Solo GP Neil Murray has just sealed $6 million for The Nordic Web Ventures, placing another house-sized bet on pre-seed in the Nordics with a focus on AI-native software, robotics and deep tech.

The Copenhagen-based investor writes the first check to technical founders and has kept his fund intentionally small to act fast while aligning returns with performance instead of fees.

Fund III will make initial investments of about $200,000 and plans to invest in 30 to 35 companies. Murray’s belief is that it pays to back Tier 1 founders early over maximising ownership in a less compelling opportunity—one, ironically, that mirrors Europe’s increasingly competitive pre-seed landscape in the region’s most engineering-heavy cluster.

What Fund III Will Support across AI and Robotics

The focus is AI-native products, industrial and healthcare robotics, and deep tech that has an obvious path to defensibility. A cadence of investments in teams building automation for logistics, autonomy and perception stacks, and domain-specific foundational models where Nordic industry data can offer a moat. A fund chasing founders with research who can also credibly go-to-market in sectors that have complex buying cycles, within a market already renowned for disciplined product development.

This thesis has a footing in the region. Denmark’s robotics cluster is already breaking ground with commercial successes in collaborative robotics and service robots, Finland and Sweden harbour world-class signal processing and embedded systems talent, while Norway’s maritime and energy tech landscape generates precious applied data sets. That combination creates the opportunity for AI-driven robotics to leave the realm of pilots and begin being deployed in production scenarios.

Why a Solo GP’s Small Fund Matters for Founders

Murray has always claimed that staying small is not a bug, but a feature. A small fund allows a solo GP to make quick, conviction-led decisions and have the time available to roll up their sleeves at the exact times when it matters most: iterating on the first product, pricing things in, and landing that flagship enterprise customer. It also sidesteps ownership targets and pacing pressures that larger funds can attract, taking them further from the first innings.

The approach matches up with larger data around micro-VC performance. Studies by Cambridge Associates and PitchBook have indicated that sub-$100 million seed funds can generate robust TVPI and DPI if they are able to achieve disciplined entry price levels while avoiding style drift. In Europe, Dealroom has seen an increasing share of pre-seed rounds led by solo GPs and specialist micro-funds—particularly in ecosystems with high technical founder density where valuations have stayed rational.

LP Base and Early Results from the Third Fund

Backers for Fund III include institutional LPs like Allocator One and Pacenotes, as well as noted seed investor Christoph Janz. Founders from Kahoot!, Pleo and operators from Meta and Google have also signed on—a commitment that usually materializes in practical support around hiring, distribution and pricing. Murray says that founders in his first two funds have re-upped and that he has already returned more than half of the capital raised across Fund I and Fund II, which is a pretty positive signal at this stage of a micro-fund’s life.

The fund will lead or co-lead seed rounds, with follow-on reserves for winners. Given the size of the fund, follow-ons will be very focused, supported by co-investment from specialist seed and Series A firms when PMF is proven.

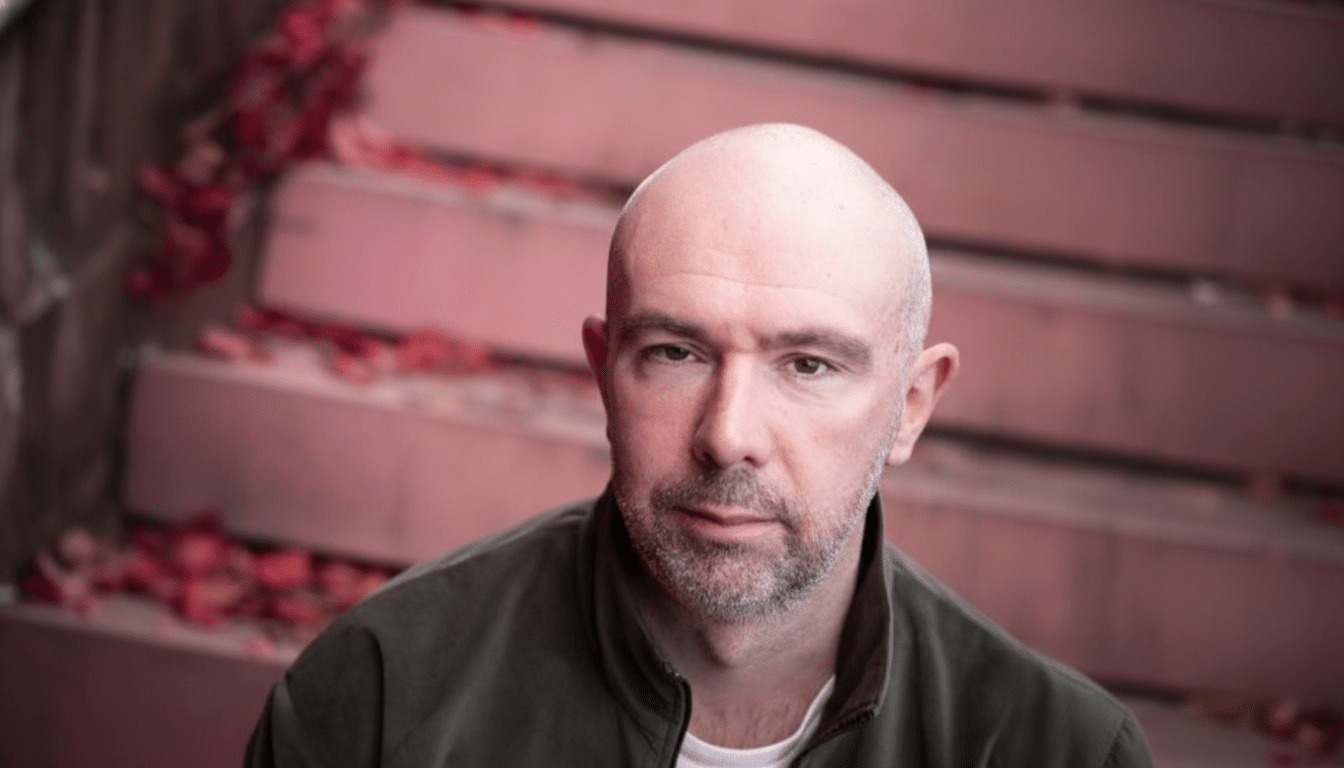

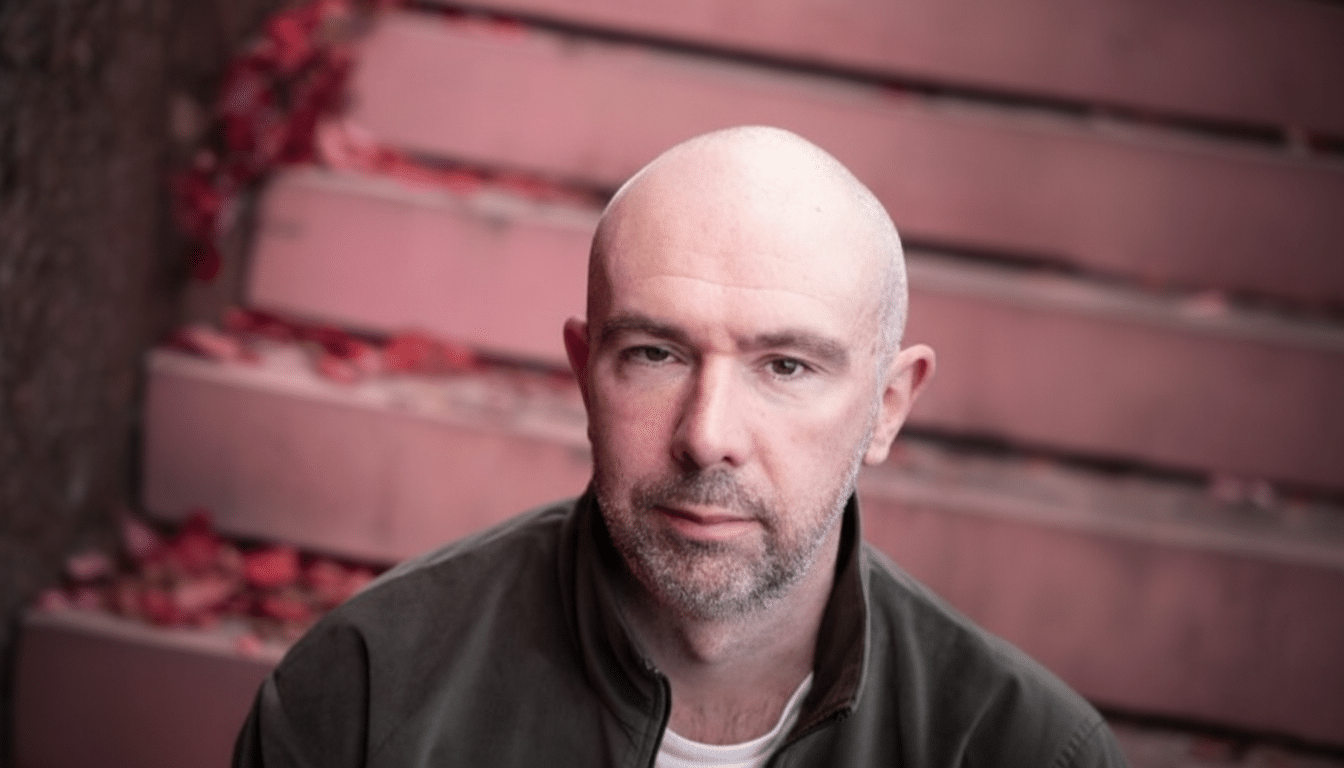

From Ecosystem Analyst to Solo GP in the Nordics

A UK expatriate, Murray relocated to Denmark and started documenting the region’s startups with The Nordic Web, a research-focused publication that tracked funding patterns, notable exits and the emergence of new operators. The data work he has built formed a group of founders and investors that organically progressed into investing; Fund I raised $500,000 in 2017, followed up by its second fund at a larger size and now Fund III. The throughline has been to focus on those who received the earliest checks and to limit geography.

The Nordic Edge in Deep Tech, AI, and Robotics

The region continues to outperform in venture returns, with Dealroom citing one of the densest unicorn populations per capita in the world and Europe-topping VC investment per citizen. Strong public research, high R&D spend in the likes of Sweden and Finland, successful universities such as DTU, KTH, Chalmers and Aalto: all create a constant stream of technical founders. Expertise in manufacturing, a design-first product ethos and a calm, methodical build culture all enhance its execution in categories where reliability and safety count as much as speed.

That infrastructure is particularly important as AI systems move from the whiteboard to factories, hospitals and warehouses. The presence of corporate buyers in the region, willing to pilot with local startups, makes the Nordics a great on-ramp for AI-powered robotics, computer vision and industrial software that can scale across Europe and the US.

What Comes Next for The Nordic Web Ventures Fund III

Deployments will proceed at a steady pace in Denmark, Sweden, Finland, Norway and Iceland, though most checks will occur around Copenhagen, Stockholm and Helsinki. Founders can count on quick decisions, assistance with early customer development and introductions to domain-specific angels and seed funds. If the first two funds are any guide, Murray’s third is aiming to capture the next compounding wave of Nordic breakout companies—this time with AI and robotics at their heart.