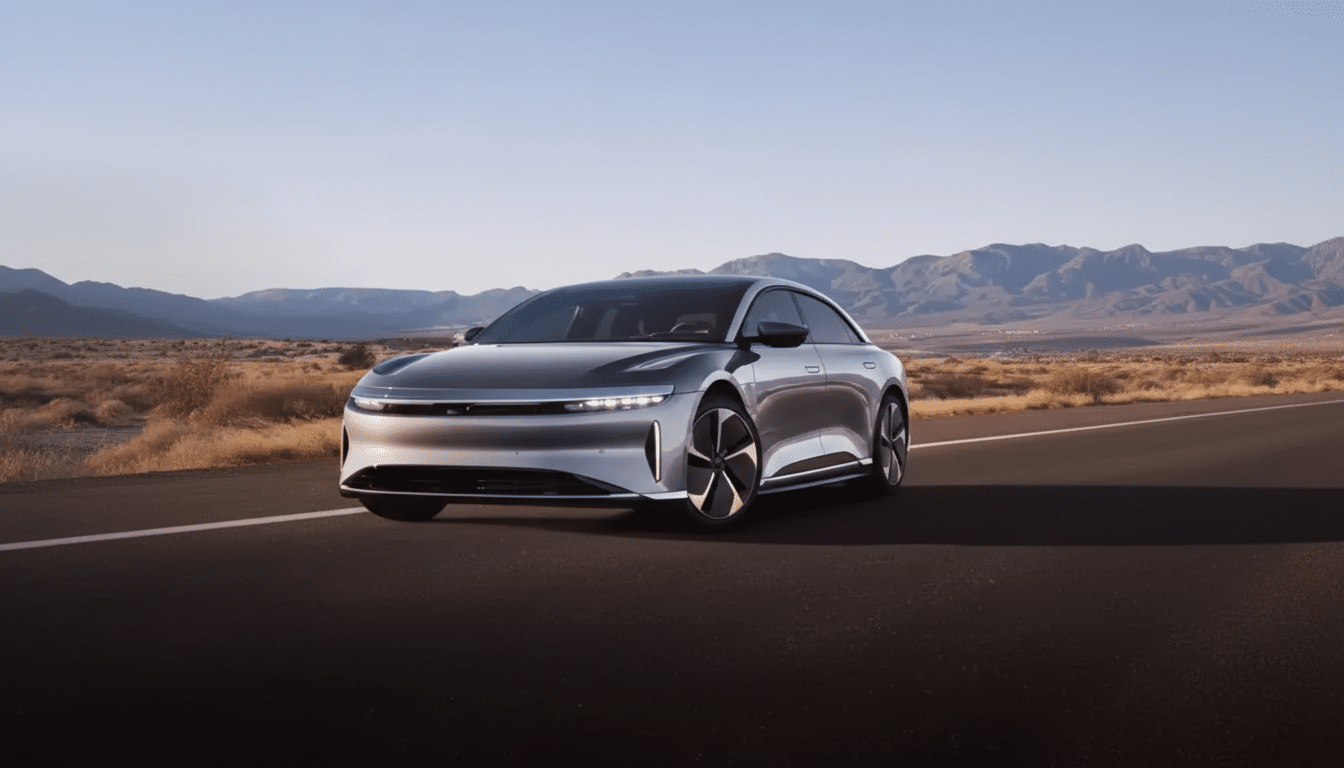

In 2017, Lucid Motors was struggling to close a Series D amid mounting capital needs and a crowded EV field. According to the files, Stern told Epstein he could help unlock the round by prying loose a roughly 30% stake held by Faraday Future founder Jia Yueting, whose control was deterring new money. Stern’s vehicle, dubbed Monstera, circulated a deck proposing to acquire about 32% of Lucid for roughly $300 million, describing the opportunity as a “fire sale” with the option to sell the position once a strategic investor—at the time, Ford—led the round.

The correspondence shows Stern also funneled other mobility deals to Epstein. He encouraged a meeting with Jia about Faraday Future as the company sought rescue financing. Stefan Krause, Faraday’s then-executive hired to stabilize operations, directly appealed to Epstein, pitching a chance to “build a better Tesla,” while emphasizing that Faraday’s cash crunch stemmed from the collapse of Jia’s broader LeEco empire. Later, when Krause left to co-found Canoo, Stern sent Epstein materials on the new venture. Epstein, in a separate 2018 message included in the files, stated he had no direct or indirect interest in Canoo.

Lucid Funding Crunch and the Saudi Lifeline

The Lucid play never materialized as pitched. Ford stepped back, and the EV maker ultimately secured more than $1 billion from Saudi Arabia’s Public Investment Fund in 2018. Regulatory filings show the Saudi fund later repurchased Jia’s shares over subsequent years, consolidating its control. Faraday Future, meanwhile, received a substantial investment commitment from Evergrande affiliates in late 2017 before the relationship unraveled in disputes over funding tranches and governance.

The timing of these pitches tracks the broader inflection point in electric mobility. According to the International Energy Agency, global plug-in sales climbed from roughly 1.1 million in 2017 to around 2 million in 2018, as battery costs fell and legacy automakers ramped EV programs. With capital needs escalating—vehicle programs routinely require multi-billion-dollar outlays—nontraditional financiers and sovereign funds increasingly surfaced in cap tables, creating both lifelines and headline risk.

The ‘Ghost’ Behind Pitch@Palace and Prince Andrew’s Startup Push

Stern’s role in the emails reflects a well-connected operator moving between palace corridors, Wall Street, and Chinese business circles. A German national educated in London and China, he worked at Siemens and Deutsche Bank in Shanghai, chaired China Millennium Capital’s local arm, and founded Asia Gateway, according to biographies included in the documents. The files depict Stern touting ties to prominent Chinese and Gulf figures, including early relationships that later intersected with Canoo’s investor base and prompted national security scrutiny when Canoo went public.

Inside the royal orbit, Stern directed Prince Andrew’s Pitch@Palace entrepreneurship contest and was informally described as a “ghost” for his low public profile. The DOJ materials suggest Stern first approached Epstein in 2008 and, over the following decade, floated a stream of ideas—from a joint China-focused fund (variously called JEDS or Serpentine Group) to bids for European banks and media assets. At times the correspondence is blunt, with Epstein criticizing Stern’s deal prep while Stern referred to Epstein as a mentor and valued “China contact.”

Why the EV Pitches Mattered for Investors and Startups

Even if Epstein did not ultimately invest in Lucid, Faraday Future, or Canoo, the episode enhances the record of his proximity to high-growth technology pursuits right up to his arrest. It also illuminates a dynamic common to the EV surge: intermediaries bundling strategic stakes, distressed sellers, and sovereign co-investors to piece together nine-figure rounds under intense time pressure.

For startups, the allure was obvious. Lucid needed runway for its luxury sedan program; Faraday needed cash to keep the lights on; Canoo sought backers willing to bet on an engineering team with a clean-sheet approach. For investors, the payoff could be immediate—control positions, optionality to flip into a strategic-led round, or discounted access to a segment that, at the time, was outgrowing the broader auto market by double digits. Yet the files underscore the downside: reputational and regulatory risk tied to opaque money, a point governance experts say can complicate future fundraising, public listings, or CFIUS reviews when foreign ownership is involved.

The Bottom Line on Epstein, Stern, and EV Deal Outreach

The Justice Department’s disclosures portray Stern, a key adviser to Prince Andrew, trying to steer Epstein into EV deals during a pivotal moment for Lucid Motors and its peers. The investments did not happen, but the outreach itself is revealing—charting how royal-adjacent fixers, embattled founders, and controversial financiers converged as electrification scrambled the automotive capital stack.