Pickle Robot, a warehouse robotics maker, has recruited Jeff Evanson from Tesla (TSLA) in the company’s first move to get ready for large-scale expansion from pilot program into wide commercial rollouts.

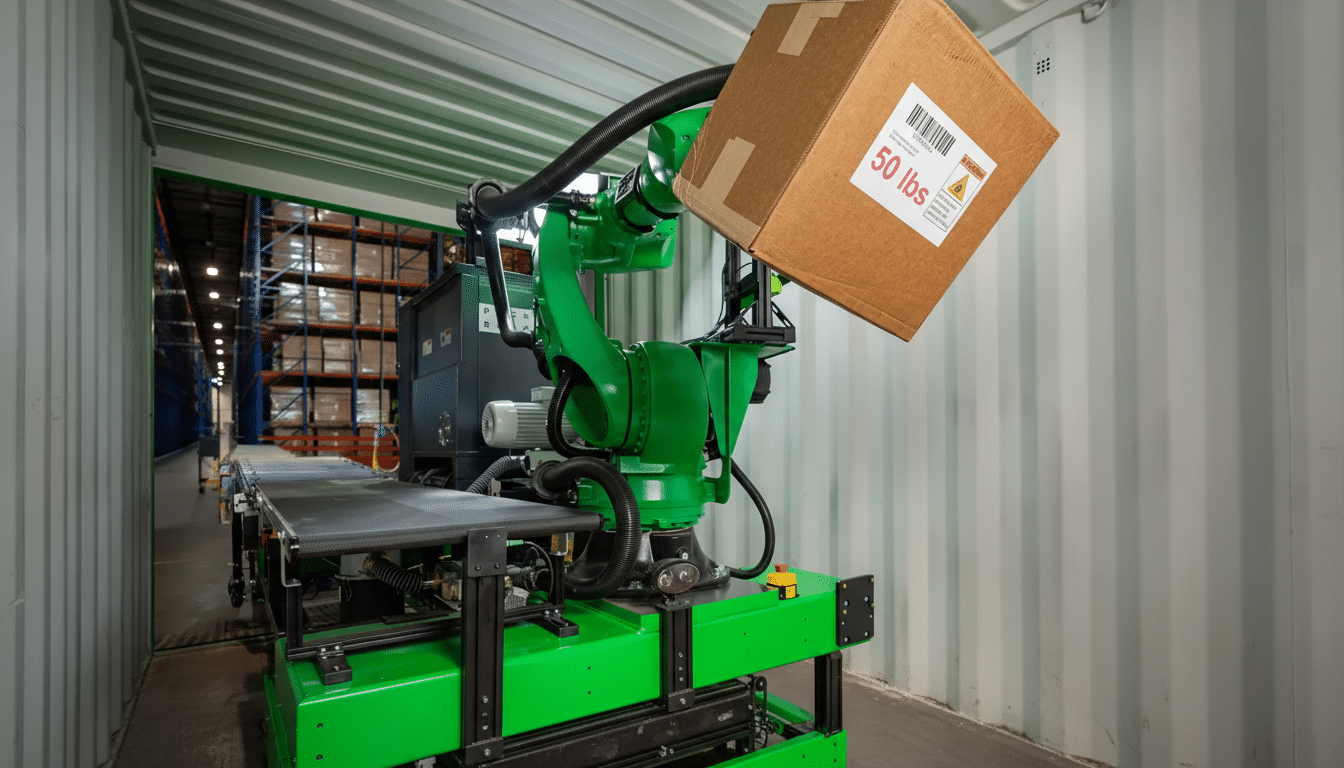

The Charlestown, Mass., startup manufactures mechatronic-emptying systems that are robotic gizmos fit for the task of unloading trailers and containers—one of the most dangerous and labor-intensive roles in parcel hubs. Evanson had been advising the company for a number of months and now joins full time with extensive experience in capital markets, manufacturing scale and investor signaling from his time at Tesla.

Why Pickle Robot Is Hiring a Finance Chief Now

Pickle has raised about $100 million in venture financing to develop AI-powered robots that can sort through the madness of mixed parcels. Bringing in a seasoned CFO at this point indicates that the company is moving from engineering milestones to serial production, multi-site deployments and more complex commercial relationships with carriers and 3PLs.

That transition comes with heavy financial complexity: tooling and contract manufacturing, inventory and working capital management, field service networks and potentially creative financing—like via leases or usage-based models—to alleviate the capex burdens of its customers. The distance between a handful of pilot robots and hundreds in the field is in units, but also supply chain discipline, uptime guarantees, margin math.

Public comps illustrate the importance of being big in finance. Symbotic, an automation provider to large retailers, has shown it can get more profitable as overhead costs drop and as volume grows (and service revenue scales), its earnings releases say. Studies of warehouse automation from LogisticsIQ, for example, point to this as a market expanding into the tens of billions over a couple of years, but profitability is on the side of those that can command deployment velocity and system uptime.

What Jeff Evanson Brings From His Years at Tesla

Evanson was vice president of global investor relations and strategy at Tesla, working through several capital raises, significant manufacturing ramp-ups and high-stakes product launches. Those who have worked with him attribute a mix of operational pragmatism and capital markets fluency—skills that are more valuable as robotics startups progress from promising demos to industrial-grade fleets.

At Tesla, he collaborated closely with the executive team on equity and debt financings that raised capital for new vehicle programs and strategic acquisitions, according to company filings and investor presentations from the time. Translating complex technical and execution risk into a convincing financial story was part of the task; Pickle will almost certainly lean on that same playbook as it scales production, develops service operations and mulls longer-term options like strategic partnerships or public-market readiness.

UPS Partnership Could Add Scale and Execution Pressure

The move comes after reporting that UPS will be making a major expansion with Pickle. The shipping giant, known for delivering packages on time, is investing $120 million to buy 400 robots, which will start working in coming peak seasons. Pickle was not immediately available to comment on the report but confirmed UPS had been a customer.

If the deal was struck, such a large commitment would make Pickle one of the premier providers on the unloading automation side, by installed base. It would also require close coordination between manufacturing, logistics and field operations to meet delivery schedules and performance SLAs across numerous hubs.

The competitive context is intensifying. Carriers and providers of logistics services from around the world are also trying out and rolling out systems for unloading trailers and handling parcels from the likes of Boston Dynamics, Dexterity AI, Plus One Robotics and others. The capability to win at scale will depend on throughput per robot, gentle handling without damaging goods, the recovery behaviors when dealing with odd-shaped items, and sustaining uptime through peak surges—all places where financial stewardship and operational telemetry collide.

Why Trailer-Unloading Robots Are Gaining Real Traction

Trailer unloading is still a stubborn pinch point in automated facilities. The work is repetitive, abusive on the body and difficult to staff consistently. Material handling is listed as the cause of nearly a third of all warehouse injuries and the Bureau of Labor Statistics has consistently reported higher rates of warehousing injuries compared to its private-industry average. Against that backdrop, and the increasing number of parcels counted by the Pitney Bowes Parcel Shipping Index, demand is spiking for automation to take humans out of the trailer mouth and push them into higher value, safer positions.

State-of-the-art pick-and-place robots with unloading tasks can use depth cameras, force sensing and model-driven grasp policies to pick up boxes of different sizes, materials or labeled content—even when these are irregularly stacked. Going from supervised pilots to autonomy-first deployments comes down to software learning curves, and the “how” most likely depends on robust end-of-arm tooling. As volumes ramp, the cost of components for sensors and compute generally plummets, benefiting unit economics—another lever a CFO will be manicuring.

What to Watch Next as Pickle Robot Scales Operations

Key milestones will be when the company shows production cadence, improvements in time-to-install and statistics on field performance like picks per hour and sustained uptime from live hubs. Finance terms (sales, lease or consumption model) will affect how revenue is recognized and cash flow required. Customer concentration will need to be considered from a strategic perspective if one carrier makes up a majority of units.

To Pickle, Evanson’s hiring is a wager that the next phase of the business has less to do with proving their robot can unload a trailer, and more to do with proving the company can do so hundreds of times over, on time, at predictable unit economics. It’s in warehouse robotics where companies graduate from clever technology to lasting businesses.