OnePlus says it isn’t shutting down. That’s the headline. Yet the caveats tucked into recent corporate statements, alongside chatter about canceled devices and limited launches, explain why Android fans still feel uneasy. Even if the brand is not going away, the conditions around it are shifting in ways that could ripple across the entire Android ecosystem.

Denials Are Not the Whole Story Behind OnePlus

Reports surfaced that OnePlus was being dismantled, followed by an unusually narrow rebuttal from the company emphasizing ongoing operations and after-sales support. That reassured some buyers—but notably sidestepped clear commitments about product roadmaps.

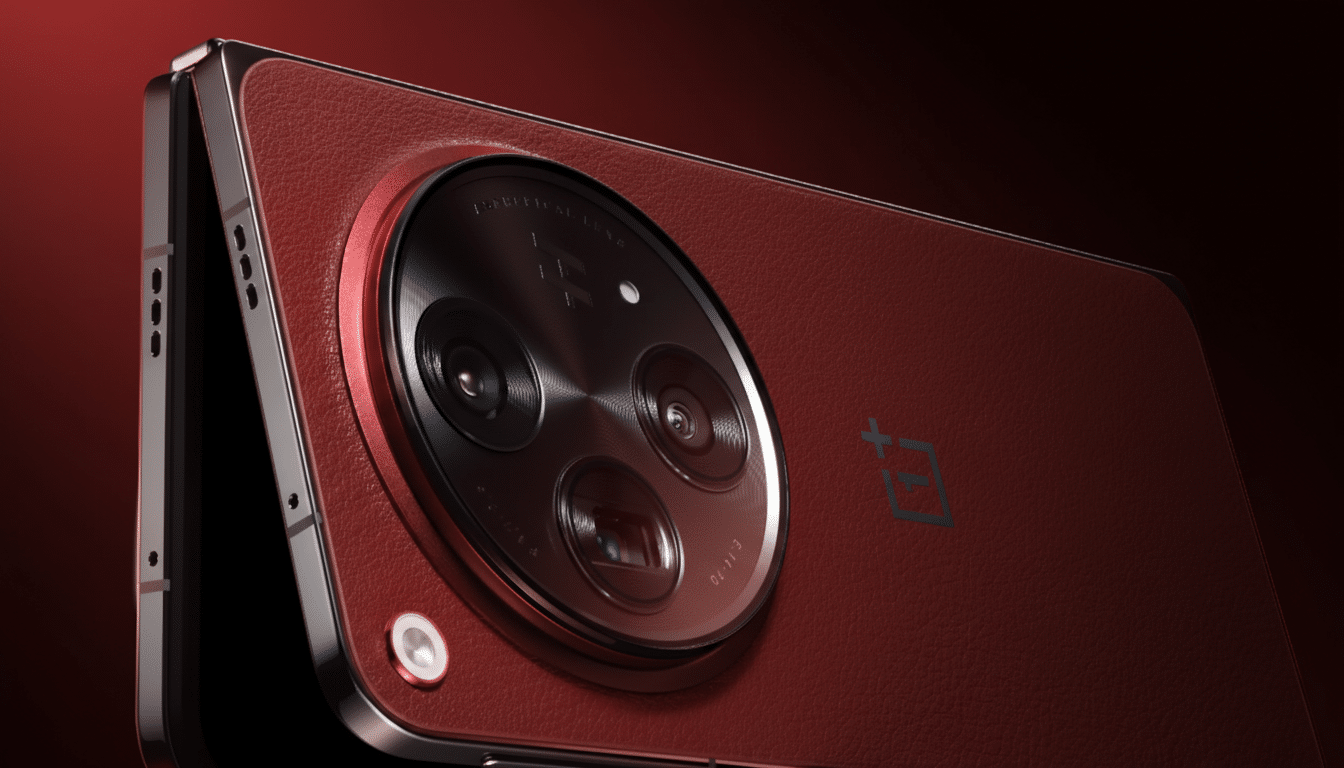

At the same time, industry watchers have pointed to internal turbulence: rumors of the OnePlus Open 2 being shelved, whispers that “15s” derivatives were abandoned, and claims that the next flagship might skip a full global rollout. None of this amounts to a death certificate, but together it suggests a company re-evaluating scope, budgets, or both.

Context matters. OnePlus sits under OPPO, and reorganizations inside parent groups often cascade into portfolio reshuffles. When communications grow cautious, investors and consumers read between the lines—fairly or not. That’s why anxiety lingers even after a denial.

Why OnePlus Still Matters to the Android Ecosystem

OnePlus has repeatedly served as a catalyst. Consider batteries: while many mainstream Android phones still hover around 5,000mAh using traditional chemistries, OnePlus pushed silicon-carbon cells into the spotlight with capacities north of 7,000mAh in recent models. That’s not a spec-sheet stunt; it can alter real-world endurance and battery longevity curves.

Charging is another area where OnePlus forced the pace. The company normalized 65W and then 80W–100W wired charging long before conservative rivals budged. That pressure has helped shift consumer expectations and, over time, nudged competitors to accelerate their own charging roadmaps, even if some still cap speeds for thermal or regulatory reasons.

Go back a bit further and you’ll find more ripple effects: the OnePlus 7 Pro helped popularize 90Hz displays; the alert slider became a defining ergonomic flourish that competitors have since flirted with; earlier OxygenOS builds earned praise for clean, low-latency execution of Android. Even when OnePlus stumbled—bugs, feature regressions, design drift—the competitive tension it created was healthy for users.

The US Market Has the Most to Lose if OnePlus Fades

The US smartphone market has a choice problem. According to Counterpoint Research, Apple and Samsung together routinely account for well over 70% of shipments, leaving the remaining slice to everyone else. In practice, that means Android buyers mostly toggle between Samsung, Google, and a small handful of challengers.

Many of the world’s most aggressive Android innovators—OPPO, Xiaomi, HONOR, and vivo—don’t sell widely in the US. OnePlus, therefore, carries outsized weight as a fourth or fifth option capable of competing on specs, performance, and price. Remove or weaken that option and the duopoly gets even cozier, which historically leads to slower iteration and firmer pricing.

Alternatives exist, but with caveats. Nothing’s phones are officially available but constrained by network support and distribution. ASUS has scaled back its smartphone footprint. Smaller niche players can’t match nationwide carrier relationships. OnePlus, with years of US channel experience, is uniquely positioned to keep pressure on the front-runners.

Software Promises and Trust Gaps Shape Buyer Confidence

Another reason the worry feels rational: software support standards are rising fast. Google and Samsung now advertise up to 7 years of OS and security updates on current flagships. OnePlus has improved its policies, but most models still trail that benchmark.

Add to that the ongoing identity crisis of OxygenOS after deeper integration with ColorOS. Some users appreciate the added features; others say the brand lost the snappy minimalism that defined it. When update cadences slip or UX priorities feel muddled, confidence erodes—and rumors hit harder.

What to Watch in the Months Ahead for OnePlus

Three signals will tell us where OnePlus is headed.

- Clarity on the global strategy for its next flagship: a broad release would calm nerves, while a regional rollout would suggest retrenchment.

- The foldable roadmap: whether an Open successor appears—and where—will indicate appetite for premium R&D.

- Software commitments: firmer timelines, longer support windows, and visible OxygenOS polish would rebuild trust faster than any slogan.

None of this means OnePlus is on the brink. Denials can be true, and corporate restructuring can be healthy. But given OnePlus’s track record of sparking industry shifts—faster charging, bigger batteries, smoother screens—its stability is disproportionately important for Android users, especially in markets starved for choice.

In short, OnePlus isn’t dead. The concern isn’t melodrama; it’s a rational response to mixed signals from a company whose presence keeps the Android world sharper, faster, and fairer. Losing that pressure would be the real problem.