India now counts 100 million people using ChatGPT every week, according to OpenAI chief executive Sam Altman, underscoring how decisively the country has become one of the company’s largest and most dynamic markets. The milestone, disclosed ahead of a major AI summit in New Delhi, positions India as ChatGPT’s second-biggest user base after the United States and highlights the speed at which generative AI has moved from curiosity to daily utility across the subcontinent.

Why This Milestone Matters for India’s AI Adoption

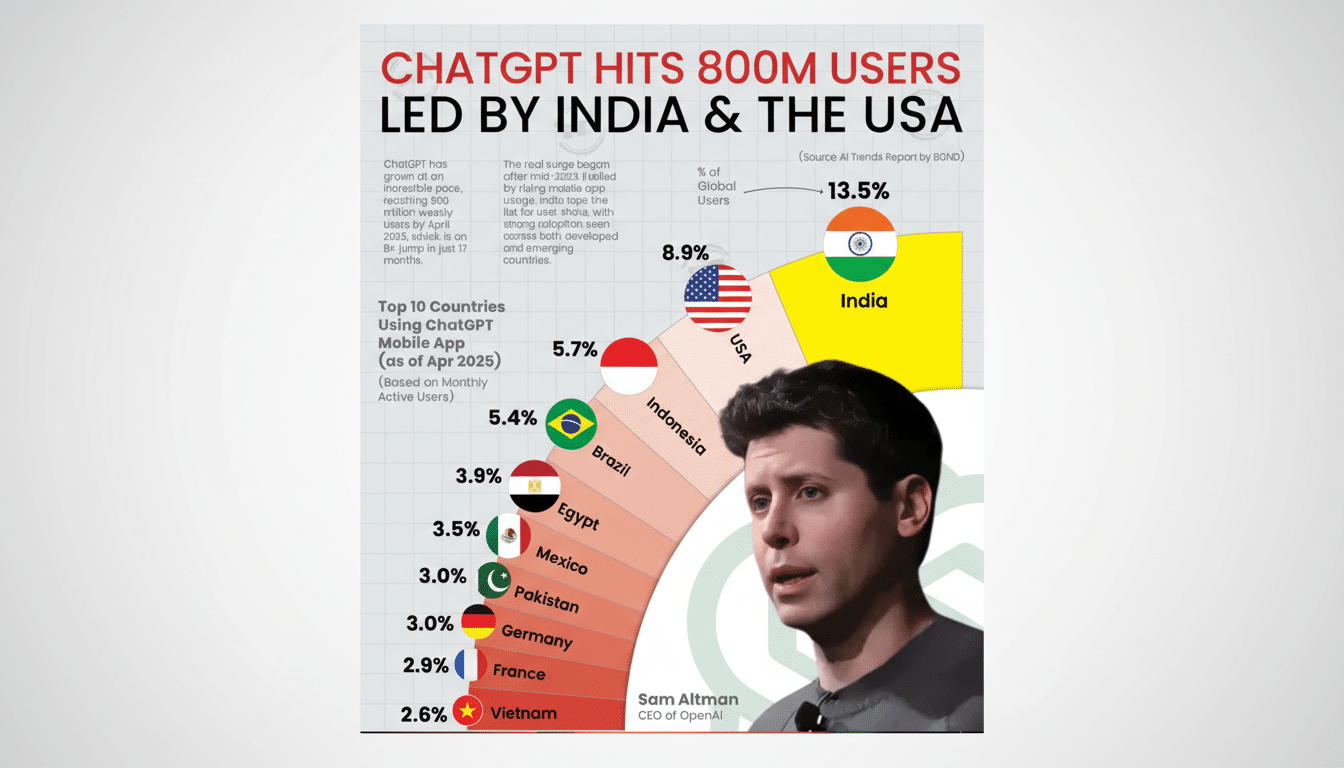

ChatGPT’s global weekly active users were reported to be about 800 million in late 2025 and are said to be nearing 900 million. By that yardstick, India alone could account for more than one-tenth of weekly usage—a remarkable concentration in a single emerging market. The country’s combination of over a billion internet users, a young median age, and a thriving mobile-first culture has proven fertile ground for rapid AI adoption.

- Why This Milestone Matters for India’s AI Adoption

- Local Pricing and Product Fit in a Price-Sensitive Market

- The Monetization And Infrastructure Puzzle

- Government Ties and Policy Signaling for AI Expansion

- Competition and Developer Momentum in India’s AI Scene

- What to Watch Next for India’s Expanding AI Usage

Altman also pointed to students as a primary driver, noting India has the largest cohort of student users. That aligns with broader industry patterns: Google has targeted Indian learners with promotional access to its premium AI tools, and company executives have said India leads global usage of Gemini for education. Study assistance, language practice, and test prep are proving to be sticky, high-frequency use cases.

Local Pricing and Product Fit in a Price-Sensitive Market

OpenAI’s push into India has not been one-size-fits-all. The company opened a New Delhi office and rolled out a low-cost ChatGPT Go plan under $5, later making it free for a year to Indian users. In a market where subscription fatigue and price sensitivity are real constraints, those decisions likely compressed the adoption curve by reducing friction for first-time users and students.

Localization goes beyond price. India’s language diversity means high utility for tools that can switch between English and major Indic languages within a single workflow—think drafting in Hindi for community outreach while refining policy notes in English. Early evidence from educators and small businesses suggests multimodal features—voice, image, and text—are especially valuable in mobile-first, bandwidth-constrained settings.

The Monetization And Infrastructure Puzzle

Turning massive engagement into sustainable economics is the next test. Average revenue per user in India typically trails developed markets, and enterprise software cycles are longer. Yet the country’s digital rails—UPI for instant, low-cost payments and Aadhaar for identity—make tiered subscriptions and pay-as-you-go API usage more feasible than in many emerging economies.

Compute and connectivity are the other fulcrums. India’s national IndiaAI Mission aims to expand domestic compute capacity, fund startups, and accelerate AI adoption in public services. If successful, those investments could reduce latency, lower inference costs, and support data-residency preferences that large Indian enterprises and public sector agencies increasingly prioritize.

Government Ties and Policy Signaling for AI Expansion

Altman indicated OpenAI plans deeper collaboration with the Indian government, with new partnerships designed to widen access and encourage practical use. While details remain under wraps, the direction is clear: public-private pilots in areas like education, agriculture advisory, and citizen services can both prove value and set norms for safe, inclusive deployment.

The high-profile AI gathering in New Delhi, drawing global tech leaders alongside top Indian business figures, underscores how India’s user base now confers real policy influence. Decisions forged in New Delhi—from guardrails to data access frameworks—will shape how “democratic AI” reaches first-time users across the Global South.

Competition and Developer Momentum in India’s AI Scene

India’s AI landscape is not a single-platform story. Google continues to court students and educators, while domestic startups are racing to build models optimized for Indic languages and local contexts. Firms such as Sarvam AI and Krutrim are developing homegrown capabilities, and a growing cottage industry of AI integrators is packaging chat-based tools for WhatsApp commerce, contact centers, and SME marketing.

The developer base matters, too. India is among the world’s largest communities on major code platforms, and API-driven experiments—from customer support copilots to internal knowledge agents—are becoming commonplace. If even a small fraction of those prototypes convert into production workloads, India’s share of global AI traffic and spending could rise quickly.

What to Watch Next for India’s Expanding AI Usage

Three signals will reveal whether 100 million weekly users is a ceiling or a waypoint.

- Paid conversion and enterprise uptake: Can low-cost tiers seed durable revenue without dampening growth?

- Compute localization: Do government and private investments shorten inference paths and satisfy data governance needs?

- Education outcomes: Can widespread student use translate into measurable learning gains while preserving academic integrity?

For now, the headline is clear. India has vaulted into the front row of the AI era not only as a vast market but as an increasingly influential shaper of how generative tools are built, priced, and governed. Altman’s 100 million figure is less a finish line than a marker of how quickly the center of gravity is tilting toward the world’s largest democracy.