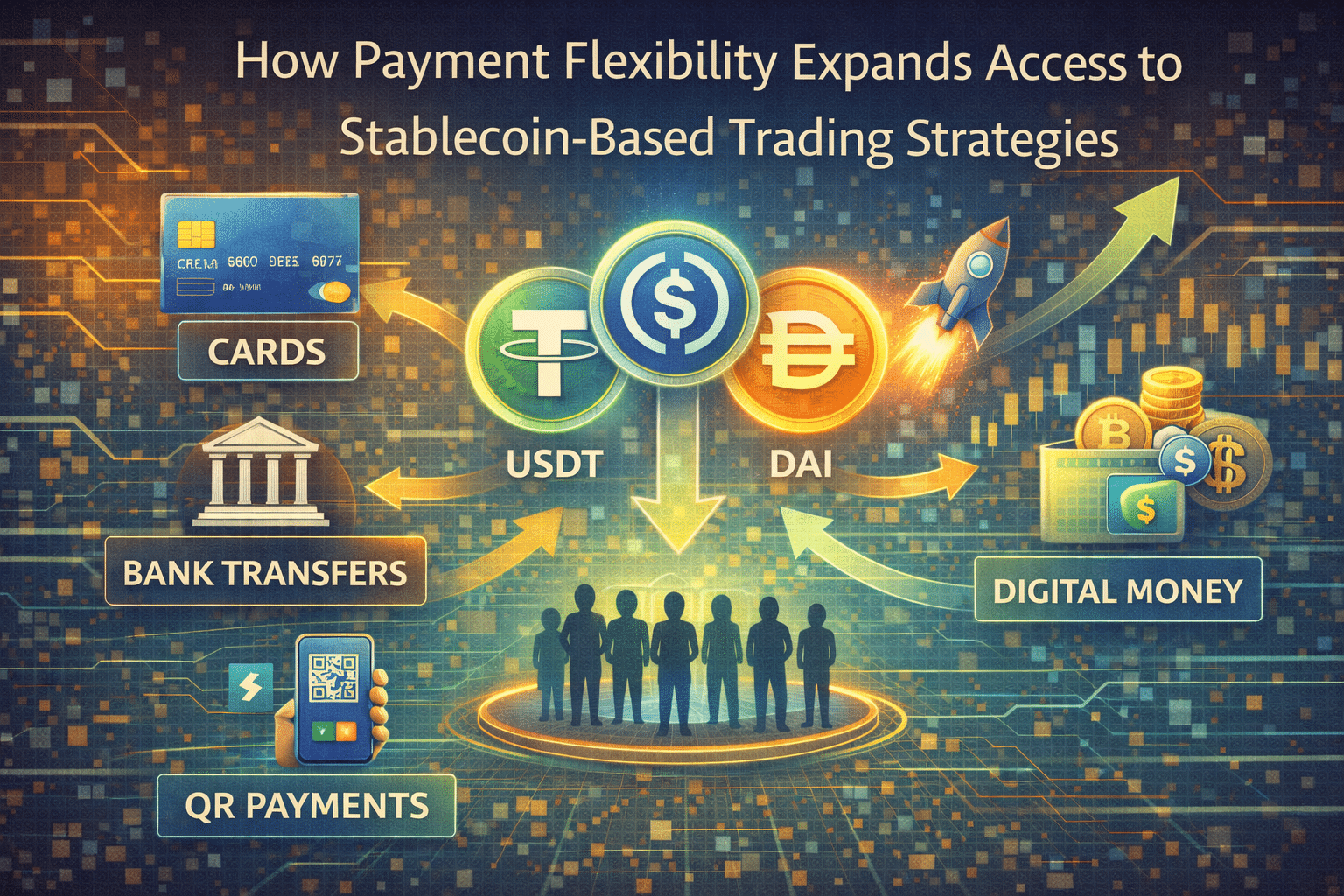

Stablecoins like USDT have become essential in crypto trading, offering price stability in volatile markets. They peg to fiat currencies, maintaining value close to $1, making them ideal for holding value or as trading pairs. In a landscape where Bitcoin swings 5-10% daily, stablecoins provide a reliable base for strategies. Payment flexibility, such as buy USDT with a credit card, lowers entry barriers for new traders. This accessibility drives adoption, with stablecoin volume exceeding $150 billion daily. This article explores how flexible payments unlock stablecoin trading for broader audiences.

Why Stablecoins Attract Traders

Stablecoins reduce volatility risk. Holding USDT during BTC dips preserves capital, ready for re-entry. They serve as base pairs—BTC/USDT or ETH/USDT—with tight spreads and high liquidity.

DeFi integration boosts utility. Lend USDT for 5-10% yields or use as collateral. In leveraged trading, stablecoins fund margin, amplifying exposure without fiat conversion.

Payment ease matters. Credit card buys of USDT take minutes, versus days for wires. This speed lets traders act on opportunities instantly.

Credit Cards: The Preferred Instant Method

Credit cards lead for stablecoin buys. Link Visa or Mastercard to acquire USDT instantly, with fees 1-3% and limits up to $10,000 daily. Rewards or cashback often offset costs.

Speed is unmatched. Fund during dips, buy USDT, then trade BTC without delay. In volatile sessions, this captures 2-5% moves.

Security features reassure. 3D Secure and fraud monitoring protect transactions, with chargebacks for disputes.

Other Flexible Payment Options

Debit cards offer low fees (0.5-2%), drawing directly from banks. Processing is instant, ideal for regular stablecoin top-ups.

Mobile payments like Apple Pay or Google Pay add one-tap convenience with biometric security. Fees 1-2%, limits $5,000 daily.

Bank-linked apps enable quick transfers under 5 minutes, fees below 1%, suiting larger amounts.

These methods expand access. Beginners buy USDT effortlessly, entering DeFi or trading pairs.

| Method | Speed | Fees | Limits | Best For |

|---|---|---|---|---|

| Credit Card | Instant | 1-3% | $10,000/day | Urgent buys |

| Debit Card | Instant | 0.5-2% | Bank-dependent | Low-cost regular |

| Mobile Pay | Instant | 1-2% | $5,000/day | Convenience |

| Bank App | Minutes | <1% | High | Larger transfers |

Building Strategies with Stablecoins

Stablecoins enable diverse approaches. Hold USDT during volatility, deploy to BTC on dips for 10-20% gains. Use as margin for leveraged trades, amplifying 2% moves to 20% at 10x.

DeFi yields add income. Lend USDT for 5-10%, compounding in low-volatility. Arbitrage exploits small gaps in stablecoin pairs.

Risk management is key. 80% lose to overexposure—use 1% risk per trade, 5% stops.

Risks and Smart Practices

Fees compound on frequent buys—limit to strategic entries. Volatility can hit post-purchase if swapping later.

Fraud risks exist. Use platforms with SSL and KYC. Avoid public Wi-Fi.

Regulatory limits vary—check local rules for card buys. Credit overuse risks debt, set budgets.

Best practices: compare fees, use 2FA, start small. Fund dips to maximize value.

Conclusion

Payment flexibility expands access to stablecoin-based strategies, with credit cards and mobile pay enabling instant USDT buys. Fees 1-3% and high limits support DeFi yields or leveraged trades. In volatile markets, stablecoins hedge risks, but 80% lose without discipline. Use 1% risk, tight stops, and diversify. In crypto’s growth, flexible payments aren’t convenience—they’re your gateway to stable, strategic trading.