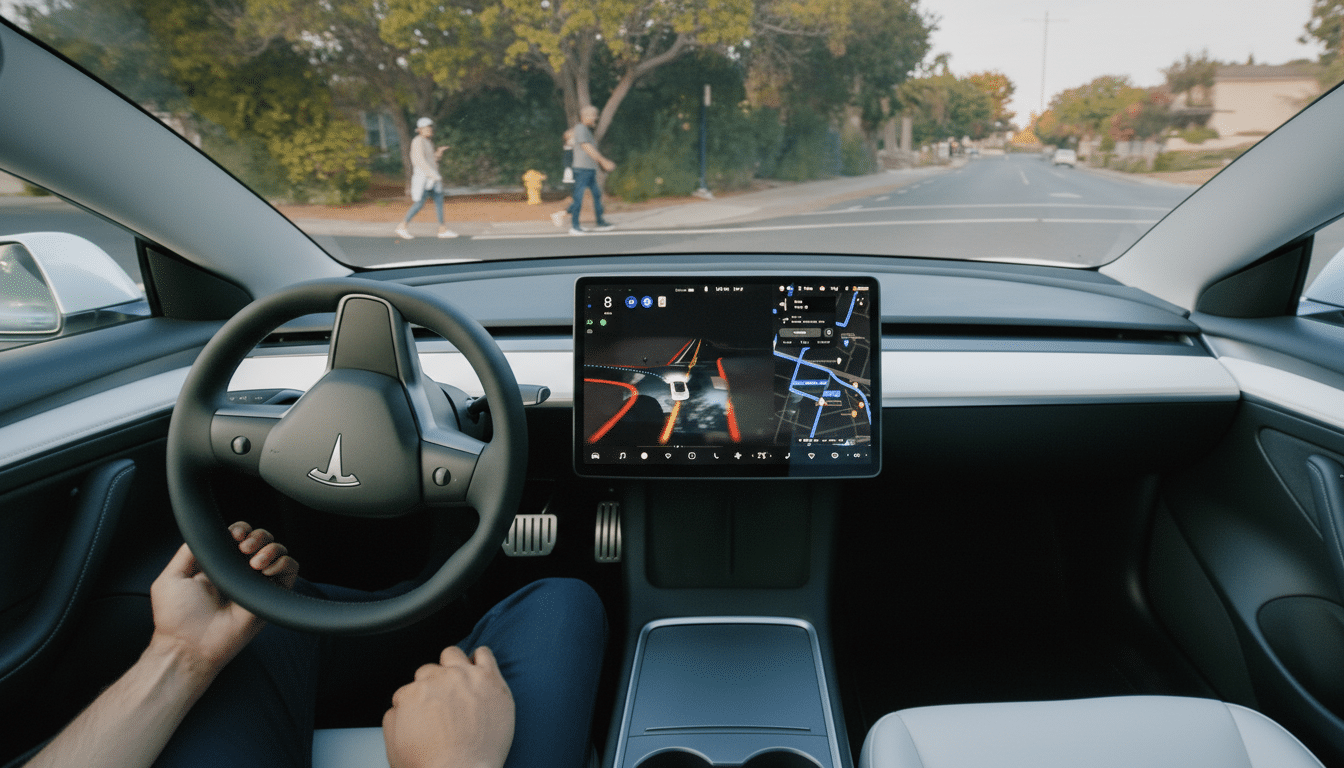

Digital insurer Lemonade has unveiled a new auto product tailored to Tesla owners who use Full Self-Driving (Supervised), promising dynamic pricing that can lower per-mile costs by about 50% when the software is in control. The program debuts in Arizona first, with Oregon to follow, marking one of the earliest attempts to price risk based on how autonomy software actually drives.

How the policy works for Tesla FSD supervised insurance

Lemonade says it is tapping vehicle telemetry made available through a technical collaboration with Tesla to distinguish software-driven miles from human-driven miles. The company plans to train its own usage-based risk models, adjusting per-mile rates accordingly. In other words, the safer the software performs in a variety of scenarios, the more the price algorithm can reward those trips.

The product, branded as “Autonomous Car” insurance, still treats the driver as ultimately responsible. Tesla’s system is supervised and requires constant attention, so the policy is not a blanket “self-driving” coverage. Instead, it is a bet that measurable driving assistance, when reliably engaged, can reduce loss frequency and severity enough to justify materially lower pricing.

For owners already on Lemonade’s pay-per-mile plans, the new approach layers additional precision by segmenting miles by control mode. That granular classification is the key underwriting input the industry has historically lacked.

Why pricing autonomy matters for safer, cheaper coverage

Telematics-led insurance has been expanding across the U.S. personal auto market, with research from LexisNexis Risk Solutions noting strong, double-digit growth in programs where driving data informs pricing. As more vehicles ship with connected hardware, the ability to measure real behavior—hard braking, time of day, road type, and now software control—becomes a competitive advantage for underwriting.

Safety gains from advanced driver assistance are well documented. The Insurance Institute for Highway Safety has found that technologies like automatic emergency braking can cut rear-end crashes by roughly 50%. If supervised autonomy maintains consistent, machine-level reaction times and 360-degree situational awareness, insurers can begin to price that advantage directly rather than averaging it across a population.

The stakes are high. The U.S. still sees roughly 40,000 roadway fatalities each year, according to federal data. Even modest reductions in collision frequency translate into meaningful loss-cost savings in personal auto lines, where combined ratios have been pressured by rising repair costs, pricier sensors, and elevated claim severities.

Data and privacy considerations for telematics insurance

Collecting fine-grained telemetry from vehicles raises questions about transparency and consent. State regulators typically require clear disclosures on what data is captured, how it is used for pricing, how long it is retained, and whether it is shared with third parties. The National Association of Insurance Commissioners has pressed carriers to adopt robust consumer privacy frameworks for telematics programs.

Lemonade says it is leveraging previously unavailable signals from Tesla vehicles to detect when Full Self-Driving is engaged and how it performs. Owners will want to understand precisely which data elements feed the model—such as speed, steering inputs, and system engagement flags—and how those translate into discounts or potential surcharges.

Regulatory and competitive landscape for autonomy pricing

Every state requires filings to approve new rating plans, particularly when they rely on telematics. Lemonade is starting in select markets and will expand as approvals and operational readiness allow. The company already offers auto coverage for popular models in states including Arizona, California, Colorado, Illinois, Indiana, Ohio, Oregon, Tennessee, Texas, and Washington.

Tesla itself sells insurance in several states using a Safety Score and in-car telemetry. That program has faced scrutiny, including an enforcement action from the California Department of Insurance alleging unfair claims practices; Tesla has denied the allegations. Against that backdrop, a third-party insurer building pricing around supervised autonomy introduces a new competitive vector that could push the market toward more software-aware rating.

What it means for Tesla owners using supervised FSD

If Lemonade’s loss experience validates the promise of supervised autonomy, engaged miles could become the cheapest miles to insure. That would reward owners who frequently use the system on suitable roads and maintain attentive supervision. Conversely, city segments with complex edge cases, or scenarios that require frequent human takeovers, may see less pronounced savings until software performance improves.

Key variables to watch include the consistency of the advertised ~50% per-mile reduction, claim adjudication when control switches between human and software, and how quickly rate filings are updated as real-world data accrues. Regulators like the National Highway Traffic Safety Administration continue to scrutinize advanced driver assistance, so any safety findings—positive or negative—will ripple into actuarial models.

For now, Lemonade is signaling a future where insurance prices reflect not just who is driving, but what is driving. As autonomous capabilities advance, that shift could redefine how risk is measured, discounted, and ultimately competed for in personal auto insurance.