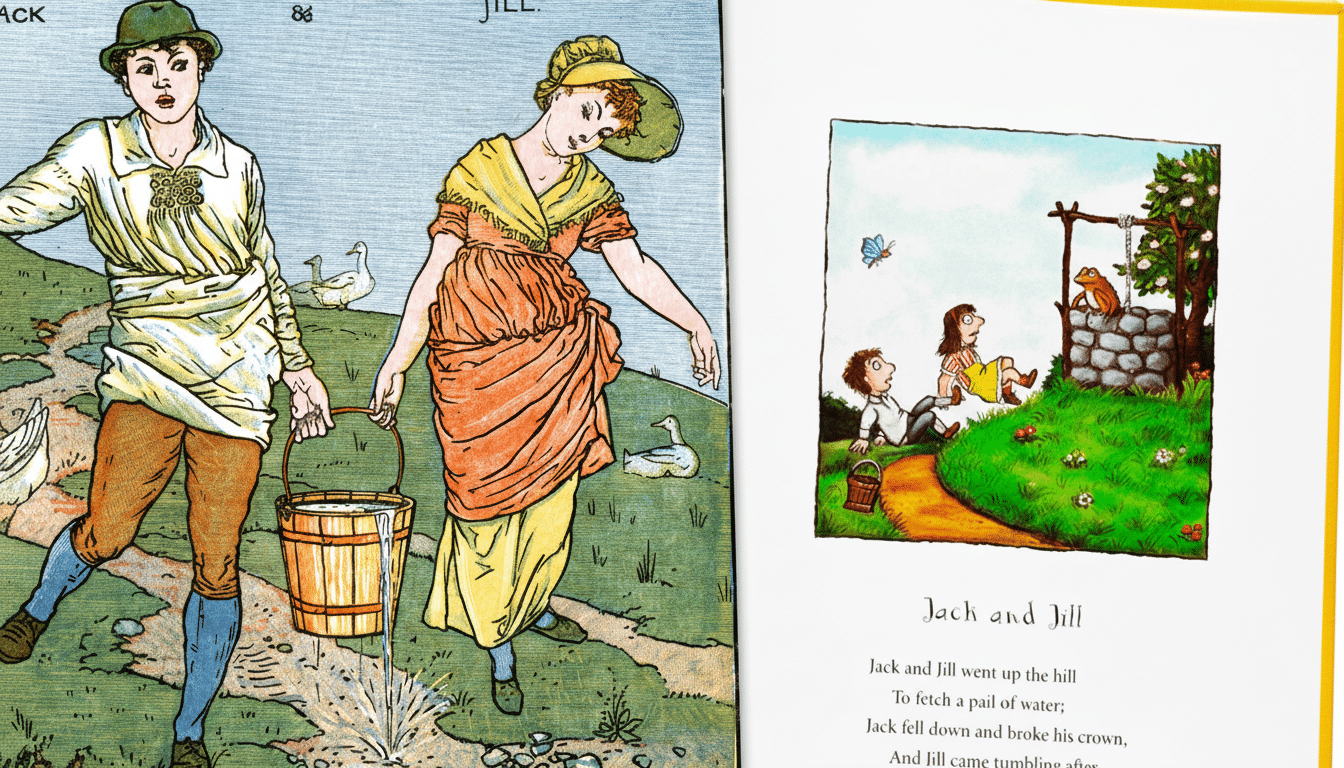

Jack & Jill gets $20M to bring the web’s wealth of continuous job searching tools to non-sales professions where smaller businesses don’t have a foothold, starting with dentistry. The round is being led by Creandum and the funding will be used to fuel U.S. expansion, further product development and for employer integrations. According to the London-based startup, its service has already drawn close to 50,000 users in its home market.

A Two-Sided Conversational Recruiter for Hiring Teams

Jack & Jill is designed to be experienced in pairs. On the “Jack” side, candidates take a 20-minute AI-led interview to record their work history, skills, preferences and constraints. From that exchange, the system surfaces a customized list of roles it has culled from public listings and partner feeds, and it can coach candidates with mock interviews, personalized feedback and résumé refinements that sound in the language of a specific role.

- A Two-Sided Conversational Recruiter for Hiring Teams

- Why Now Is the Time to Automate Hiring with Conversational AI

- Inside the Jack & Jill Product and Underlying Data Model

- Funding, Expansion And Competitive Landscape

- Bias, compliance, and trust in AI hiring platforms

- What to Watch Next for Conversational Recruiting Adoption

The “Jill” side supports employers. Hiring managers set clear expectations for the role with a pre-specified conversational flow that explains must-haves vs. nice-to-haves, compensation bands, and team context. Jill then flags up candidates who fit those conversational profiles based on other signals that match, rather than simple keyword matches. The company charges a typical success fee on hires, which situates the platform as an end-to-end funnel, not just a job board.

Why Now Is the Time to Automate Hiring with Conversational AI

Recruiting is now a numbers game. Popular openings get hundreds of applications in a matter of hours, overloading teams and driving more automation on both the applicant’s side and the employer’s side. Candidates depend on one-click submissions and AI-written cover letters while employers increasingly rely on applicant tracking systems that filter aggressively — sometimes to the detriment of legitimate talent. The result is a noisy market that features far too much guessing and not enough signal.

Conversational screening is an attempt to collect richer data with less friction. Rather than relying on static résumés, structured chats can map skills, context, motivations and constraints in people’s natural language before translating that into machine-readable profiles. It’s a strategy reminiscent of early AI adopters in first-round screening, including multinationals that have employed asynchronous, AI-augmented interviews to shrink time-to-hire while also involving human reviewers.

Beyond convenience, the economics matter. The Society for Human Resource Management pegs average cost-per-hire at just north of $4,700, and time-to-fill for many positions can still take weeks. Tools that eliminate early screening, surface better-matched candidates and cut enough of the back-and-forth scheduling can provide actual savings. Recruiting benchmark data from LinkedIn consistently illustrates that shorter cycles are associated with higher offer acceptance and candidate satisfaction.

Inside the Jack & Jill Product and Underlying Data Model

Jack & Jill’s pitch is that a conversation records nuance — career pivots, upskilling ambitions, hybrid restrictions — that standard forms overlook. The system analyzes transcripts into a skills graph, then factors in behavioral signals like role intent and seniority comfort to score alignment to employer inputs. It then supplies that intelligence into two loops: coaching for candidates to boost their odds, and ranked shortlists for hiring teams to expedite review.

The company says that it uses guardrails to limit AI hallucinations and provides employers with controls for establishing hard disqualifiers and “soft” preferences. Mock interviews are ladder-specific and feedback is based on the competencies employers indicate they valued. The promise to candidates is less spam and more relevance; the promise to recruiters is fewer cold outreach attempts and more context going into that first human call.

Funding, Expansion And Competitive Landscape

The $20 million seed led by Creandum will give Jack & Jill momentum to grow beyond London and into the U.S. as its first stop.

Prioritization: The impression is conversational profiles should fit into the overall desk flow with no extra admin; native integrations to leading applicant tracking systems and HR platforms — e.g., Greenhouse, Workday, Lever. Their initial revenue comes from placement fees, though adding a subscription layer for employer seats and premium coaching for candidates could be a natural follow-on.

The market is fragmented: LinkedIn and Indeed lead on discovery; specialized platforms like Hired and Wellfound focus on tech and startup positions; and AI-native vendors (Eightfold AI, Paradox, HireVue) provide screening and virtual assistants.

The differentiation for Jack & Jill comes down to treating conversation as a first-class data source (not an add-on) and serving both sides with a tightly coupled experience.

Bias, compliance, and trust in AI hiring platforms

Hiring AI faces some true scrutiny. Within the EU’s AI Act, employment algorithms are considered high-risk and burdened with risk management and transparency. In the United States, the Equal Employment Opportunity Commission issued guidance reminding employers that applications powered by artificial intelligence must conform with antidiscrimination law and be accessible to people with disabilities. Any platform that claims it has AI-based screening must have auditable models, explainable scores, and routine adverse impact testing.

Jack & Jill says it keeps humans in decision loops and focuses on structured, job-related criteria. The company will also require clear documentation for candidates — what exactly is being measured, how data is used, and how to request a substitution — in order to gain trust and please regulators as well as enterprise buyers.

What to Watch Next for Conversational Recruiting Adoption

There are three data points that will measure the thesis: a decrease in time-to-screen for employers, increased match quality in terms of onsite-to-offer conversion, and finally candidate satisfaction post-AI-led experiences. If Jack & Jill is able to provide quantifiable upside on those dimensions, and keep up with new compliance requirements, conversational recruiting could transition from a novelty to the default workflow in more roles and markets.