Importance of pay stub templates in payroll reporting. These ensure consistency, precision, and transparency in how income and withholdings are communicated. Organizations have tried many alternatives to simplify payroll, and sharing templates has emerged as one of the most common solutions. In the next sections, let us explore how a pay stub template facilitates uniform payroll reporting for both the employers and the employees.

Clear and Consistent Format

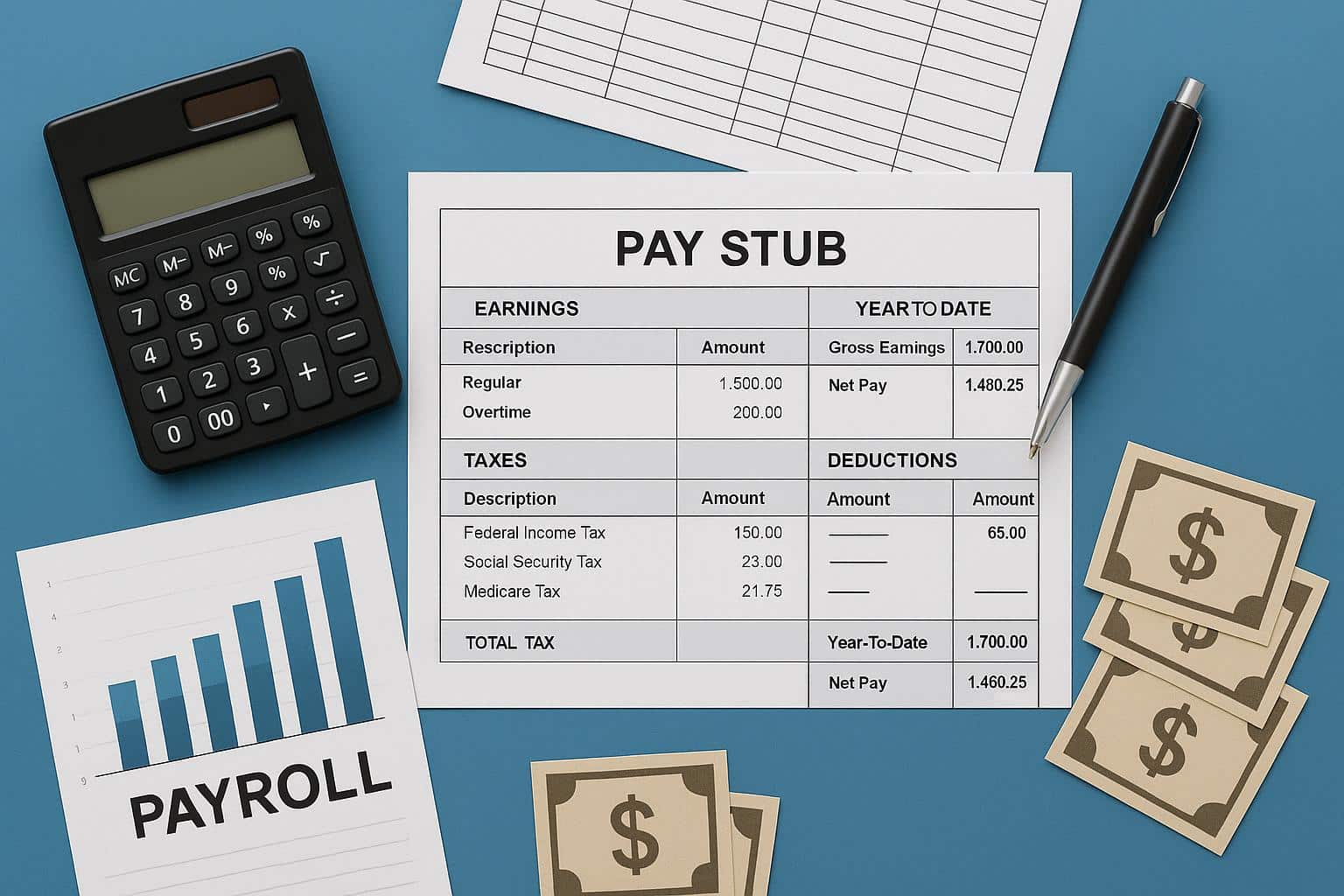

Pay stub templates provide a format for recording salary information. They present the same information in the same order every pay period. It helps to eliminate confusion for payroll and recipients alike. Because the layout is familiar, it becomes easy for employees to identify any changes or discrepancies. It also simplifies training additional payroll personnel, as the format does not change.

Accurate Earnings and Deductions

Templates remind payroll professionals to add everything that is necessary every time. There are clear sections for gross pay, taxes, insurance, and deductions. This structure helps minimize your chances of missing anything important. Well-prepared pay stubs act as a protective measure to ensure no miscommunication or claims arise between you and your employee regarding pay statements. Having transparency in these documents also builds trust and ensures compliance with labor laws.

Efficient Recordkeeping

Standard documents support efficient recordkeeping. The payroll department can sort, file, and retrieve the pay stubs with ease and in seconds. Audits or reviews are easier and less painful, as all reports are uniform. This consistency saves a lot of time around the tax season or when analyzing past data. A systematized approach enables businesses to keep their financial records in order and according to various regulatory requirements.

Legal Compliance Made Simple

Government regulations frequently mandate what information employers give workers. Templates ensure that required fields show up on each pay stub. This process minimizes the risk of non-compliance and its associated penalties. Updated templates make it easy to stay on top of labor laws. Templates that urge thorough and meticulous disclosures can help companies steer clear of penalties.

Better Communication with Employees

Pay documentation in uniform work for employees as well; they can easily look up the gross wages, deductions, and net pay. Transparency shields and allows staff to ask any questions or raise any red flags more clearly. Using the same template repeatedly makes it easy for employees to understand their compensation details. Without this, it makes it impossible to maintain great employer-employee relationships and a happy workplace.

Streamlined Payroll Processes

Automated payroll systems can help run payroll calculations and even make reporting and data entry easy using templates. They minimize manual steps between steps and shorten turnaround time, ensuring fewer errors. Payroll staff do not have to create a separate document for every pay cycle. Instead, they fill up the necessary fields, and the system creates the proper pay stubs effortlessly. Simplified processes eliminate waste, creating resources available for higher-value work by the organization.

Easier Auditing and Reporting

For adequate reviews, auditors look for consistency. Standardized pay stubs help expedite the auditing process. All the documents follow the same format, which makes it easier for auditors to compare them; this process could even be enhanced with machine learning. This homogeneity assists in preparing financial statements or a summary for management. With credible data, both internal and external reporting become a breeze.

Supports Employee Financial Planning

Standardized pay stubs make it easier for employees to better plan their budgets. They can easily keep track of earnings, deductions, and savings. Steady reporting allows employees to plan budgets or secure loans, because many loan processors will request copies of pay stubs. Access to clean financial data helps you be financially healthier.

Reduces Risk of Disputes

Disputes can arise from mistakes or misunderstandings about pay. Templates effectively eliminate these risks by clearly listing all necessary information. If there are complaints on either side, then both the employer and employee can refer to the same document. Unified, thorough records enable a swift dispute resolution among all parties.

Conclusion

Pay stub templates streamline the payroll reporting process for every type of organization. Their role is to ensure that information is concise, factual, and regulatory-compliant. Both employers and employees gain from dependable, transparent records. Documenting pay in a standardized fashion helps not only with payroll execution but also with communication and planning for pay for all concerned.