Luminar’s biggest automotive customer just slammed the door — at absolutely the worst possible time.

Swedish automaker Volvo has canceled a five-year-old supply deal and pulled back from future plans, escalating a clash that comes as the lidar maker warns investors it may need to file for bankruptcy protection due to loan defaults and a cash crunch.

Volvo Pulls the Plug on Iris for EX90 and ES90 Models

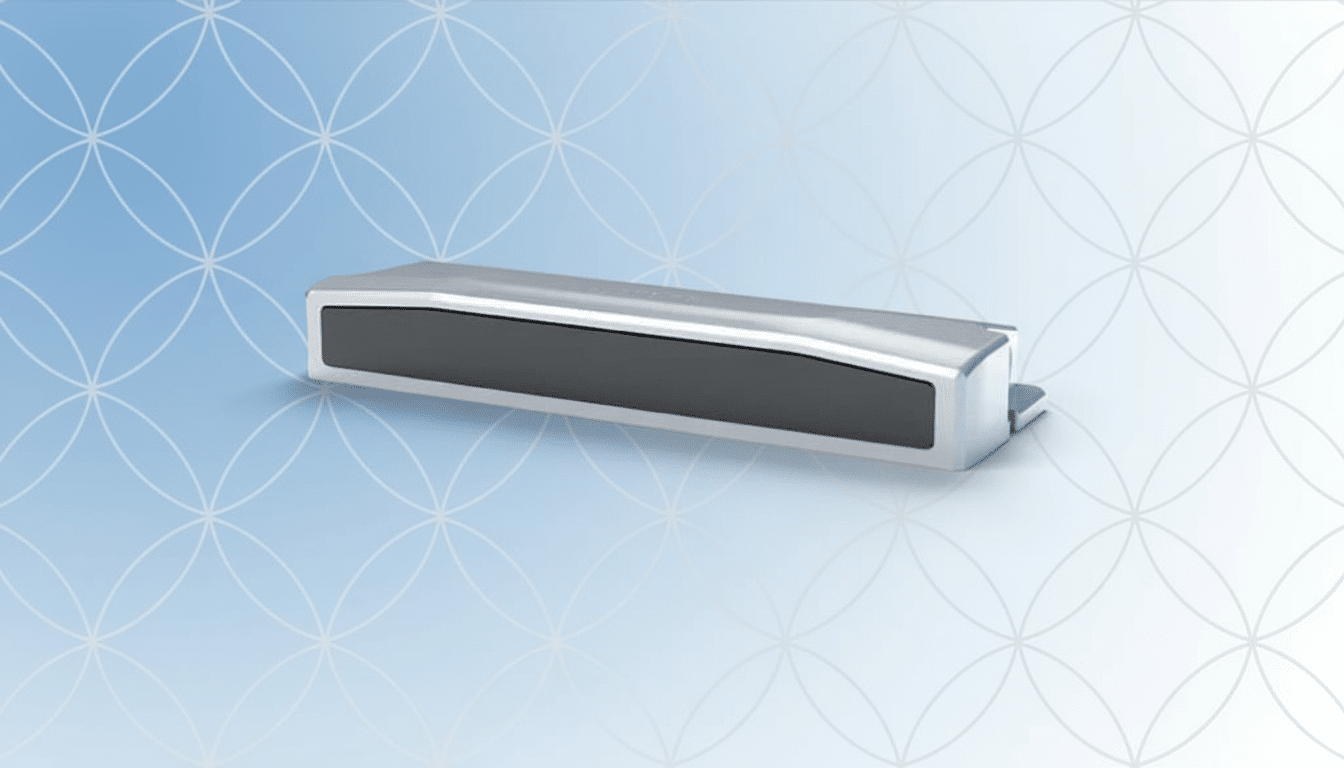

In regulatory filings, Luminar has recently stated that Volvo is no longer planning to make standard its “Iris” lidar technology for the EX90 and ES90, effectively cutting off what had been the company’s leading production program validating its technology on public roads. Volvo also pushed back a decision on using Luminar’s next-generation “Halo” sensor for future cars, reducing near-term visibility around volumes and revenue.

Luminar countersued, filing a suit alleging significant damages, and suspended additional Iris commitments to Volvo while the two sides work out their differences. The impact spread swiftly: Luminar paused spending related to the Volvo-bound units, and its contract manufacturer accused it of a breach of contract after that pause, the company said in its filing.

How the Volvo–Luminar Partnership Is Unraveling

The split is sharp in part because the two companies were surprisingly aligned. Volvo was an early investor in Luminar and helped port the Florida-based startup to production programs, offering credibility as Luminar sought to go public in 2020 through a SPAC merger. This, in turn, led to Luminar’s long-range lidar serving as the foundation of Volvo’s safety narrative and highway automation goals and EX90 branding. Iris was core hardware for high-level driver assistance.

But concentration risk has always hounded Luminar’s strategy. And despite marketing victories on other fronts, Volvo was still its anchor account. That single-customer exposure can become existential when automakers recalibrate product plans or suppliers trip up on cost and manufacturability. That liability has played out in real time.

Financial Stress and Governance Chaos Deepen at Luminar

The commercial stumble comes as Luminar grapples with rising financial pressure. The company has recently defaulted on multiple loan agreements, and confirmed that, if a settlement was not reached beforehand, declaring bankruptcy was an option. In an effort to conserve cash, Luminar slashed about 25% of its workforce a year after trimming about 20% and transitioning to outsource sensor production in order to drive down unit costs.

Strategic choices are also on the march. Luminar is considering selling the business or some of its assets. A possible bidder may be founder Austin Russell, who resigned as CEO this year after an investigation was launched by the board into whether he had violated the company’s code of conduct. In a separate filing, Luminar disclosed it is under investigation by the Securities and Exchange Commission, further muddying the waters for creditors, customers and would-be acquirers.

The news is grim for the equity holders. Lidar-wielding fellow SPAC peers have grappled with similar pressures — one-time sector leader Velodyne combined with Ouster to consolidate costs, and Innoviz, among others, has pushed back a revenue ramp or two as programs slip. In this world, debt is usually king and shareholders can be overly diluted in a restructuring.

What It Means for the Lidar Race and Automaker Strategies

“It’s a good sign that automakers are waiting to see where exactly this technology falls out before they choose who should be their hardware partner and software partner,” Otto said.

Volvo’s move comes amid a broader industrywide retrenchment, in which automakers are less inclined to hardwire a lidar supplier into mass-market trims until cost, reliability and software stacks can be proven at scale. Many OEMs now favor optional packages along with a multi-sourcing strategy to de-risk and preserve pricing pressure. The matrix of decisions includes sensor range and resolution, but also thermal performance, cleaning systems, ISO 26262 safety compliance and unit economics under $500 — goals that remain a stretch for many long-range units.

For Volvo to re-source hardware would be nontrivial. Changing lidar suppliers mid-program can require new validation, durability testing, and software re-integration, usually taking up to 12–18 months or more depending on the scope. Volvo has already had software-related delays in the start of sales on its major models; a hardware change could make that cadence more challenging. On the regulation side, Euro NCAP’s latest protocols incentivize thick sensing stacks, but those credits rely on a stable supply chain and demonstrated performance — not just spec sheets.

Meanwhile, Chinese competitor Hesai has shown manufacturing scale and robust shipment growth despite dealing with trade and regulatory headwinds from the U.S. European suppliers such as Valeo still have inroads with premium OEMs. Luminar must keep marquee deployments as it has to justify its long-distance architecture and keep cost curves pointing downward.

What to Watch Next as Luminar Faces Legal and Financial Risks

The key near-term milestones are any forbearance or standstill agreement with lenders, clarity on the sale process and possible debtor-in-possession financing if a court process begins, as well as whether arbitration with or litigation against Volvo goes forward or is settled.

Also important: news on the Iris-tied supply chain dispute for Iris construction, cash runway guidance, and Halo development and customer interest beyond just the Volvo orbit.

The bottom line is stark. Luminar requires a fast détente with its largest customer, a white-knight buyer willing to roll scale or a court-driven reset that preserves core programs. Absent one of those paths, the company that was once a symbol of lidar’s jump from prototype to production could become the sector’s most extreme cautionary tale.