Netskope will be testing a delicate IPO window for cybersecurity, coming hot on the heels of Rubrik and with the same lead backer, Lightspeed Venture Partners. In a market where security startups more frequently sell than float, the pairing remains a rare back-to-back exit for a single venture firm and a strong nod to the potential of cloud-first defense platforms.

Why this list is important for security

IPOs out of the gate in cybersecurity have been relatively scarce, given the size and resiliency of the sector. Many of those high-growth names have instead taken the acquisition route rather than the roadshow; even Wiz, one-time category rocket ship, decided to had be bought by Google. The most-recent wave of significant IPOs included SentinelOne in 2021 and Rubrik, emphasizing how particular the IPO window has been for security vendors.

Netskope’s arrival is also a referendum on Secure Access Service Edge (SASE), the architectural model designed by Gartner, in which networking and security are consolidated in the cloud era. While businesses still pull forward effort on remote work and SaaS, both Gartner and 451 Research analysts have been following ongoing demand for SASE and related services that secure web, cloud and private apps without traditional perimeter appliances.

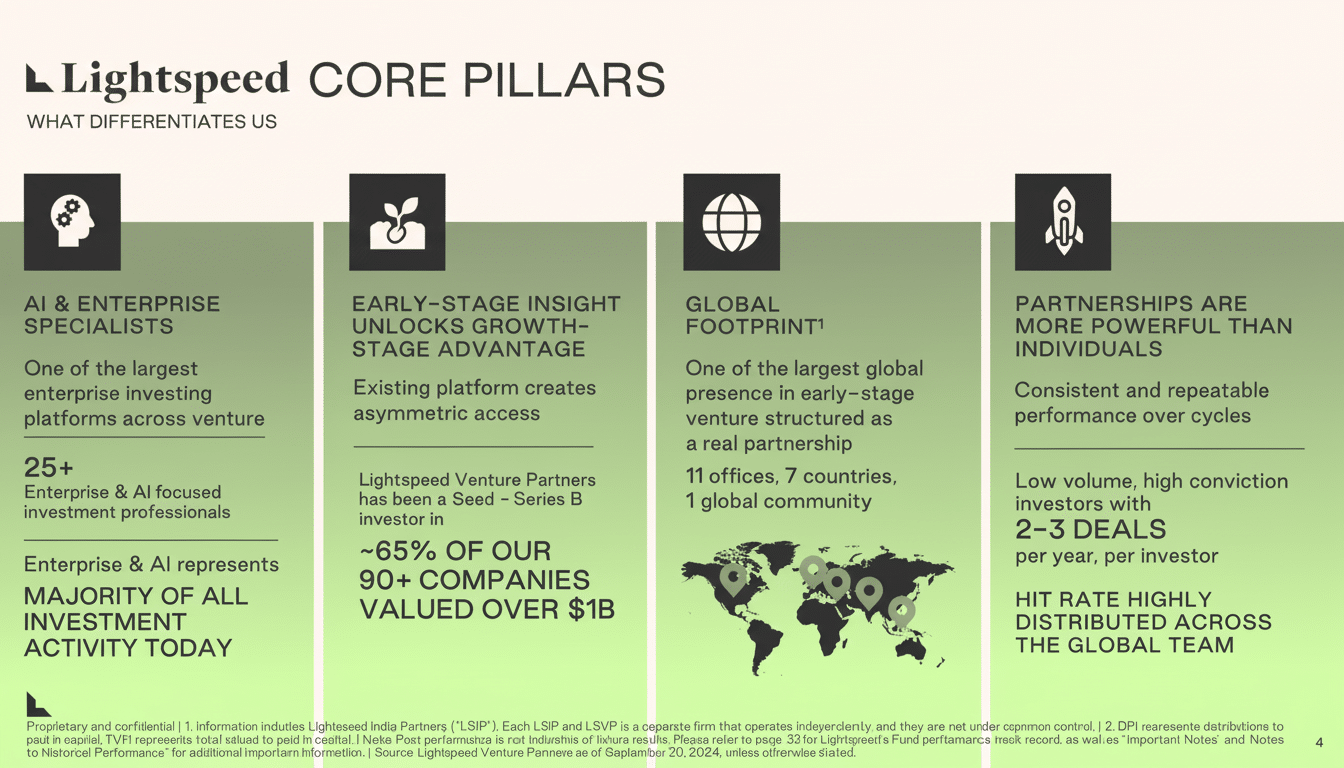

Lightspeed’s double wins: Rubrik and Netskope

Lightspeed also became a significant shareholder in the two companies. It owned 23.9% of Rubrik when it went public at a valuation of about $6.6 billion and 19.3% of Netskope, according to the updated S-1. At Netskope’s proposed price range of $15 to $17 a share, Lightspeed’s stake would be valued at roughly $1.1 billion on paper at the high end.

The firm first invested in Netskope in 2013, when it led a $21 million Series B and remained involved through several rounds. Another big holder is ICONIQ Growth, which owns 19.2%, and Accel, which is near 9%. Concentrated ownership tilted more to seasoned growth investors bodes well for post-IPO stability but also sets up a meaningful lock-up release to monitor once insider shares hit the market.

Netskope by the numbers and position

Netskope is most-metadataed for its SASE functions, such as a secure web gateway and firewall as a service for protecting traffic across cloud and remote sections. Its closest public comparables are Zscaler and Palo Alto Networks, both of which have been moving toward cloud-delivered security and zero trust architectures.

Revenue for the first six months of the year increased to $328.5 million from $251.3 million a year earlier, and net loss narrowed to $169.5 million from $206.7 million, according the company’s filing. Therein lies the key to today’s market, where investors are according premium-multiples to security names evidencing durable growth with a credible path to operational leverage.

Netskope’s cap table is also representative of the late-stage capital dynamics of recent years. The company was valued at $7.5 billion in 2021 when it announced a $300 million Series H led by ICONIQ Growth and later issued a $401 million convertible note in 2023. Those financings fueled the ability to expand platform breadth and global go-to-market, but they also put a high watermark against today’s public valuation test.

Valuation check and the IPO barometer

At a hypothetical $6.5 billion valuation, Netskope would be part of the throng of venture-backed estabs listing under their final private marks, a non-ordinary result in this cycle. Recent companies include businesses like Chime and Hinge Health. Still, investor appetite isn’t uniformly tepid: a few new listings, like Figma and Circle, have traded strongly upon debut, seemingly pointing to a market that rewards clear category leadership and lean growth.

When it comes to security in particular, there’s effectively a strong backdrop from public comps. Big buyers are continuing to merge vendors to simplify operations, and cloud-delivered controls remain priority spend while IT budgets are trimmed. The open question when it comes to Netskope is what mixture of growth, gross margins and sales efficiency it can maintain — and how close it can do that to the best-in-class cloud security precedents.

What to Watch After the Bell

So beyond first-day trading, monitor retention metrics, upsell from initial SASE footholds, and momentum with large enterprise accounts where multi-year commitments power long-term durability. Any discussion of how fast we convert that convertible note, the cadence of operating cash flow and the ramp of international expansion will also be telling for medium-term profitability.

Rubrik gives us a close yardstick post-I.P.O.: Investors also have preferred security names that could combine platform expansion with disciplined sales productivity. If Netskope lands those numbers, they could go down as the pair of Lightspeed offerings that signaled the reopening of the cybersecurity-IPO market — selectively, but in earnest.