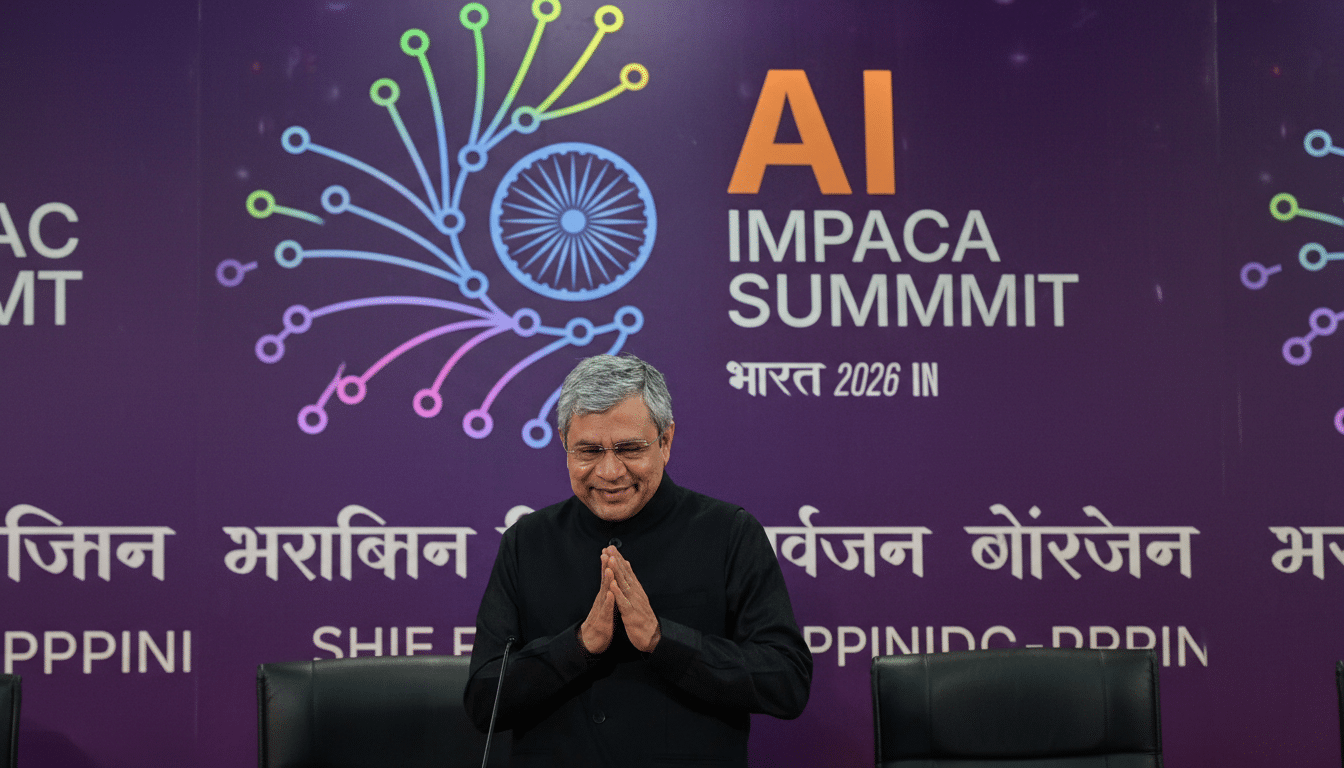

India is mounting an ambitious bid to pull in more than $200 billion for artificial intelligence infrastructure by 2028, signaling a bid to become one of the world’s primary build sites for AI compute, data centers, and model development. The effort, unveiled by IT minister Ashwini Vaishnaw at the government-backed AI Impact Summit in New Delhi, blends policy incentives, public capital, and partnerships with global tech firms to compress years of capacity building into the next two years.

A Two-Year Sprint to Rapidly Scale AI Compute Capacity

At the heart of the plan is raw compute. Under the IndiaAI Mission, the government says shared national capacity currently sits near 38,000 GPUs, with roughly 20,000 more to be added in the near term. That pool is intended to support startups, researchers, and state agencies that would otherwise struggle to access high-end accelerators.

- A Two-Year Sprint to Rapidly Scale AI Compute Capacity

- Policy Sweeteners and Public Capital to Spur AI Investment

- Who Could Spend the Money Building India’s AI Infrastructure

- The Power and Cooling Challenge for AI Data Centers

- Regulation, Security, and Market Access for AI Growth

- Why the timing matters for India’s AI infrastructure

Officials are positioning the $200 billion target as a continuation of the investment wave already underway. U.S. hyperscalers have disclosed about $70 billion in AI and cloud expansions across the country, and the government expects those outlays to catalyze new build-outs in data centers, networking, specialized chips, and software platforms.

Policy Sweeteners and Public Capital to Spur AI Investment

To unlock private spending, New Delhi is layering tax relief for export-oriented cloud services with a government-backed ₹100 billion fund—about $1.1 billion—to seed higher-risk deep-tech bets. Policymakers also extended the “startup” window for deep-tech ventures to 20 years and raised the revenue threshold for program benefits to ₹3 billion, or roughly $33 million, giving AI companies a longer runway to commercialize research-heavy products.

The pitch goes beyond racks and real estate. Vaishnaw said authorities expect an additional $17 billion to flow into AI applications and deep-tech use cases, aiming to capture more of the value chain within India rather than exporting compute demand abroad.

These moves sit alongside the India Semiconductor Mission and production-linked incentives designed to localize parts of the chip stack. Recent examples include Micron’s assembly and test facility in Gujarat and Tata Group’s semiconductor initiatives, both of which are meant to reduce reliance on external supply chains over time.

Who Could Spend the Money Building India’s AI Infrastructure

A $200 billion buildout will likely be led by a familiar cast: global hyperscalers, domestic telcos, and large colocation specialists. Reliance Jio and Tata have both announced plans with leading chipmakers to deploy AI infrastructure, while data center operators such as STT GDC India, AdaniConneX, CtrlS, and Sify are expanding footprints in Mumbai, Chennai, Hyderabad, and Pune to capture AI workloads.

Sovereign and infrastructure funds have been active backers of the sector, and analysts expect that trend to deepen as AI clusters demand multi-gigawatt campuses with long-duration renewable power purchase agreements. Industry bodies like NASSCOM argue that India’s large pool of software and data engineering talent is a structural advantage, particularly as models and tooling become more modular and enterprise adoption accelerates.

The Power and Cooling Challenge for AI Data Centers

Execution risk sits squarely in utilities. AI training halls require dense, reliable power and advanced cooling. The Ministry of Power and the Central Electricity Authority have spotlighted a rapidly growing pipeline of renewable capacity and transmission upgrades, and officials say clean sources now account for a significant share of installed generation. Pairing that growth with high-availability supply for data centers will be the test.

Cities on the western and southern coasts are already pivoting to liquid and hybrid cooling to address heat loads from high-end GPUs. Water use is a rising concern; operators are experimenting with reclaimed water and adiabatic systems to reduce draw. According to JLL and other industry trackers, India’s data center capacity is set to expand sharply mid-decade, but speed-to-power remains the gating factor across most campuses.

Regulation, Security, and Market Access for AI Growth

Policy clarity will influence where the next clusters land. The Digital Personal Data Protection Act establishes a privacy baseline that large enterprises require, while MeitY’s emerging AI guardrails aim to balance innovation with accountability. Export controls on advanced accelerators and evolving cybersecurity requirements add complexity that operators must bake into procurement and deployment timelines.

On the financing side, Reserve Bank of India data shows continued strength in inbound flows to digital infrastructure, and the government’s tax incentives are designed to improve after-tax returns during the construction-heavy early years when utilization is volatile.

Why the timing matters for India’s AI infrastructure

Global AI demand is outrunning capacity. With Singapore tightening land and power allocations and the U.S. and Europe facing grid bottlenecks, investors are scouting alternative hubs. India’s cost structure, talent density, and policy push position it as a front-runner—if it can stand up power, cooling, and supply chains at pace.

Success by 2028 would be visible in a few hard metrics: tens of thousands of additional high-end GPUs online; multiple multi-hundred-megawatt campuses commissioned; utilization ramping without brownouts; and a pipeline of India-built AI applications for finance, healthcare, logistics, and public services. The headline goal is bold. The next 24 months will determine whether India turns intent into installed capacity.