Europe’s startup engine is back to humming. More than 10 venture-backed companies across the continent have entered the so-called $1 billion valuation club this year, pointing to a selective but undeniable recovery in late-stage financing and a pivot to sectors where Europe’s research depth and regulatory tailwinds count.

The new cohort is not a clone of the last boom. Mega-rounds still are fewer and more formed, but capital is focusing around startups that have dug wide moats in AI, dual-use aerospace and defense, privacy-preserving compute and next-generation health. Dealroom, PitchBook and Atomico’s State of European Tech have all highlighted this shift in sector leadership.

Where the herd is increasing

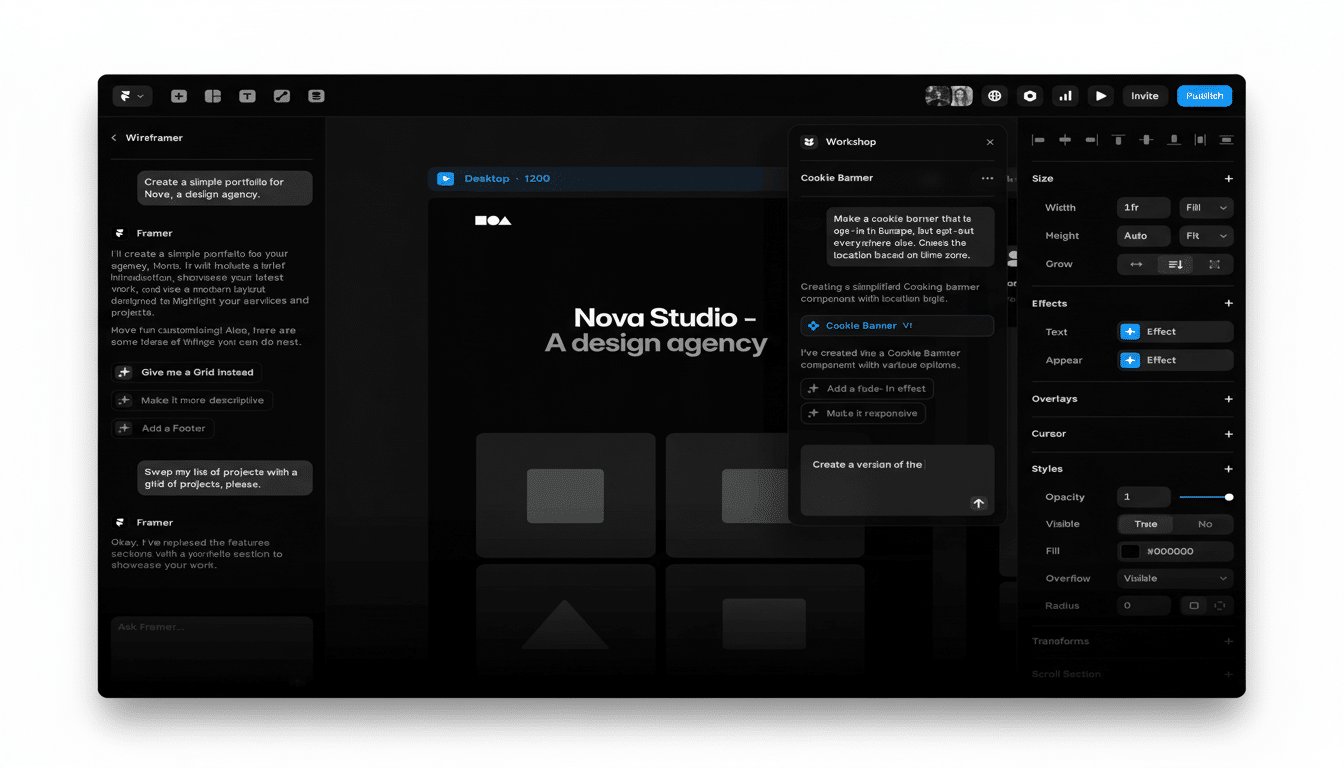

AI is the headline driver. Framer, a design-forward website builder, hit a $2 billion valuation with product-led growth and an enterprise push. Conversational automation upstart Parloa came in at $1 billion, and, finally, the workflow tooling vendor Tines passed the line at $1.1 billion as it expanded beyond security to include a broader swath of the engineering and ops world. Early-stage standout Lovable, an AI coding upstart from Sweden, skyrocketed to a reported $1.8 billion valuation in its first year of life.

Deep tech and privacy keep pace. Finland’s IQM became a unicorn by marrying quantum hardware with a cloud platform, demonstrating some of Europe’s advantages in physics and compute. France’s Zama, which is centered on homomorphic encryption, vaulted beyond $1 billion by demonstrating demand for privacy-preserving AI — a subsector aligned with the continent’s regulatory stance.

Dual-use aerospace and defense is having a moment, driven by procurement and strategic investors. Quantum Systems from Germany is a unicorn that develops scaling autonomous drones in collaboration and funded by Hensoldt and Airbus Defense and Space. Clinging on to a unicorn throughout last week was Portugal’s Tekever, which announced the completion of a funding round with a valuation of £1 billion or more, which was backed by the likes of the NATO Innovation Fund and Baillie Gifford as well as the announcement of a £400 million UK investment plan, while another one of last week’s success stories, Germany’s Isar Aerospace, graduated to unicorn status through a large convertible, highlighting market risk taking in non-traditional last PRD structures in capital-intensive sectors.

Healthcare and consumer also achieved breakout status. Isomorphic Labs, which is based in London, raised $600 million to assist in rewiring drug discovery with A.I. The Swedish preventative health company Neko Health, where momentum propelled the company to $1.8 billion on full-body scanning clinics. In biotech land, Verdiva Bio’s monster Series A instantly minted a unicorn as it pushed an oral GLP-1 prospect forward. Culture-tech even made the list: Mubi, which proved that curated streaming can still extract growth capital, joined the club at $1 billion. And in climate, the U.K. energy company Fuse Energy was one of the year’s stealth unicorns, The Times reported.

Why now: capital, policy and procurement

Three forces are at work. For one, late-stage capital has come back selectively. Growth funds and crossover investors are cutting checks, but they are demanding efficient growth, clear unit economics, and, increasingly, near-term paths to profitability. According to PitchBook data, there were fewer blockbuster rounds, but stable activity concentrated in market leaders.

Over 10 European startups join unicorn club Image : TiesDB Over 10 European startups join unicorn club TiesDB over 3 years ago Berlin-based TiesDB joined the unicorn club this week, further adding to a list growing bigger; the number of European tech startups that are now worth over $1bn.

Second, Europe’s policy architecture is now, for the first time in this crisis, a tailwind. The NATO Innovation Fund has spurred dual-use investing, and the European Investment Bank remains the anchor of deep-tech credit, and equity initiatives. Strategic investors, from defense primes to cloud and semiconductor players, are hungrier than in previous cycles, increasingly participating in or even leading rounds in frontier tech.

Third, deal design has evolved. Convertibles, milestone-based financing and inside-led extensions are commonplace, allowing companies to raise significant dollar amounts without the headline-grabbing valuations. This pragmatism is seen in the Isar Aerospace convertible and multiple insider-led rounds in AI.

Geography: the U.K., Germany and the Nordics are in the lead

Unicorn building is still concentrated but increasingly diverse geographically. The punets-and-donets-led U.K. spawned AI-first leaders in Isomorphic Labs, and witnessed energy and media entries via Fuse Energy and Mubi. Germany piled up wins in aerospace and AI with Isar Aerospace, Quantum Systems and Parloa given its industrial depth and strong university pipelines.

The Nordics keep punching above their weight: in Finland, IQM; in Sweden, Neko Health and Lovable — all represent the Nordic region’s compentence in translating research into product. Zama in France underscores the growing importance of the cryptography and AI safety talent pool in Paris, while Tekever in Portugal demonstrates how Iberia’s dual-use ecosystem is maturing.

Caveats and what to watch next

All unicorn rounds are not created equal. Some of the offerings have structure, investor-friendly terms or heavy secondary components. The unicorn is not an exit; the companies will still need to have durable gross margins, a predictable go-to-market motion and, increasingly, a path to profitability.” The exit window is still spotty, so secondary liquidity, and M&A, will be important.

Still, the pipeline looks strong. Expect more unicorns in AI infrastructure and agents, autonomy and defence software, privacy-preserving compute, quantum-adjacent tools and energy flexibility. Amid demand driven by procurement and world-class R&D spinning out of places like the Technical University of Munich, Europe’s new unicorn factory looks leaner, more technical, and better suited to creating long-term value than it was during the last hype cycle.